Cara Therapeutics, Inc. (CARA): Price and Financial Metrics

CARA Price/Volume Stats

| Current price | $0.37 | 52-week high | $3.45 |

| Prev. close | $0.37 | 52-week low | $0.24 |

| Day low | $0.37 | Volume | 513,611 |

| Day high | $0.39 | Avg. volume | 750,536 |

| 50-day MA | $0.47 | Dividend yield | N/A |

| 200-day MA | $0.78 | Market Cap | 20.36M |

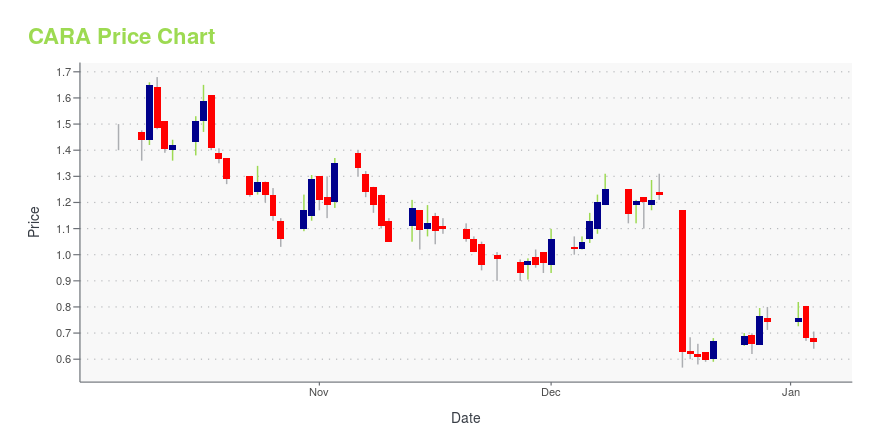

CARA Stock Price Chart Interactive Chart >

Cara Therapeutics, Inc. (CARA) Company Bio

Cara Therapeutics is a clinical-stage biopharmaceutical company focused on developing and commercializing new chemical entities designed to alleviate pain and pruritus by selectively targeting kappa opioid receptors. The company was founded in 2004 and is based in Shelton, Connecticut.

Latest CARA News From Around the Web

Below are the latest news stories about CARA THERAPEUTICS INC that investors may wish to consider to help them evaluate CARA as an investment opportunity.

CARA's Late-Stage Skin Disease Study Fails, Stock Plummets 49%CARA discontinues the clinical program of oral difelikefalin for pruritus associated with atopic dermatitis following the failure of dose-finding Part A of the late-stage study. Stock plunges 49%. |

Cara Therapeutics Announces Outcome from Dose-Finding Part A of KIND 1 Study Evaluating Oral Difelikefalin for Moderate-to-Severe Pruritus in Patients with Atopic Dermatitis– Oral difelikefalin as adjunct to topical corticosteroids (TCS) did not demonstrate meaningful clinical benefit compared to TCS alone; As a result, Cara will discontinue its clinical program in pruritus associated with atopic dermatitis – – Late-stage oral difelikefalin clinical programs for pruritus associated with notalgia paresthetica and advanced chronic kidney disease continue to enroll on track with key data readouts expected in 2H24 – – Cara expects to end 2023 with approximately $100 mi |

Cara Therapeutics, Inc. (NASDAQ:CARA) Q3 2023 Earnings Call TranscriptCara Therapeutics, Inc. (NASDAQ:CARA) Q3 2023 Earnings Call Transcript November 13, 2023 Cara Therapeutics, Inc. misses on earnings expectations. Reported EPS is $-0.52 EPS, expectations were $-0.5. Operator: Good afternoon. My name is Latif and I will be your conference facilitator. I would like to welcome everyone to the Cara Therapeutics Third Quarter Financial Results […] |

Q3 2023 Cara Therapeutics Inc Earnings CallQ3 2023 Cara Therapeutics Inc Earnings Call |

Cara (CARA) Reports Q3 Earnings: What Key Metrics Have to SayThe headline numbers for Cara (CARA) give insight into how the company performed in the quarter ended September 2023, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals. |

CARA Price Returns

| 1-mo | 27.59% |

| 3-mo | -45.93% |

| 6-mo | -35.82% |

| 1-year | -87.99% |

| 3-year | -96.88% |

| 5-year | -98.39% |

| YTD | -50.20% |

| 2023 | -93.08% |

| 2022 | -11.82% |

| 2021 | -19.50% |

| 2020 | -6.08% |

| 2019 | 23.92% |

Continue Researching CARA

Want to do more research on Cara Therapeutics Inc's stock and its price? Try the links below:Cara Therapeutics Inc (CARA) Stock Price | Nasdaq

Cara Therapeutics Inc (CARA) Stock Quote, History and News - Yahoo Finance

Cara Therapeutics Inc (CARA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...