Casa Systems, Inc. (CASA): Price and Financial Metrics

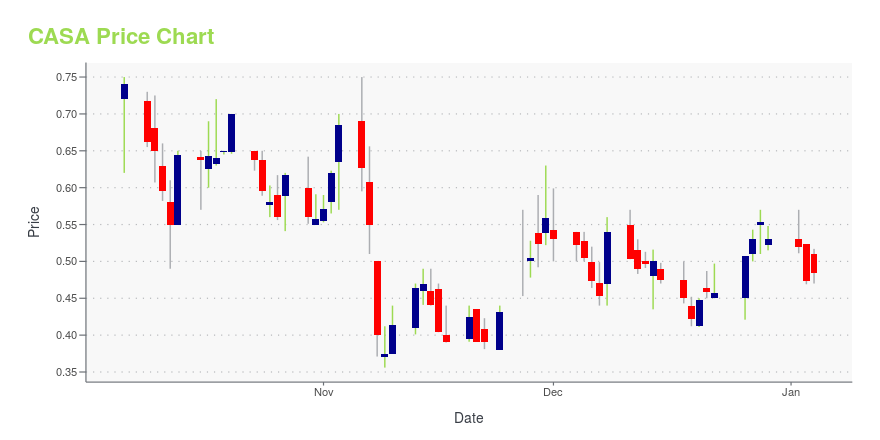

CASA Price/Volume Stats

| Current price | $0.04 | 52-week high | $1.42 |

| Prev. close | $0.06 | 52-week low | $0.03 |

| Day low | $0.03 | Volume | 30,080,000 |

| Day high | $0.05 | Avg. volume | 1,748,409 |

| 50-day MA | $0.32 | Dividend yield | N/A |

| 200-day MA | $0.64 | Market Cap | 3.47M |

CASA Stock Price Chart Interactive Chart >

Casa Systems, Inc. (CASA) Company Bio

Casa Systems, Inc. provides software-centric broadband products in North America, Latin America, Europe, the Middle East, Africa, and Asia-Pacific. The company offers converged cable access platform solutions that allow cable service providers to deliver voice, video, and data services over a single platform at multi-gigabit speeds. It also provides solutions for next-generation distributed and virtualized architectures in cable operator, fixed telecom, and wireless networks. The company was founded in 2003 and is based in Andover, Massachusetts.

Latest CASA News From Around the Web

Below are the latest news stories about CASA SYSTEMS INC that investors may wish to consider to help them evaluate CASA as an investment opportunity.

Casa Systems Appoints Former Cisco Executive Sanjay Kaul as Chief Revenue Officer; Chief Customer Officer Alfred de Cárdenas to Retire at End of YearTelecom, IT and enterprise veteran joins Casa Systems as it accelerates its focus on software-centered telecom and brings proven track record of executing complex business transformationANDOVER, Mass., Nov. 27, 2023 (GLOBE NEWSWIRE) -- Casa Systems (Nasdaq: CASA), a market leader in cloud-native network solutions serving Tier 1 and regional service providers worldwide, today announced the appointment of telecom industry veteran Sanjay Kaul as Chief Revenue Officer (CRO). The company also announc |

New Strong Sell Stocks for November 24thCASA, CASS and MRBK have been added to the Zacks Rank #5 (Strong Sell) List on November 24, 2023. |

Casa Systems Sets Cable Industry Milestone with DOCSIS 4.0 Extended Spectrum BreakthroughGroundbreaking performance marks Casa Systems’ vCCAP and RPD as key innovators in cable technology virtualizationFull utilization of extended spectrum DOCSIS accelerates cable operator’s path to 10GCasa Systems’ continued commitment to modernizing all access providers’ technologies underscores the company’s leadership in the telecom industry into the cloud-native future ANDOVER, Mass., Nov. 21, 2023 (GLOBE NEWSWIRE) -- Casa Systems (Nasdaq: CASA), a market leader in cloud-native network solution |

Casa Systems, Inc. (NASDAQ:CASA) Q3 2023 Earnings Call TranscriptCasa Systems, Inc. (NASDAQ:CASA) Q3 2023 Earnings Call Transcript November 7, 2023 Casa Systems, Inc. misses on earnings expectations. Reported EPS is $-0.2 EPS, expectations were $0.01. Operator: Good afternoon and welcome to Casa Systems Third Quarter 2023 Earnings Call. [Operator Instructions] As a reminder this call is being recorded. At this time, I would […] |

Casa Systems Reports Third Quarter 2023 Financial ResultsThird Quarter Revenue Increases 7% Over Prior QuarterContinued High Growth In Our Cloud and RAN Product LinesRevises Annual Revenue Guidance Range to $205 Million to $225 Million ANDOVER, Mass., Nov. 07, 2023 (GLOBE NEWSWIRE) -- Casa Systems, Inc. (Nasdaq: CASA), a leading provider of cloud-native software and physical broadband technology solutions for access, cable, and cloud, today reported its financial results for the third quarter ended September 30, 2023. Third Quarter 2023 Financial & Op |

CASA Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -89.48% |

| 1-year | -96.23% |

| 3-year | -99.48% |

| 5-year | -99.41% |

| YTD | -92.45% |

| 2023 | -80.59% |

| 2022 | -51.85% |

| 2021 | -8.10% |

| 2020 | 50.86% |

| 2019 | -68.85% |

Continue Researching CASA

Here are a few links from around the web to help you further your research on Casa Systems Inc's stock as an investment opportunity:Casa Systems Inc (CASA) Stock Price | Nasdaq

Casa Systems Inc (CASA) Stock Quote, History and News - Yahoo Finance

Casa Systems Inc (CASA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...