China Eastern Airlines Corporation Ltd. (CEA): Price and Financial Metrics

CEA Price/Volume Stats

| Current price | $20.09 | 52-week high | $22.92 |

| Prev. close | $19.59 | 52-week low | $15.54 |

| Day low | $19.22 | Volume | 17,000 |

| Day high | $20.23 | Avg. volume | 15,818 |

| 50-day MA | $20.32 | Dividend yield | N/A |

| 200-day MA | $18.13 | Market Cap | 6.58B |

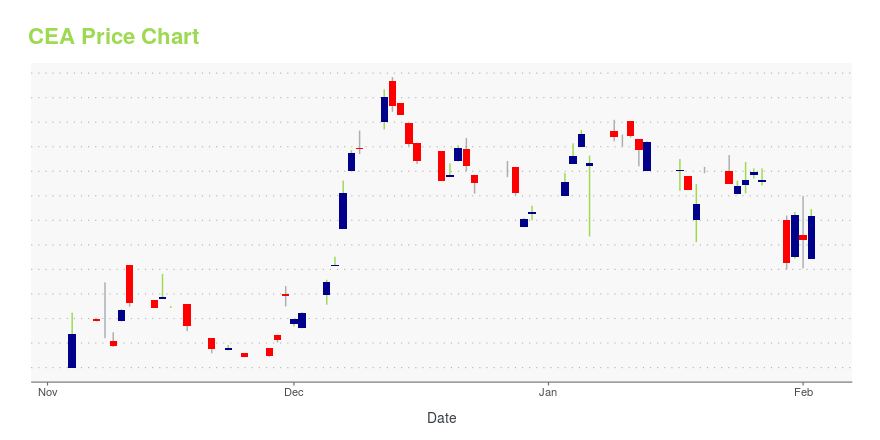

CEA Stock Price Chart Interactive Chart >

China Eastern Airlines Corporation Ltd. (CEA) Company Bio

China Eastern Airlines is one of the three largest airline companies in China. It offers passenger, cargo, mail delivery, and other extended transportation services. The company was founded in 1988 and is based in Shanghai, the Peoples Republic of China.

Latest CEA News From Around the Web

Below are the latest news stories about CHINA EASTERN AIRLINES CORP LTD that investors may wish to consider to help them evaluate CEA as an investment opportunity.

China Eastern Airlines: Bullish But Delisting Nears (NYSE:CEA)Chinese air travel demand is surging. Chinese airline stocks intend to de-list from NYSE amidst audit control access. Read more here. |

China Eastern Airlines: China Eastern''s Daily Passenger Count Exceeds 200,000, Number of International Flights Expected to Grow 220 pct in JanuaryChina Eastern Airlines (China Eastern) has recently seen a sharp increase in its daily passenger count as the number of its flights gradually recovered. On Jan. 12, 2023, the company operated 2,03… |

China Southern Airlines, China Eastern Airlines to delist from NYSE amid exodus of state-owned enterprises from US exchangesChina Southern Airlines and China Eastern Airlines said they will voluntarily delist ADRs from the NYSE, following the exits of five other Chinese state-owned enterprises in August. |

China Eastern Airlines notifies NYSE of proposed ADSs delisting (NYSE:CEA)China Eastern Airlines (CEA) has notified the NYSE of its proposed application for voluntary delisting of its ADSs from the exchange and the subsequent deregistration of the ADSs and… |

Last Two Chinese State-Owned Companies to Delist from NYSEThere will soon be no more Chinese state-owned companies trading on American stock exchanges. The last two remaining—China Eastern Airlines and China Southern Airlines— said they would apply to delist their American depositary shares from the New York Stock Exchange, following other Chinese state-owned firms that delisted last year. The moves came after a U.S. audit regulator's determination last month that it [secured complete access](https://www.wsj.com/articles/u-s-regulator-says-it-has-acces |

CEA Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | 7.72% |

| 5-year | -28.24% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | 9.08% |

| 2021 | -13.99% |

| 2020 | -20.16% |

| 2019 | -0.04% |

Continue Researching CEA

Want to do more research on China Eastern Airlines Corp Ltd's stock and its price? Try the links below:China Eastern Airlines Corp Ltd (CEA) Stock Price | Nasdaq

China Eastern Airlines Corp Ltd (CEA) Stock Quote, History and News - Yahoo Finance

China Eastern Airlines Corp Ltd (CEA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...