Catalyst Biosciences, Inc. (CBIO): Price and Financial Metrics

CBIO Price/Volume Stats

| Current price | $12.95 | 52-week high | $63.00 |

| Prev. close | $13.20 | 52-week low | $11.06 |

| Day low | $12.89 | Volume | 47,454 |

| Day high | $13.51 | Avg. volume | 35,240 |

| 50-day MA | $18.24 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 253.17M |

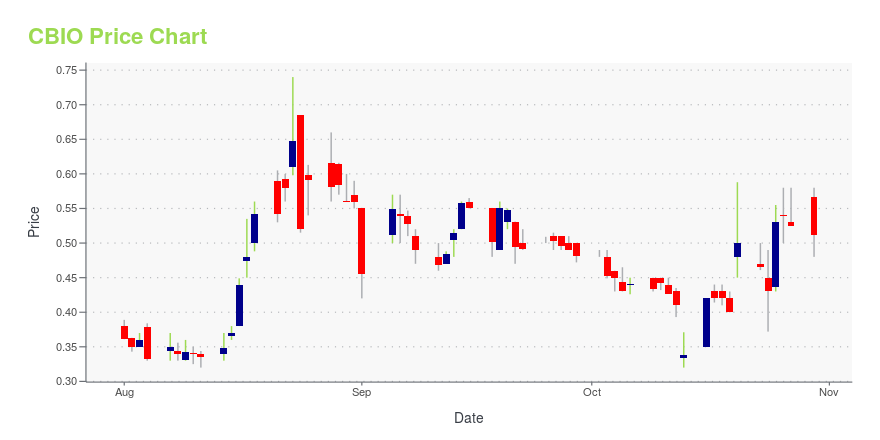

CBIO Stock Price Chart Interactive Chart >

Catalyst Biosciences, Inc. (CBIO) Company Bio

Catalyst Biosciences, Inc., a clinical-stage biopharmaceutical company, focuses on engineering proteases as therapeutics for hemophilia, hemeostasis, complement-mediated diseases, and other unmet medical needs. The company is based in South San Francisco, California.

CBIO Price Returns

| 1-mo | -13.67% |

| 3-mo | -45.75% |

| 6-mo | -52.00% |

| 1-year | -60.02% |

| 3-year | -81.92% |

| 5-year | -97.24% |

| YTD | -47.99% |

| 2024 | -89.45% |

| 2023 | -22.11% |

| 2022 | 110.42% |

| 2021 | -61.70% |

| 2020 | -28.92% |

Loading social stream, please wait...