CBL & Associates Properties, Inc. (CBL): Price and Financial Metrics

CBL Price/Volume Stats

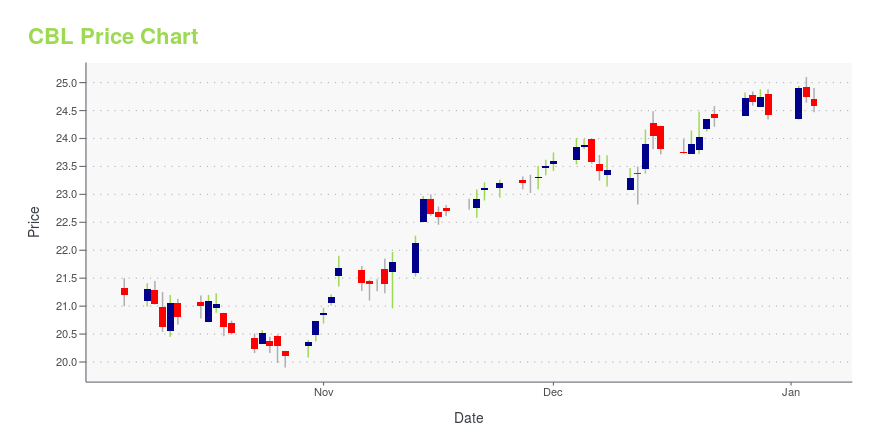

| Current price | $26.24 | 52-week high | $26.38 |

| Prev. close | $25.65 | 52-week low | $19.90 |

| Day low | $25.74 | Volume | 67,732 |

| Day high | $26.32 | Avg. volume | 103,869 |

| 50-day MA | $23.23 | Dividend yield | 6.15% |

| 200-day MA | $22.90 | Market Cap | 836.32M |

CBL Stock Price Chart Interactive Chart >

CBL & Associates Properties, Inc. (CBL) Company Bio

CBL & Associates owns and operates a portfolio of properties, consisting of enclosed malls and open-air centers. The company was founded in 1978 and is based in Chattanooga, Tennessee.

Latest CBL News From Around the Web

Below are the latest news stories about CBL & ASSOCIATES PROPERTIES INC that investors may wish to consider to help them evaluate CBL as an investment opportunity.

CBL Properties Sees Strong Demand From New Retail and Non-Traditional TenantsCHATTANOOGA, Tenn., December 04, 2023--Over the last several months, CBL Properties (NYSE:CBL) has welcomed a number of new retail, service, entertainment and restaurant concepts to its portfolio with more openings planned for 2024 and beyond. |

CBL Properties Reports Results for Third Quarter 2023CHATTANOOGA, Tenn., November 09, 2023--CBL Properties (NYSE: CBL) announced results for the third quarter ended September 30, 2023. Results of operations as reported in the consolidated financial statements for these periods are prepared in accordance with GAAP. A description of each supplemental non-GAAP financial measure and the related reconciliation to the comparable GAAP financial measure is located at the end of this news release. |

CBL Properties Declares Fourth Quarter Common Stock DividendCHATTANOOGA, Tenn., November 08, 2023--CBL Properties (NYSE:CBL) today announced that its Board of Directors has declared a cash dividend of $0.375 per common share for the quarter ending December 31, 2023. The dividend, which equates to an annual dividend payment of $1.50 per common share, is payable on December 29, 2023, to shareholders of record as of December 12, 2023. |

CBL Properties Earns 2023 Great Place to Work Certification™CHATTANOOGA, Tenn., November 06, 2023--CBL Properties (NYSE:CBL) today announced that it has achieved Great Place to Work® Certification™ for 2023. This prestigious designation is based on the results of a recently conducted survey of CBL’s current employees regarding their experience working at CBL. An overwhelming 95% of employees said CBL is a great place to work – 38 points higher than the average U.S. company. |

CBL Properties Publishes First ESG Progress UpdateCHATTANOOGA, Tenn., October 04, 2023--CBL Properties (NYSE:CBL) today announced that it has published its first ESG Progress Update that focuses on the Company’s accomplishments in 2022 and provides an update on its 2023 goals as well as a look ahead. |

CBL Price Returns

| 1-mo | 16.16% |

| 3-mo | 21.89% |

| 6-mo | 13.85% |

| 1-year | 28.60% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | 11.37% |

| 2023 | 12.96% |

| 2022 | -17.96% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

CBL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CBL

Here are a few links from around the web to help you further your research on Cbl & Associates Properties Inc's stock as an investment opportunity:Cbl & Associates Properties Inc (CBL) Stock Price | Nasdaq

Cbl & Associates Properties Inc (CBL) Stock Quote, History and News - Yahoo Finance

Cbl & Associates Properties Inc (CBL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...