Cidara Therapeutics, Inc. (CDTX): Price and Financial Metrics

CDTX Price/Volume Stats

| Current price | $13.24 | 52-week high | $24.40 |

| Prev. close | $11.95 | 52-week low | $10.00 |

| Day low | $11.88 | Volume | 70,900 |

| Day high | $13.34 | Avg. volume | 48,794 |

| 50-day MA | $12.19 | Dividend yield | N/A |

| 200-day MA | $14.33 | Market Cap | 60.40M |

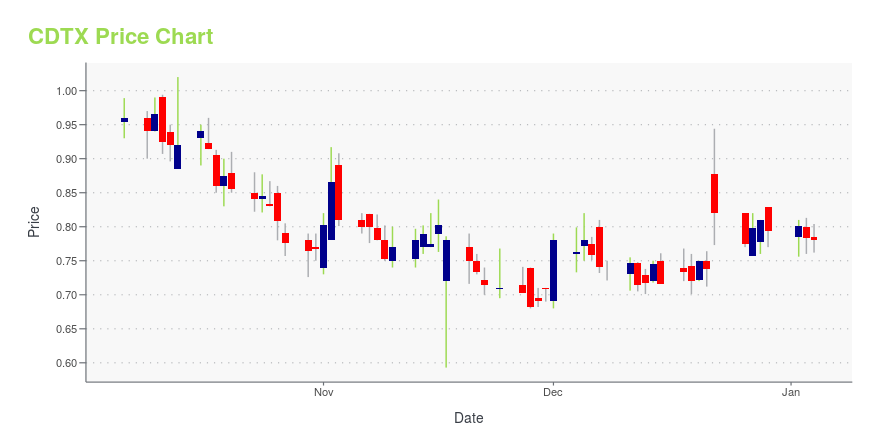

CDTX Stock Price Chart Interactive Chart >

Cidara Therapeutics, Inc. (CDTX) Company Bio

Cidara Therapeutics, Inc. focuses on the discovery, development, and commercialization of novel anti-infectives for the treatment of diseases. The company was formerly known as K2 Therapeutics, Inc. and changed its name to Cidara Therapeutics, Inc. in June 2014. The company was founded in 2012 and is based in San Diego, California.

Latest CDTX News From Around the Web

Below are the latest news stories about CIDARA THERAPEUTICS INC that investors may wish to consider to help them evaluate CDTX as an investment opportunity.

Cidara (CDTX) Up on EC Nod for Rezzayo in Invasive CandidiasisCidara's (CDTX) Rezzayo (rezafungin acetate) gets approval from the European Commission for the treatment of invasive candidiasis in adults. The stock rises 11.1%. |

Cidara Therapeutics Announces European Approval of REZZAYO® (rezafungin) for the Treatment of Invasive Candidiasis in AdultsApproval based on positive results from the pivotal ReSTORE Phase III clinical trial and supported by the STRIVE Phase II clinical trials and extensive nonclinical development program.REZZAYO represents the first new treatment option in over 15 years for patients with invasive candidiasis.Cidara is entitled to receive a milestone payment of approximately $11.14 million from Mundipharma for the European Medicines Agency (EMA) approval. SAN DIEGO, Dec. 22, 2023 (GLOBE NEWSWIRE) -- Cidara Therapeut |

Cidara Therapeutics Presents New Promising Preclincal Data on Novel Dual-Acting Drug-Fc Conjugates at ESMO Immuno-Oncology Annual CongressFirst in class, multi-specific CD73/PD-1 inhibitor DFC, exhibited robust anti-tumor activity in humanized mouse models of colorectal cancer at low doses CD73/PD-1 DFC demonstrated superior anti-tumor activity to CD73 and PD-1 monotherapies SAN DIEGO, Dec. 07, 2023 (GLOBE NEWSWIRE) -- Cidara Therapeutics, Inc. (Nasdaq: CDTX), a biotechnology company using its proprietary Cloudbreak® platform to develop drug-Fc conjugate (DFC) immunotherapies designed to save lives and improve the standard of care |

Cidara Therapeutics Announces Completion of Enrollment in Phase 3 Restore Trial of Rezafungin in ChinaTop-line data expected in Q2 2024 SAN DIEGO, Dec. 06, 2023 (GLOBE NEWSWIRE) -- Cidara Therapeutics, Inc. (Nasdaq: CDTX), a biotechnology developing therapies designed to save lives and improve the standard of care for patients facing serious diseases, today announced the company, along with Mundipharma, has completed enrollment in the Phase 3 ReSTORE trial in China evaluating the efficacy and safety of rezafungin as a treatment for candidemia and invasive candidiasis. The portion of the trial co |

Cidara Therapeutics to Present New Preclinical Data on Novel Dual-Acting Drug-Fc Conjugates at ESMO Immuno-Oncology Annual CongressPreclinical data on dual CD73/PD-1 targeting DFC to be presented for the first timeSAN DIEGO, Nov. 30, 2023 (GLOBE NEWSWIRE) -- Cidara Therapeutics, Inc. (Nasdaq: CDTX), a biotechnology company using its proprietary Cloudbreak® platform to develop drug-Fc conjugate (DFC) immunotherapies designed to save lives and improve the standard of care for patients facing serious diseases, today announced the company will present new preclinical data on its novel, dual-acting CD73/PD-1 targeting drug-Fc co |

CDTX Price Returns

| 1-mo | 18.32% |

| 3-mo | 4.83% |

| 6-mo | -1.63% |

| 1-year | -31.91% |

| 3-year | -56.45% |

| 5-year | -59.14% |

| YTD | -16.62% |

| 2023 | 4.98% |

| 2022 | -40.45% |

| 2021 | -36.50% |

| 2020 | -47.92% |

| 2019 | 63.40% |

Loading social stream, please wait...