Cadence Design Systems Inc. (CDNS): Price and Financial Metrics

CDNS Price/Volume Stats

| Current price | $258.79 | 52-week high | $328.99 |

| Prev. close | $258.38 | 52-week low | $217.77 |

| Day low | $257.78 | Volume | 2,605,433 |

| Day high | $264.55 | Avg. volume | 1,623,824 |

| 50-day MA | $299.81 | Dividend yield | N/A |

| 200-day MA | $285.88 | Market Cap | 70.50B |

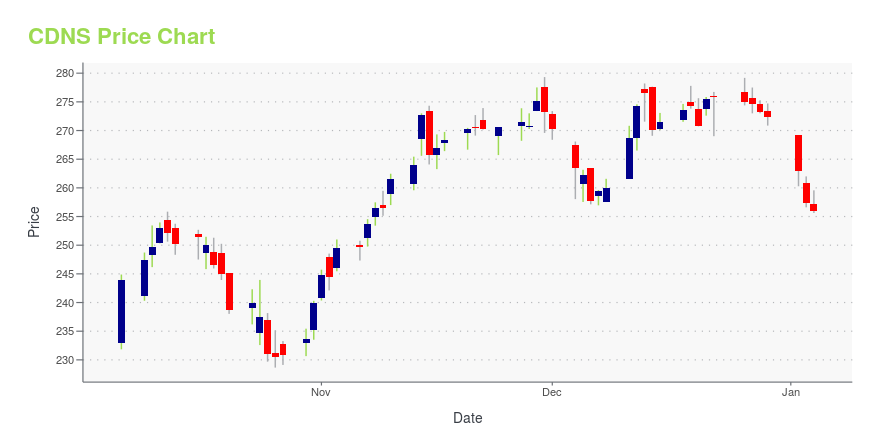

CDNS Stock Price Chart Interactive Chart >

Cadence Design Systems Inc. (CDNS) Company Bio

Cadence Design Systems, Inc. (stylized as cādence), headquartered in San Jose, California, is an American multinational computational software company, founded in 1988 by the merger of SDA Systems and ECAD, Inc. The company produces software, hardware and silicon structures for designing integrated circuits, systems on chips (SoCs) and printed circuit boards. (Source:Wikipedia)

Latest CDNS News From Around the Web

Below are the latest news stories about CADENCE DESIGN SYSTEMS INC that investors may wish to consider to help them evaluate CDNS as an investment opportunity.

Cadence Design Systems (CDNS) Stock Drops Despite Market Gains: Important Facts to NoteIn the most recent trading session, Cadence Design Systems (CDNS) closed at $274.64, indicating a -0.12% shift from the previous trading day. |

Are Computer and Technology Stocks Lagging Arlo Technologies (ARLO) This Year?Here is how Arlo Technologies (ARLO) and Cadence Design Systems (CDNS) have performed compared to their sector so far this year. |

The 3 Best Software Stocks to Buy for 2024In recent weeks, software stocks have taken off, with the iShares Expanded Tech-Software Sector ETF (CBOE:IGV) soaring 23% from Oct. 30 to Dec. |

12 High Growth High Margin Stocks to BuyIn this article, we will take a look at the 12 high growth high margin stocks to buy. To skip our analysis of the recent trends, and market activity, you can go directly to see the 5 High Growth High Margin Stocks to Buy. Profit margins tend to fluctuate based on several factors which can […] |

Ansys Stock Jumps on Sale Reports. These Buyers Make Sense.Ansys shares jumped Friday after a report that the simulation solution company is considering a potential sale. Bloomberg reported Thursday evening that Ansys is working with advisors, following takeover interest. The unidentified sources also said Ansys may choose to remain independent. |

CDNS Price Returns

| 1-mo | -16.34% |

| 3-mo | -8.36% |

| 6-mo | -10.99% |

| 1-year | 10.17% |

| 3-year | 80.63% |

| 5-year | 240.92% |

| YTD | -4.99% |

| 2023 | 69.55% |

| 2022 | -13.80% |

| 2021 | 36.59% |

| 2020 | 96.70% |

| 2019 | 59.52% |

Continue Researching CDNS

Want to do more research on Cadence Design Systems Inc's stock and its price? Try the links below:Cadence Design Systems Inc (CDNS) Stock Price | Nasdaq

Cadence Design Systems Inc (CDNS) Stock Quote, History and News - Yahoo Finance

Cadence Design Systems Inc (CDNS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...