Codiak BioSciences Inc. (CDAK): Price and Financial Metrics

CDAK Price/Volume Stats

| Current price | $0.06 | 52-week high | $6.98 |

| Prev. close | $0.13 | 52-week low | $0.05 |

| Day low | $0.05 | Volume | 14,634,700 |

| Day high | $0.11 | Avg. volume | 1,366,845 |

| 50-day MA | $0.54 | Dividend yield | N/A |

| 200-day MA | $1.21 | Market Cap | 2.10M |

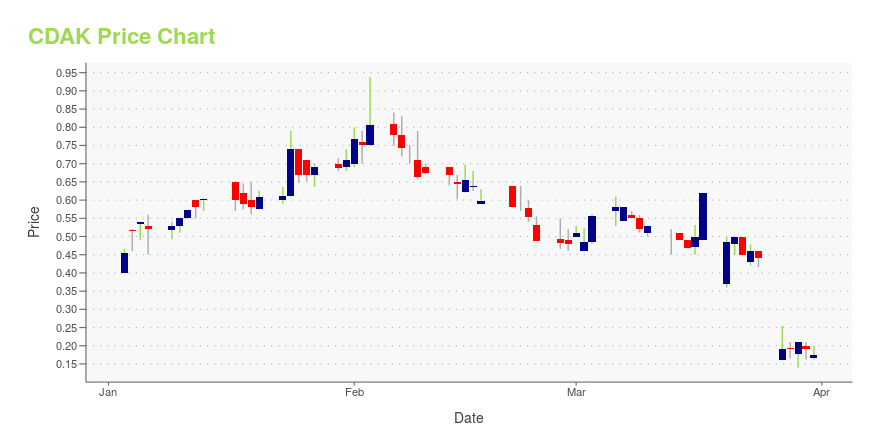

CDAK Stock Price Chart Interactive Chart >

Codiak BioSciences Inc. (CDAK) Company Bio

Codiak BioSciences, Inc. engages in the development and manufacturing of exosomes. It engages in harnessing exosomes, therapeutic applications, diagnostic applications, and proprietary production. The firm develops engEx Platform, a proprietary and versatile exosome engineering and manufacturing platform, to expand upon the innate properties of exosomes to design novel exosome therapeutics. The company was founded by Douglas E. William, Raghu Kalluri, and Eric S. Lander in 2015 and is headquartered in Cambridge, MA.

Latest CDAK News From Around the Web

Below are the latest news stories about CODIAK BIOSCIENCES INC that investors may wish to consider to help them evaluate CDAK as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on TuesdayGood morning! |

Codiak BioSciences to Participate 5th Annual Evercore ISI HealthCONx ConferenceCAMBRIDGE, Mass., Nov. 28, 2022 (GLOBE NEWSWIRE) -- Codiak BioSciences, Inc. (Nasdaq: CDAK), a clinical-stage biopharmaceutical company pioneering the development of exosome-based therapeutics as a new class of medicines, today announced that management will be participating in the 5th Annual Evercore ISI HealthCONx Conference, a virtual conference. Codiak’s Chief Executive Officer, Douglas E. Williams, Ph.D., will participate in a fireside chat on Wednesday, November 30 at 8:00 am ET and the Co |

Codiak Presents Preclinical Data on exoASO™-STAT6 and exoASO™-C/EBPβ Programs at the Society for Immunotherapy of Cancer (SITC) 2022 Annual Meeting– exoASO-STAT6 demonstrated durable pharmacokinetic/pharmacodynamic profile in preclinical models; biomarkers with clinical translational potential identified, providing a rationale for selecting cancer subtypes for treatment with exoASO-STAT6 – – Systemically administered exoASO-C/EBPβ demonstrated extra-hepatic delivery and potent systemic anti-tumor activity across multiple myeloid-derived suppressor cell (MDSC) rich tumor models – – A Phase 1 clinical trial of exoASO-STAT6 in patients with a |

Codiak BioSciences Third Quarter 2022 Earnings: EPS Beats Expectations, Revenues LagCodiak BioSciences ( NASDAQ:CDAK ) Third Quarter 2022 Results Key Financial Results Revenue: US$522.0k (down 55% from... |

Codiak BioSciences, Inc. (CDAK) Reports Q3 Loss, Lags Revenue EstimatesCodiak BioSciences, Inc. (CDAK) delivered earnings and revenue surprises of 6.10% and 70.39%, respectively, for the quarter ended September 2022. Do the numbers hold clues to what lies ahead for the stock? |

CDAK Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -99.63% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -96.43% |

| 2021 | -65.51% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...