Byline Bancorp, Inc. (BY): Price and Financial Metrics

BY Price/Volume Stats

| Current price | $29.12 | 52-week high | $29.49 |

| Prev. close | $28.72 | 52-week low | $18.39 |

| Day low | $28.53 | Volume | 266,897 |

| Day high | $29.49 | Avg. volume | 125,662 |

| 50-day MA | $24.18 | Dividend yield | 1.25% |

| 200-day MA | $22.00 | Market Cap | 1.28B |

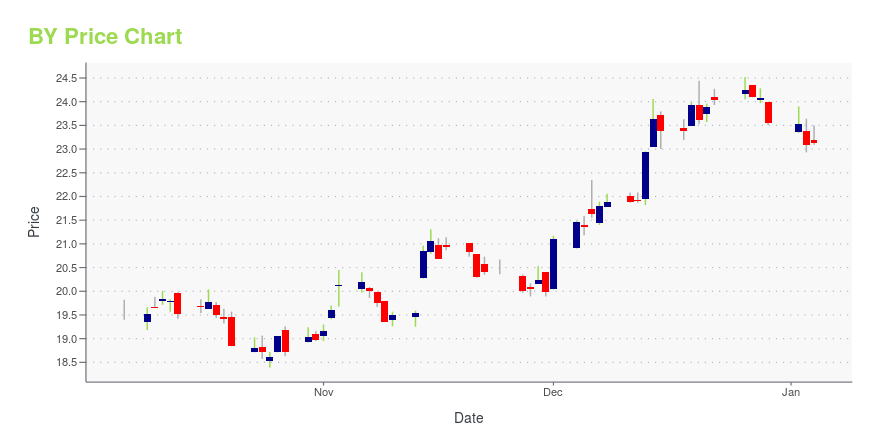

BY Stock Price Chart Interactive Chart >

Byline Bancorp, Inc. (BY) Company Bio

Byline Bancorp, Inc. operates as the bank holding company for Byline Bank that provides banking products and services to small and medium sized businesses, commercial real estate and financial sponsors, and consumers in mostly Chicago and a small presence in Wisconsin. The company was founded in 1978 and is based in Chicago, Illinois.

Latest BY News From Around the Web

Below are the latest news stories about BYLINE BANCORP INC that investors may wish to consider to help them evaluate BY as an investment opportunity.

HBT Financial (HBT) Rewards Shareholders With New Buyback PlanHBT Financial (HBT) announces a new share buyback program worth up to $15 million. This will commence after the expiration of the current program and continue till Jan 1, 2025. |

Orange County Bancorp, Inc. (OBT) Hit a 52 Week High, Can the Run Continue?Orange County Bancorp, Inc. (OBT) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues. |

Deutsche Bank (DB) Rewards Investors, Completes Share Buyback PlanDeutsche Bank (DB) completes its share repurchase plan announced in July 2023. |

Strong Balance Sheet Aids Citizens Financial (CFG) Amid High CostCitizens Financial (CFG) gains from diversifying its revenue streams through growth in wealth management offerings, loan growth and efficiency initiatives. Yet, rising expenses will affect its bottom line. |

JPMorgan (JPM) to Outsource Hong Kong, Taiwan Custody BusinessAmid the rising cost-income ratio, JPMorgan (JPM) is considering outsourcing its custodian business in Hong Kong and Taiwan to another bank. |

BY Price Returns

| 1-mo | 26.72% |

| 3-mo | 34.22% |

| 6-mo | 30.54% |

| 1-year | 45.93% |

| 3-year | 32.93% |

| 5-year | 68.20% |

| YTD | 24.61% |

| 2023 | 4.32% |

| 2022 | -14.74% |

| 2021 | 79.31% |

| 2020 | -20.24% |

| 2019 | 17.65% |

BY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BY

Here are a few links from around the web to help you further your research on Byline Bancorp Inc's stock as an investment opportunity:Byline Bancorp Inc (BY) Stock Price | Nasdaq

Byline Bancorp Inc (BY) Stock Quote, History and News - Yahoo Finance

Byline Bancorp Inc (BY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...