CBAK Energy Technology Inc. (CBAT): Price and Financial Metrics

CBAT Price/Volume Stats

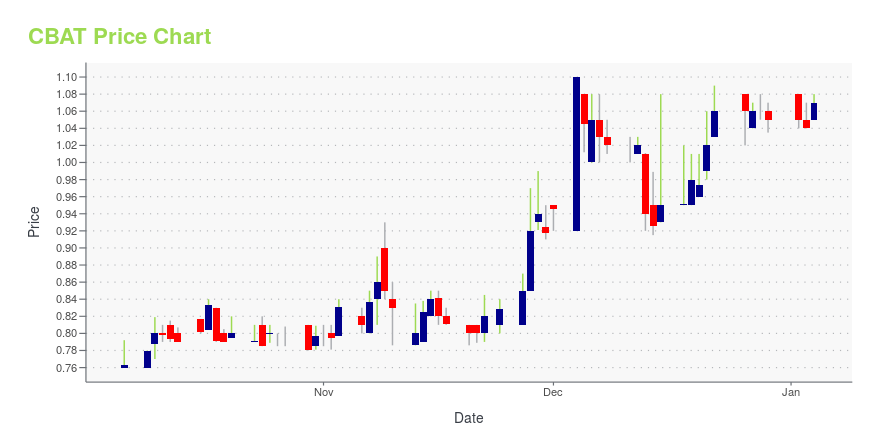

| Current price | $1.09 | 52-week high | $1.43 |

| Prev. close | $1.13 | 52-week low | $0.57 |

| Day low | $1.08 | Volume | 149,029 |

| Day high | $1.13 | Avg. volume | 233,051 |

| 50-day MA | $1.04 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 98.05M |

CBAT Stock Price Chart Interactive Chart >

CBAK Energy Technology Inc. (CBAT) Company Bio

CBAK Energy Technology, Inc. engages in the development, manufacture, and sale. of lithium ion rechargeable batteries. It offers aluminum-case cell, battery pack, cylindrical cell, lithium polymer cell, and high-power lithium battery cell. Its products are used for electronic vehicles; light electric vehicles; and electric tools, energy storage, uninterruptible power supply, and other high power applications. The company was founded in August 2001 and is headquartered in Dalian, China.

CBAT Price Returns

| 1-mo | -5.22% |

| 3-mo | N/A |

| 6-mo | 21.96% |

| 1-year | -14.84% |

| 3-year | -10.66% |

| 5-year | 19.78% |

| YTD | 15.96% |

| 2024 | -10.48% |

| 2023 | 6.06% |

| 2022 | -36.54% |

| 2021 | -69.17% |

| 2020 | 340.00% |

Continue Researching CBAT

Want to see what other sources are saying about CBAK Energy Technology Inc's financials and stock price? Try the links below:CBAK Energy Technology Inc (CBAT) Stock Price | Nasdaq

CBAK Energy Technology Inc (CBAT) Stock Quote, History and News - Yahoo Finance

CBAK Energy Technology Inc (CBAT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...