Companhia Brasileira de Distribuicao ADS (CBD): Price and Financial Metrics

CBD Price/Volume Stats

| Current price | $0.45 | 52-week high | $4.76 |

| Prev. close | $0.46 | 52-week low | $0.45 |

| Day low | $0.45 | Volume | 80,300 |

| Day high | $0.46 | Avg. volume | 320,311 |

| 50-day MA | $0.65 | Dividend yield | N/A |

| 200-day MA | $1.40 | Market Cap | 119.91M |

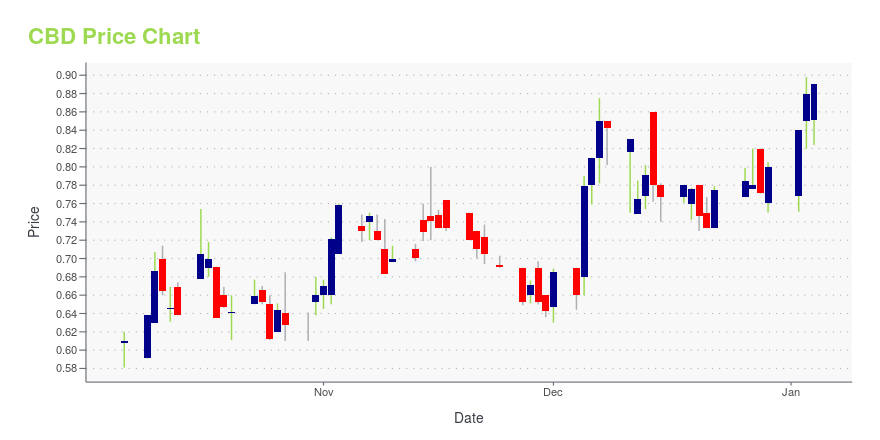

CBD Stock Price Chart Interactive Chart >

Companhia Brasileira de Distribuicao ADS (CBD) Company Bio

Companhia Brasileira de Distribuição engages in the retail of food, clothing, home appliances, electronics, and other products through its chain of hypermarkets, supermarkets, specialized stores, and department stores primarily in Brazil. The company was founded in 1948 and is headquartered in São Paulo, Brazil.

Latest CBD News From Around the Web

Below are the latest news stories about BRAZILIAN DISTRIBUTION CO COMPANHIA BRASILEIRA DE DISTR CBD that investors may wish to consider to help them evaluate CBD as an investment opportunity.

Companhia Brasileira de Distribuição (NYSE:CBD) Q3 2023 Earnings Call TranscriptCompanhia Brasileira de Distribuição (NYSE:CBD) Q3 2023 Earnings Call Transcript October 31, 2023 Operator: Good morning, everyone, and thank you for holding. Welcome to GPA’s Third Quarter of 2023 Earnings Call. [Operator Instructions]. We’d like to inform you that this video conference is being recorded and will be made available on the company’s Investor Relations […] |

Latin American Markets May Be A Mess, But This Stock Is IrresistibleCompanhia Brasileira de Distribuição is one of the largest grocery and convenience stores in Brazil. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on TuesdayIt's time for another dive into the biggest pre-market stock movers as we check out the shares worth watching on Tuesday! |

Companhia Brasileira (CBD) Up More Than 40% YTD: Here's WhyCompanhia Brasileira (CBD) benefits from its focus on strategic priorities. Digital transformation and store expansions have been working well amid escalated costs. |

Zacks Industry Outlook Highlights Walmart, The Kroger and Companhia Brasileira de DistribuicaoWalmart, The Kroger and Companhia Brasileira de Distribuicao are part of the Zacks Industry Outlook article. |

CBD Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -44.57% |

| 1-year | -89.84% |

| 3-year | -93.13% |

| 5-year | -92.26% |

| YTD | -43.75% |

| 2023 | -74.19% |

| 2022 | -21.25% |

| 2021 | 12.92% |

| 2020 | -33.90% |

| 2019 | 6.14% |

Continue Researching CBD

Want to see what other sources are saying about Brazilian Distribution Co Companhia Brasileira De Distr Cbd's financials and stock price? Try the links below:Brazilian Distribution Co Companhia Brasileira De Distr Cbd (CBD) Stock Price | Nasdaq

Brazilian Distribution Co Companhia Brasileira De Distr Cbd (CBD) Stock Quote, History and News - Yahoo Finance

Brazilian Distribution Co Companhia Brasileira De Distr Cbd (CBD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...