Cardlytics, Inc. (CDLX): Price and Financial Metrics

CDLX Price/Volume Stats

| Current price | $8.83 | 52-week high | $20.52 |

| Prev. close | $8.37 | 52-week low | $5.71 |

| Day low | $8.46 | Volume | 358,823 |

| Day high | $8.90 | Avg. volume | 1,263,815 |

| 50-day MA | $8.64 | Dividend yield | N/A |

| 200-day MA | $9.59 | Market Cap | 430.75M |

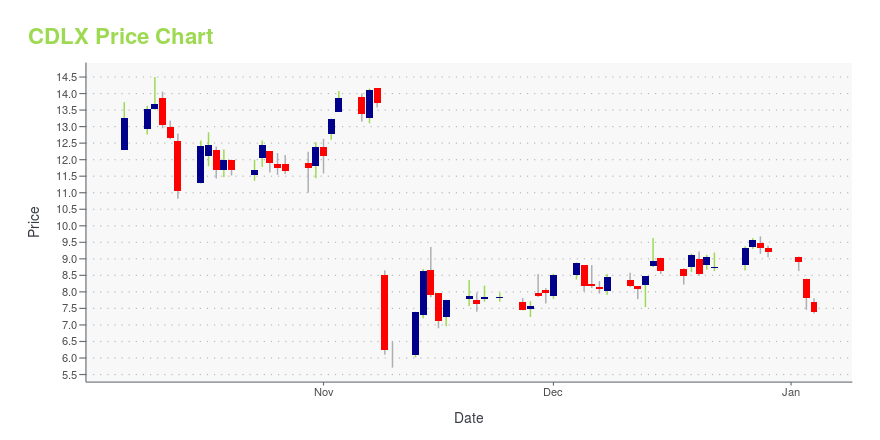

CDLX Stock Price Chart Interactive Chart >

Cardlytics, Inc. (CDLX) Company Bio

Cardlytics, Inc. operates purchase data intelligence platforms in the United States and the United Kingdom. The company operates through two segments, Cardlytics Direct and Other Platform Solutions. It operates Cardlytics Direct, a proprietary native bank advertising channel that enables marketers to reach consumers through their trusted and frequently visited online and mobile banking channels; and offers solutions that enable marketers and marketing service providers to leverage the power of purchase intelligence outside the banking channel. The company was founded in 2008 and is based in Atlanta, Georgia.

Latest CDLX News From Around the Web

Below are the latest news stories about CARDLYTICS INC that investors may wish to consider to help them evaluate CDLX as an investment opportunity.

Investors in Cardlytics (NASDAQ:CDLX) have seen impressive returns of 103% over the past yearCardlytics, Inc. ( NASDAQ:CDLX ) shareholders might understandably be very concerned that the share price has dropped... |

Cardlytics Announces Multi-Year Contract Renewal with Lloyds Bank PlcATLANTA, Dec. 19, 2023 (GLOBE NEWSWIRE) -- Cardlytics (NASDAQ: CDLX), an advertising platform in banks’ digital channels, announced that Cardlytics UK Limited, a wholly owned subsidiary of Cardlytics, Inc., renewed its Spending Rewards Agreement with Lloyds Bank Plc. Under the agreement, Cardlytics UK Limited will continue to provide service to Lloyds customers through December 31, 2026. About Cardlytics Cardlytics (NASDAQ: CDLX) is a digital advertising platform. We partner with financial insti |

Kigo, an Augeo subsidiary, acquires Entertainment® to advance Open Loyalty™ innovation & elevate digital offer experiencesAugeo, a global leader in engagement platforms, announced today that its digital asset technology subsidiary, Kigo, has acquired America's most trusted offer network, Entertainment®, from Cardlytics, Inc. (NASDAQ: CDLX). |

Insider Sell Alert: CEO Karim Temsamani Unloads Shares of Cardlytics IncIn a notable insider transaction, CEO Karim Temsamani has parted with a substantial number of shares in Cardlytics Inc (NASDAQ:CDLX). |

Institutional investors in Cardlytics, Inc. (NASDAQ:CDLX) lost 39% last week but have reaped the benefits of longer-term growthKey Insights Given the large stake in the stock by institutions, Cardlytics' stock price might be vulnerable to their... |

CDLX Price Returns

| 1-mo | 9.28% |

| 3-mo | -28.27% |

| 6-mo | 53.03% |

| 1-year | -8.31% |

| 3-year | -92.96% |

| 5-year | -69.61% |

| YTD | -4.13% |

| 2023 | 59.34% |

| 2022 | -91.25% |

| 2021 | -53.71% |

| 2020 | 127.12% |

| 2019 | 480.42% |

Continue Researching CDLX

Want to see what other sources are saying about Cardlytics Inc's financials and stock price? Try the links below:Cardlytics Inc (CDLX) Stock Price | Nasdaq

Cardlytics Inc (CDLX) Stock Quote, History and News - Yahoo Finance

Cardlytics Inc (CDLX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...