C4 Therapeutics Inc. (CCCC): Price and Financial Metrics

CCCC Price/Volume Stats

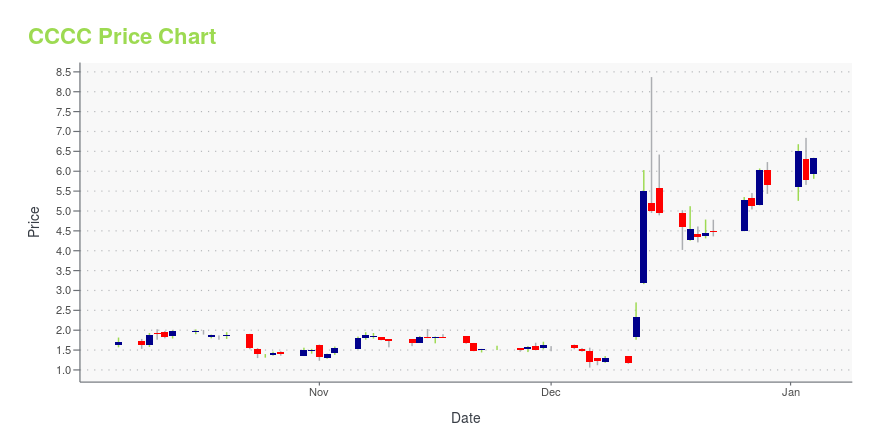

| Current price | $6.50 | 52-week high | $11.88 |

| Prev. close | $6.44 | 52-week low | $1.06 |

| Day low | $6.49 | Volume | 1,361,409 |

| Day high | $6.94 | Avg. volume | 2,755,583 |

| 50-day MA | $5.24 | Dividend yield | N/A |

| 200-day MA | $5.45 | Market Cap | 447.24M |

CCCC Stock Price Chart Interactive Chart >

C4 Therapeutics Inc. (CCCC) Company Bio

C4 Therapeutics, Inc. provides new class of targeted protein degradation. It develops Degronimid platform that incorporates small molecule binders to target disease-causing proteins and facilitate their destruction and clearance from the cell through the natural ubiquitin and proteasome system. The company was founded by James E. Bradner, Kenneth C. Anderson, Nathanael S. Gray and Marc A. Cohen in October 2015 and is headquartered in Cambridge, MA.

Latest CCCC News From Around the Web

Below are the latest news stories about C4 THERAPEUTICS INC that investors may wish to consider to help them evaluate CCCC as an investment opportunity.

The Zacks Analyst Blog Highlights Allogene Therapeutics, Arcutis Biotherapeutics and C4 TherapeuticsAllogene Therapeutics, Arcutis Biotherapeutics and C4 Therapeutics are part of the Zacks top Analyst Blog. |

11 Hot Healthcare Stocks To Buy NowIn this article, we will be taking a look at 11 hot healthcare stocks to buy now. To skip our detailed analysis of the healthcare sector, you can go directly to see the 5 Hot Healthcare Stocks To Buy Now. Healthcare is a vital part of daily living for everyone, whether it be to cure […] |

Wall Street Analysts Think C4 Therapeutics, Inc. (CCCC) Could Surge 222.95%: Read This Before Placing a BetThe mean of analysts' price targets for C4 Therapeutics, Inc. (CCCC) points to a 223% upside in the stock. While this highly sought-after metric has not proven reasonably effective, strong agreement among analysts in raising earnings estimates does indicate an upside in the stock. |

Following a 38% decline over last year, recent gains may please C4 Therapeutics, Inc. (NASDAQ:CCCC) institutional ownersKey Insights Institutions' substantial holdings in C4 Therapeutics implies that they have significant influence over the company's share price The top 9 shareholders own 51% of the company Analyst forecasts along with ownership data serve to give a strong idea about prospects for a business |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayPre-market stock movers are a hot topic on Wednesday and we're starting the day with a breakdown of the biggest ones worth watching! |

CCCC Price Returns

| 1-mo | 40.39% |

| 3-mo | 5.35% |

| 6-mo | 18.83% |

| 1-year | 78.57% |

| 3-year | -84.21% |

| 5-year | N/A |

| YTD | 15.04% |

| 2023 | -4.24% |

| 2022 | -81.68% |

| 2021 | -2.81% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...