Caleres, Inc. (CAL): Price and Financial Metrics

CAL Price/Volume Stats

| Current price | $37.34 | 52-week high | $41.94 |

| Prev. close | $36.67 | 52-week low | $23.79 |

| Day low | $36.77 | Volume | 499,469 |

| Day high | $37.61 | Avg. volume | 481,854 |

| 50-day MA | $34.55 | Dividend yield | 0.77% |

| 200-day MA | $33.28 | Market Cap | 1.31B |

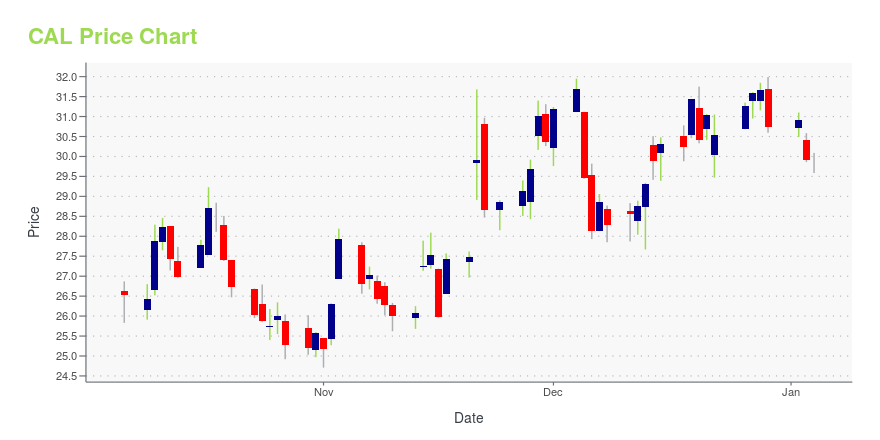

CAL Stock Price Chart Interactive Chart >

Caleres, Inc. (CAL) Company Bio

Caleres Inc. retails and wholesales footwear worldwide. The company operates through two segments, Famous Footwear and Brand Portfolio. The company was founded in 1878 and is based in St. Louis, Missouri.

Latest CAL News From Around the Web

Below are the latest news stories about CALERES INC that investors may wish to consider to help them evaluate CAL as an investment opportunity.

Caleres (NYSE:CAL) Will Pay A Dividend Of $0.07Caleres, Inc.'s ( NYSE:CAL ) investors are due to receive a payment of $0.07 per share on 5th of January. The dividend... |

Caleres Declares Regular Quarterly DividendST. LOUIS, December 07, 2023--Caleres (NYSE: CAL), a market-leading portfolio of consumer-driven footwear brands, today announced that its Board of Directors has declared a regular quarterly cash dividend of $0.07 per share to be paid on January 5, 2024, to shareholders of record as of December 21, 2023. |

Caleres Awarded on Newsweek’s America’s Most Responsible Companies 2024 ListST. LOUIS, December 06, 2023--Caleres (NYSE: CAL) has been awarded on Newsweek’s list of America’s Most Responsible Companies 2024 for the third consecutive year. This prestigious award is presented by Newsweek and Statista Inc., the world-leading statistics portal and industry ranking provider. The awards list was announced on December 6, 2023, and can currently be viewed on Newsweek’s website. |

Vail Resorts (MTN) to Post Q1 Earnings: What's in the Offing?Dismal performance of the Mountain segment is expected to have a negative impact on Vail Resorts' (MTN) top-line results in first-quarter fiscal 2024. |

Caleres Earns Top Score in Human Rights Campaign Foundation’s 2023-2024 Corporate Equality IndexST. LOUIS, November 30, 2023--Caleres (NYSE: CAL), a market-leading portfolio of consumer-driven footwear brands, proudly announced that it received a score of 100 on the Human Rights Campaign Foundation’s 2023-2024 Corporate Equality Index (CEI), the nation’s foremost benchmarking survey and report measuring corporate policies and practices related to LGBTQ+ workplace equality. Caleres joins the ranks of 545 major U.S. businesses that also earned top marks this year. |

CAL Price Returns

| 1-mo | 12.74% |

| 3-mo | 1.29% |

| 6-mo | 18.32% |

| 1-year | 41.06% |

| 3-year | 58.96% |

| 5-year | 121.11% |

| YTD | 21.98% |

| 2023 | 39.45% |

| 2022 | -0.55% |

| 2021 | 46.77% |

| 2020 | -31.76% |

| 2019 | -13.58% |

CAL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CAL

Here are a few links from around the web to help you further your research on Caleres Inc's stock as an investment opportunity:Caleres Inc (CAL) Stock Price | Nasdaq

Caleres Inc (CAL) Stock Quote, History and News - Yahoo Finance

Caleres Inc (CAL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...