CSI Compressco LP - common units (CCLP): Price and Financial Metrics

CCLP Price/Volume Stats

| Current price | $2.42 | 52-week high | $2.44 |

| Prev. close | $2.33 | 52-week low | $1.04 |

| Day low | $2.31 | Volume | 3,347,200 |

| Day high | $2.44 | Avg. volume | 208,926 |

| 50-day MA | $2.05 | Dividend yield | 1.65% |

| 200-day MA | $1.53 | Market Cap | 344.84M |

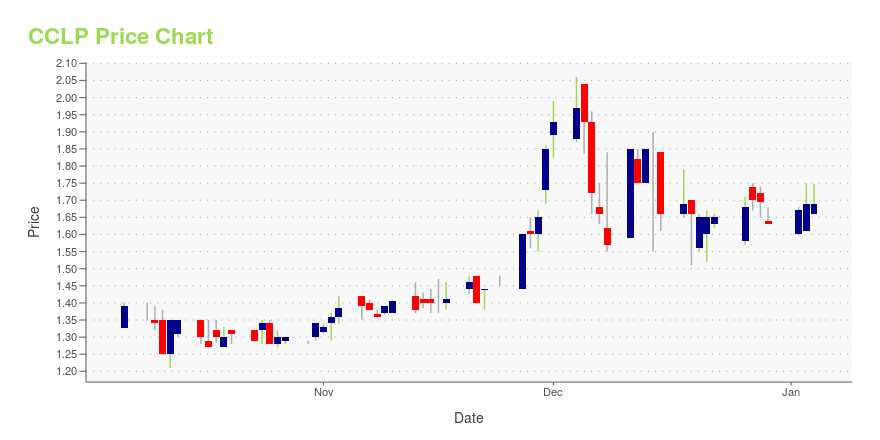

CCLP Stock Price Chart Interactive Chart >

CSI Compressco LP - common units (CCLP) Company Bio

CSI Compressco LP provides compression services and equipment for natural gas and oil production, gathering, transportation, processing, and storage applications in the United States, Latin America, Canada, and internationally. The company was founded in 2008 and is based in Midland, Texas.

Latest CCLP News From Around the Web

Below are the latest news stories about CSI COMPRESSCO LP that investors may wish to consider to help them evaluate CCLP as an investment opportunity.

CSI Compressco to Present at the Bank of America Leveraged Finance ConferenceCSI Compressco LP ("CSI Compressco") (NASDAQ: CCLP) announced today that it will be presenting at the Bank of America Leveraged Finance Conference. |

CSI Compressco LP (NASDAQ:CCLP) Q3 2023 Earnings Call TranscriptCSI Compressco LP (NASDAQ:CCLP) Q3 2023 Earnings Call Transcript November 2, 2023 Operator: Good morning, and welcome to CSI Compressco LP’s Third Quarter 2020 Earnings Conference Call. Speakers for today’s call are John Jackson, Chief Executive Officer of CSI Compressco LP; and Jonathan Byers, Chief Financial Officer of CSI Compressco LP; Rob Price, Chief Operating […] |

CSI Compressco LP (CCLP) Announces Q3 2023 Results: 14% YoY Quarterly Adjusted EBITDA GrowthCSI Compressco LP (CCLP) Continues Leverage Reduction |

CSI COMPRESSCO LP ANNOUNCES THIRD QUARTER 2023 RESULTS; ACHIEVES 14% YEAR-ON-YEAR QUARTERLY ADJUSTED EBITDA GROWTH; CONTINUES LEVERAGE REDUCTIONCSI Compressco LP ("CSI," or the "Partnership") (NASDAQ: CCLP) today announced third quarter 2023 results. |

CSI Compressco LP's Dividend AnalysisAs investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into CSI Compressco LPs dividend performance and assess its sustainability. CSI Compressco LP is a limited partnership operating in the U.S. The company is a provider of compression services and equipment for natural gas and oil production, gathering, transportation, processing, and storage. |

CCLP Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | 28.04% |

| 1-year | 122.86% |

| 3-year | 65.05% |

| 5-year | -18.24% |

| YTD | 49.24% |

| 2023 | 26.57% |

| 2022 | 15.27% |

| 2021 | 15.28% |

| 2020 | -58.99% |

| 2019 | 18.62% |

CCLP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CCLP

Here are a few links from around the web to help you further your research on CSI Compressco LP's stock as an investment opportunity:CSI Compressco LP (CCLP) Stock Price | Nasdaq

CSI Compressco LP (CCLP) Stock Quote, History and News - Yahoo Finance

CSI Compressco LP (CCLP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...