ChromaDex Corporation (CDXC): Price and Financial Metrics

CDXC Price/Volume Stats

| Current price | $3.07 | 52-week high | $4.65 |

| Prev. close | $3.19 | 52-week low | $1.25 |

| Day low | $3.04 | Volume | 271,015 |

| Day high | $3.28 | Avg. volume | 314,741 |

| 50-day MA | $2.90 | Dividend yield | N/A |

| 200-day MA | $2.28 | Market Cap | 231.90M |

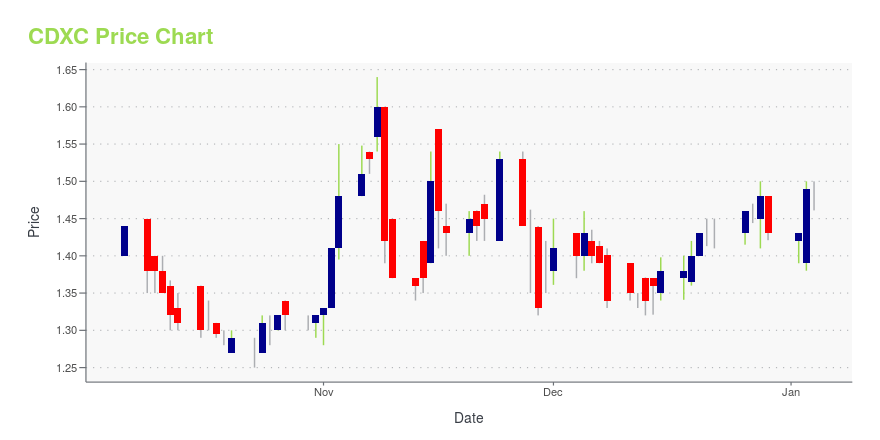

CDXC Stock Price Chart Interactive Chart >

ChromaDex Corporation (CDXC) Company Bio

ChromaDex Corporation, a natural products company, through its subsidiaries, discovers, acquires, develops, and commercializes patented and proprietary ingredient technologies. The company supplies bulk raw materials for use in dietary supplements, food, beverages, and cosmetic products; reference standards, materials, and kits to conduct quality control of raw materials and consumer products; and fine chemicals and phytochemicals for research and new product development applications. The company is based inIrvine, California.

Latest CDXC News From Around the Web

Below are the latest news stories about CHROMADEX CORP that investors may wish to consider to help them evaluate CDXC as an investment opportunity.

ChromaDex Supports the US Military with its Industry Leading NAD+ Supplement, Tru Niagen®LOS ANGELES, December 20, 2023--ChromaDex Corp. (NASDAQ:CDXC), the global authority on nicotinamide adenine dinucleotide (NAD+) and healthy aging research, is proud to announce its inaugural initiative to support the US Military. |

Neurohacker Collective and ChromaDex Partner to Optimize Cellular Health with the Debut of Qualia NAD+Neurohacker Collective, an acclaimed American science team that has been formulating advanced nutritional supplements since 2015, has just created an NAD+ supplement called Qualia NAD+ that tackles the challenge of boosting NAD+ levels in aging Americans.* |

A Milestone Phase I Randomized, Double-Blind Clinical Trial Demonstrates High-Dose Niagen®, Patented Nicotinamide Riboside (NR), Supplementation Induces a Potent NAD+ Response and Is Associated With Mild Improvement in Parkinson's Disease (PD)LOS ANGELES, November 30, 2023--ChromaDex Corp. (NASDAQ:CDXC), a global authority on Nicotinamide Adenine Dinucleotide (NAD+) and healthy aging research, shares results from a new breakthrough study analyzing the safety of high-dose nicotinamide riboside (NR) supplementation on individuals with Parkinson’s disease (PD). This study was part of the ChromaDex External Research Program (CERP™), which donated ChromaDex’s patented NR ingredient, Niagen®, the most efficient and high quality NAD+ precur |

An Intrinsic Calculation For ChromaDex Corporation (NASDAQ:CDXC) Suggests It's 44% UndervaluedKey Insights The projected fair value for ChromaDex is US$2.57 based on 2 Stage Free Cash Flow to Equity ChromaDex is... |

Newly Published Phase II Clinical Study Demonstrates that Supplementation with Niagen®, Patented Nicotinamide Riboside (NR), Elevates NAD+ Up to Fourfold, Improving Motor Coordination and Eye Movement in Ataxia Telangiectasia (AT) PatientsLOS ANGELES, November 15, 2023--ChromaDex Corp. (NASDAQ:CDXC), one of the global authorities on Nicotinamide Adenine Dinucleotide (NAD+) and healthy aging research, shares results from a phase II clinical study published in the peer-reviewed journal, Movement Disorders, by a team of researchers led by Dr. Hilde Nilsen, University of Oslo, Arkershus University Hospital, Norway. The clinical trial was part of the ChromaDex External Research Program (CERP™), which donated ChromaDex’s patented nicot |

CDXC Price Returns

| 1-mo | 14.98% |

| 3-mo | -10.76% |

| 6-mo | 100.65% |

| 1-year | 79.53% |

| 3-year | -64.43% |

| 5-year | -33.98% |

| YTD | 114.69% |

| 2023 | -14.88% |

| 2022 | -55.08% |

| 2021 | -22.08% |

| 2020 | 11.37% |

| 2019 | 25.66% |

Continue Researching CDXC

Want to do more research on ChromaDex Corp's stock and its price? Try the links below:ChromaDex Corp (CDXC) Stock Price | Nasdaq

ChromaDex Corp (CDXC) Stock Quote, History and News - Yahoo Finance

ChromaDex Corp (CDXC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...