Compugen Ltd. - Ordinary Shares (CGEN): Price and Financial Metrics

CGEN Price/Volume Stats

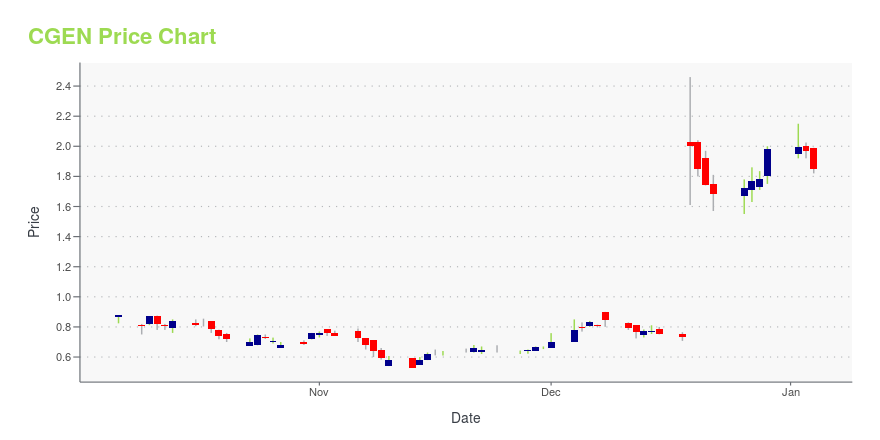

| Current price | $1.77 | 52-week high | $3.03 |

| Prev. close | $1.76 | 52-week low | $0.53 |

| Day low | $1.72 | Volume | 118,700 |

| Day high | $1.79 | Avg. volume | 495,450 |

| 50-day MA | $1.95 | Dividend yield | N/A |

| 200-day MA | $1.78 | Market Cap | 153.34M |

CGEN Stock Price Chart Interactive Chart >

Compugen Ltd. - Ordinary Shares (CGEN) Company Bio

Compugen Ltd. engages in the research, development, and commercialization of therapeutic and product candidates primarily in the United States, Europe, and Israel. The company was founded in 1993 and is headquartered in Tel Aviv, Israel.

Latest CGEN News From Around the Web

Below are the latest news stories about COMPUGEN LTD that investors may wish to consider to help them evaluate CGEN as an investment opportunity.

Biotech Stock Roundup: CGEN Up on GILD Deal, MRNA Gains on Study Data & MoreCompugen (CGEN) and Moderna (MRNA) are in the news on collaboration and study updates, respectively. |

Gilead (GILD), Compugen Collaborate for Immunotherapy ProgramGilead (GILD) enters into a license agreement with Compugen for its pre-clinical immunotherapy program. |

Compugen (NASDAQ:CGEN) delivers shareholders impressive 144% return over 1 year, surging 158% in the last week aloneThe most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you pick the right... |

Why Are Stocks Up Today?Stocks are up today and investors wondering why will want to keep reading as we have a breakdown of the market's rally on Tuesday! |

Why Is Compugen (CGEN) Stock Up 189% Today?Compugen stock is up on Tuesday as investors in CGEN shares react to an exclusive licensing agreement with Gilead Sciences. |

CGEN Price Returns

| 1-mo | 1.14% |

| 3-mo | -7.81% |

| 6-mo | -19.91% |

| 1-year | 71.84% |

| 3-year | -72.26% |

| 5-year | -48.09% |

| YTD | -10.61% |

| 2023 | 176.65% |

| 2022 | -83.36% |

| 2021 | -64.49% |

| 2020 | 103.19% |

| 2019 | 174.65% |

Loading social stream, please wait...