Community Bank System, Inc. (CBU): Price and Financial Metrics

CBU Price/Volume Stats

| Current price | $62.82 | 52-week high | $63.95 |

| Prev. close | $62.59 | 52-week low | $35.38 |

| Day low | $62.00 | Volume | 322,527 |

| Day high | $63.95 | Avg. volume | 296,870 |

| 50-day MA | $48.62 | Dividend yield | 2.93% |

| 200-day MA | $46.49 | Market Cap | 3.32B |

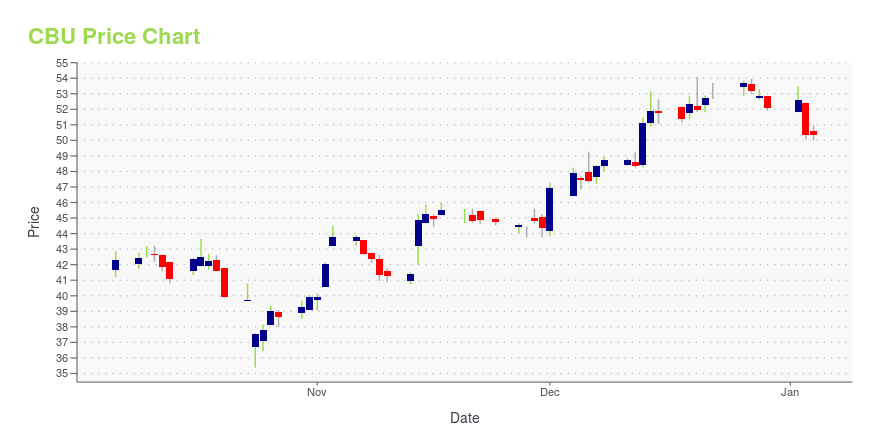

CBU Stock Price Chart Interactive Chart >

Community Bank System, Inc. (CBU) Company Bio

Community Bank System, Inc. provides various banking and financial services to retail, commercial, and municipal customers in Upstate New York and Northeastern Pennsylvania. The company was founded in 1983 and is based in Dewitt, New York.

Latest CBU News From Around the Web

Below are the latest news stories about COMMUNITY BANK SYSTEM INC that investors may wish to consider to help them evaluate CBU as an investment opportunity.

Community Bank System Announces Fourth Quarter and Full Year 2023 Earnings Conference CallSYRACUSE, N.Y., Dec. 21, 2023 (GLOBE NEWSWIRE) -- Community Bank System, Inc. (NYSE: CBU) invites you to participate in a conference call to discuss the Company’s financial and operating performance during its fourth quarter and full year ended December 31, 2023. Event:Earnings Conference Call – Fourth Quarter 2023 When:Tuesday, January 23, 2024 at 11:00 a.m. Eastern Time How:By conference call or from a simultaneous web cast Access:Conference Call Dial-In:1-833-630-0464 1-412-317-1809– Outside |

Do These 3 Checks Before Buying Community Bank System, Inc. (NYSE:CBU) For Its Upcoming DividendCommunity Bank System, Inc. ( NYSE:CBU ) is about to trade ex-dividend in the next 4 days. The ex-dividend date occurs... |

Implied Volatility Surging for Community Bank (CBU) Stock OptionsInvestors need to pay close attention to Community Bank (CBU) stock based on the movements in the options market lately. |

Dividend Champions List Ranked By Yield: Top 30In this article, we discuss top 30 dividend champions according to dividend yields. You can skip our detailed analysis of dividend stocks and their performance over the years, and go directly to read Dividend Champions List Ranked By Yield: Top 10. Dividend champions are companies that have increased their dividends for 25 years or more. […] |

Community Bank System, Inc. Announces Its Quarterly DividendSYRACUSE, N.Y., November 15, 2023--Community Bank System, Inc. Announces Its Quarterly Dividend |

CBU Price Returns

| 1-mo | 39.20% |

| 3-mo | 42.18% |

| 6-mo | 31.73% |

| 1-year | 24.44% |

| 3-year | -3.89% |

| 5-year | 10.86% |

| YTD | 23.01% |

| 2023 | -14.17% |

| 2022 | -13.16% |

| 2021 | 22.28% |

| 2020 | -9.59% |

| 2019 | 24.69% |

CBU Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CBU

Want to see what other sources are saying about Community Bank System Inc's financials and stock price? Try the links below:Community Bank System Inc (CBU) Stock Price | Nasdaq

Community Bank System Inc (CBU) Stock Quote, History and News - Yahoo Finance

Community Bank System Inc (CBU) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...