Central Federal Corporation (CFBK): Price and Financial Metrics

CFBK Price/Volume Stats

| Current price | $21.55 | 52-week high | $22.00 |

| Prev. close | $21.50 | 52-week low | $14.69 |

| Day low | $21.54 | Volume | 1,000 |

| Day high | $21.55 | Avg. volume | 4,628 |

| 50-day MA | $19.26 | Dividend yield | 1.17% |

| 200-day MA | $18.67 | Market Cap | 110.44M |

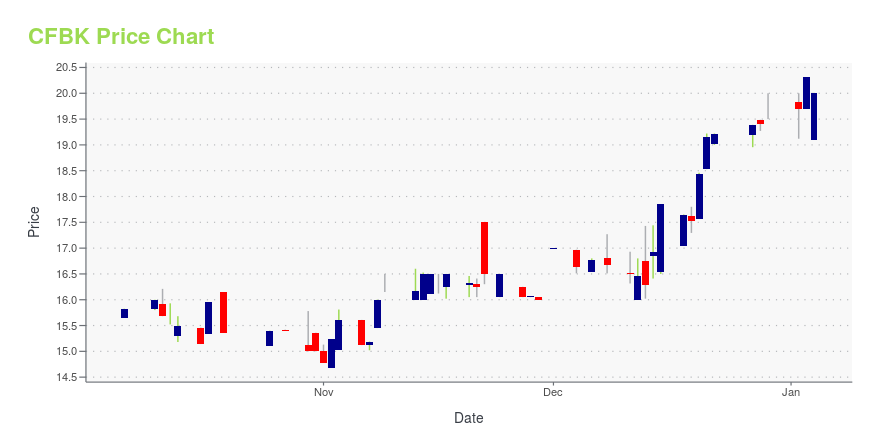

CFBK Stock Price Chart Interactive Chart >

Central Federal Corporation (CFBK) Company Bio

CF Bankshares Inc. operates as the bank holding company for CFBank, National Association that provides various banking products and services in the United States. The company accepts savings, retail and business checking accounts, and money market accounts, as well as certificates of deposit. It also offers single-family mortgage loans; commercial real estate and multi-family residential mortgage loans; commercial loans; construction and land loans; and consumer loans, such as home equity lines of credit, automobile loans, home improvement loans, and loans secured by deposits, as well as other loans. In addition, the company provides Internet and mobile banking, remote deposit, and corporate treasury management services. As of December 31, 2019, it operated six branch offices located in Franklin, Hamilton, Summit, Columbiana, and Blue Ash Counties; and a loan production office located in Franklin County; and an agency office located in Cuyahoga County, Ohio. The company was formerly known as Central Federal Corporation and changed its name to CF Bankshares Inc. in July 2020. CF Bankshares Inc. was founded in 1892 and is based in Worthington, Ohio.

Latest CFBK News From Around the Web

Below are the latest news stories about CF BANKSHARES INC that investors may wish to consider to help them evaluate CFBK as an investment opportunity.

While private equity firms own 26% of CF Bankshares Inc. (NASDAQ:CFBK), individual investors are its largest shareholders with 35% ownershipKey Insights CF Bankshares' significant individual investors ownership suggests that the key decisions are influenced... |

CF BANKSHARES INC., PARENT OF CFBANK NA, REPORTS RESULTS FOR THE THIRD QUARTER 2023.CF Bankshares Inc. (NASDAQ: CFBK) (the "Company"), the parent of CFBank, National Association ("CFBank"), today announced financial results for the third quarter ended September 30, 2023. |

CF Bankshares (NASDAQ:CFBK) Is Due To Pay A Dividend Of $0.06CF Bankshares Inc. ( NASDAQ:CFBK ) has announced that it will pay a dividend of $0.06 per share on the 27th of October... |

CF BANKSHARES INC., PARENT OF CFBANK, NA, ANNOUNCES QUARTERLY CASH DIVIDENDCF Bankshares Inc. (NASDAQ: CFBK) (the "Company"), the parent of CFBank, NA, today announced that the Board of Directors of the Company declared a quarterly cash dividend on its common stock of $0.06 per share. The dividend is payable on October 27, 2023 to shareholders of record as of the close of business on October 16, 2023. |

CF Bankshares (NASDAQ:CFBK) shareholders have earned a 18% CAGR over the last three yearsBy buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with... |

CFBK Price Returns

| 1-mo | 16.86% |

| 3-mo | N/A |

| 6-mo | -1.10% |

| 1-year | 22.68% |

| 3-year | N/A |

| 5-year | 86.93% |

| YTD | 11.55% |

| 2023 | -6.73% |

| 2022 | 4.07% |

| 2021 | 16.85% |

| 2020 | 27.08% |

| 2019 | 19.33% |

CFBK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CFBK

Here are a few links from around the web to help you further your research on Central Federal Corp's stock as an investment opportunity:Central Federal Corp (CFBK) Stock Price | Nasdaq

Central Federal Corp (CFBK) Stock Quote, History and News - Yahoo Finance

Central Federal Corp (CFBK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...