Carlyle Group Inc. (CG): Price and Financial Metrics

CG Price/Volume Stats

| Current price | $47.20 | 52-week high | $48.52 |

| Prev. close | $46.33 | 52-week low | $27.13 |

| Day low | $46.61 | Volume | 1,966,170 |

| Day high | $47.70 | Avg. volume | 2,209,941 |

| 50-day MA | $42.38 | Dividend yield | 3.01% |

| 200-day MA | $40.40 | Market Cap | 16.99B |

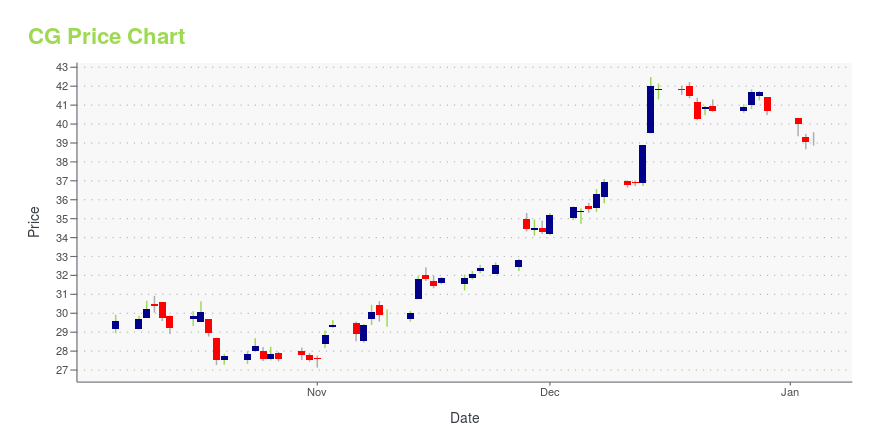

CG Stock Price Chart Interactive Chart >

Carlyle Group Inc. (CG) Company Bio

The Carlyle Group is a multinational private equity, alternative asset management and financial services corporation based in the United States with $376 billion of assets under management. It specializes in private equity, real assets, and private credit. It is one of the largest mega-funds in the world. In 2015, Carlyle was the world's largest private equity firm by capital raised over the previous five years, according to the PEI 300 index, though by 2020, it had slipped into second place. (Source:Wikipedia)

Latest CG News From Around the Web

Below are the latest news stories about CARLYLE GROUP INC that investors may wish to consider to help them evaluate CG as an investment opportunity.

Acentra Health (formerly Kepro) Earns URAC Disease Management Accreditation for Adhering to Care Standards That Prevent and Control Chronic DiseaseThree-year designation demonstrates company’s adherence to rigorous standards of quality and safety that drive better health outcomesMCLEAN, Va., Dec. 19, 2023 (GLOBE NEWSWIRE) -- Acentra Health, a leading provider of clinical services and technology solutions to government healthcare agencies, announced today that Kepro (which rebranded as Acentra Health in June 2023 following its merger with CNSI) has received full accreditation from URAC in Disease Management. The prestigious accreditation de |

Carlyle and Insight Partners to Invest in Exiger, a High-Growth AI Supply Chain Risk & Resilience Software Company, in Partnership with ManagementExiger, the market leading SaaS company revolutionizing the way corporations, government agencies and banks manage supply chains, announced today that it has entered into a definitive agreement through which it will receive a majority investment from funds managed by global investment firm Carlyle (NASDAQ: CG) and global software investor Insight Partners. The partnership will enable Exiger to continue investing in its award-winning product portfolio of AI solutions that are used in critical app |

Carlyle and Insight Partners Acquire Risk-Management Business ExigerBuyout firm Carlyle Group and technology investor Insight Partners have acquired risk-management software and services provider Exiger at a valuation of around $1.2 billion, according to two people familiar with the matter. |

Private Equity’s New Way to Defer M&A Debt Costs: Credit Weekly(Bloomberg) -- Most Read from BloombergUS Frackers Return to Haunt OPEC’s Pricing StrategyA-Rod’s Slam SPAC Is Said to Plan Merger With Lynk GlobalDimon’s Heir at JPMorgan Still Hazy as ‘Five More Years’ Tick ByCanada to Announce 2035 All-EV Sales Mandate, Reports SayNetanyahu, Under Pressure Over Hostage Deaths, Vows to Press On Private equity giants are turning to a new take on an old solution to higher debt costs for M&A deals: borrow all of the money they can and defer paying it back.KKR & C |

Billionaire reveals the biggest mistake investors makeCarlyle Group co-chairman and co-founder David Rubenstein discusses investors' 'biggest mistakes' and predicts the Federal Reserve's interest rate cut |

CG Price Returns

| 1-mo | 19.19% |

| 3-mo | 3.21% |

| 6-mo | 18.15% |

| 1-year | 43.01% |

| 3-year | 11.73% |

| 5-year | 126.83% |

| YTD | 17.89% |

| 2023 | 42.55% |

| 2022 | -43.78% |

| 2021 | 78.46% |

| 2020 | 1.62% |

| 2019 | 116.75% |

CG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CG

Want to do more research on Carlyle Group Inc's stock and its price? Try the links below:Carlyle Group Inc (CG) Stock Price | Nasdaq

Carlyle Group Inc (CG) Stock Quote, History and News - Yahoo Finance

Carlyle Group Inc (CG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...