Canaan Inc. ADR (CAN): Price and Financial Metrics

CAN Price/Volume Stats

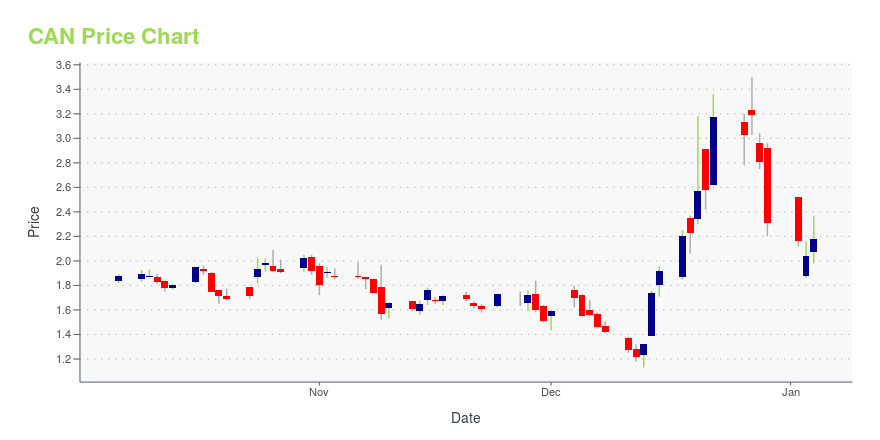

| Current price | $0.90 | 52-week high | $3.27 |

| Prev. close | $0.95 | 52-week low | $0.53 |

| Day low | $0.85 | Volume | 80,281,102 |

| Day high | $1.04 | Avg. volume | 25,504,320 |

| 50-day MA | $0.70 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 335.23M |

CAN Stock Price Chart Interactive Chart >

Canaan Inc. ADR (CAN) Company Bio

Canaan, Inc. designs and sells integrated circuits. It offers Kendryte AI and Avalon Miner products. The firm is a developer of supercomputing chips and the manufacturer of digital block chain computing equipment as well as the supplier of overall scheme for computer software and hardware of digital block chain. The company was founded by Li Jiaxuan, Liu Xiangfu and Zhang Nangeng in 2013 and is headquartered in Hangzhou, China.

CAN Price Returns

| 1-mo | 47.88% |

| 3-mo | 21.47% |

| 6-mo | -58.72% |

| 1-year | -25.62% |

| 3-year | -78.52% |

| 5-year | -60.35% |

| YTD | -56.10% |

| 2024 | -11.26% |

| 2023 | 12.14% |

| 2022 | -60.00% |

| 2021 | -13.15% |

| 2020 | -2.79% |

Loading social stream, please wait...