Chesapeake Energy Corporation (CHK): Price and Financial Metrics

CHK Price/Volume Stats

| Current price | $77.79 | 52-week high | $93.58 |

| Prev. close | $77.40 | 52-week low | $72.84 |

| Day low | $76.49 | Volume | 3,768,997 |

| Day high | $78.75 | Avg. volume | 1,878,897 |

| 50-day MA | $85.38 | Dividend yield | 2.88% |

| 200-day MA | $83.38 | Market Cap | 10.19B |

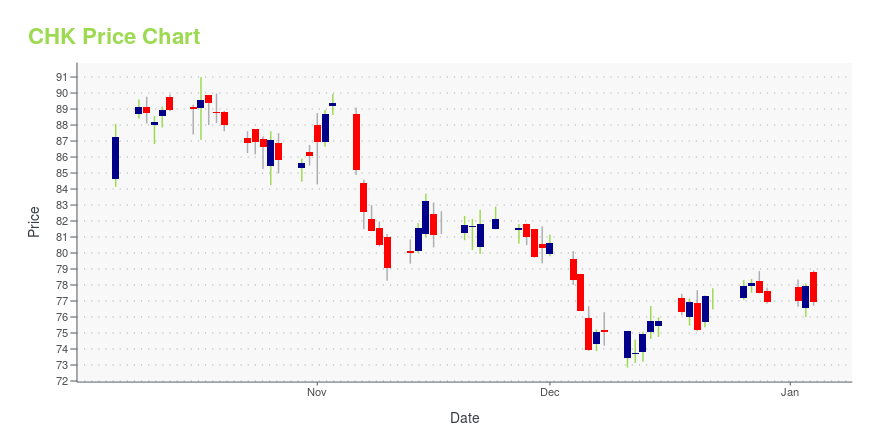

CHK Stock Price Chart Interactive Chart >

Chesapeake Energy Corporation (CHK) Company Bio

Chesapeake Energy Corp. engages in the acquisition, exploration and development of properties for the production of oil, natural gas and natural gas liquids from underground reservoirs. It focuses its acquisition, exploration, development and production efforts in the following geographic operating areas: Marcellus, Haynesville, Eagle Ford, Brazos Valley, and Powder River Basin. The company was founded by Aubrey K. McClendon and Tom L. Ward on May 18, 1989 and is headquartered in Oklahoma City, OK.

Latest CHK News From Around the Web

Below are the latest news stories about CHESAPEAKE ENERGY CORP that investors may wish to consider to help them evaluate CHK as an investment opportunity.

13 Most Profitable Natural Gas StocksIn this article, we discuss the 13 most profitable natural gas stocks in the world. To skip our detailed analysis of the gas and energy sectors, go directly to the 5 Most Profitable Natural Gas Stocks. The energy sector is once more a focal point on the global stage as we approach the end of […] |

13 Most Profitable Oil Stocks in the WorldIn this article, we discuss the 13 most profitable oil stocks in the world. To skip our detailed analysis of the oil and gas sector, go directly to the 5 Most Profitable Oil Stocks in the World. Oil stocks experienced a remarkable performance in 2022, but their fortunes took a downturn in 2023. Despite the […] |

13 Most Promising Energy Stocks According to AnalystsIn this article, we discuss the 13 most promising energy stocks according to analysts. To skip the overview of the energy sector, go directly to the 5 Most Promising Energy Stocks According to Analysts. Despite the global push toward clean energy, fossil fuels have shown their impact on the economy in recent years. While renewable […] |

10 Very Cheap Energy Stocks Ready To ExplodeIn this piece, we will take a look at ten very cheap energy stocks ready to explode. If you want to skip our overview of the energy industry and the latest news, then you can take a look at 5 Very Cheap Energy Stocks Ready To Explode. The global energy industry, despite a growing focus […] |

EQT Corp (EQT) to Divest Minority Stake in Marcellus Gas WellsEQT Corp (EQT) intends to divest stakes in assets located throughout Northeast Pennsylvania, generating 700 million cubic feet per day in current production. |

CHK Price Returns

| 1-mo | -5.98% |

| 3-mo | -14.83% |

| 6-mo | 1.86% |

| 1-year | -2.54% |

| 3-year | 68.99% |

| 5-year | N/A |

| YTD | 2.62% |

| 2023 | -14.77% |

| 2022 | 62.34% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

CHK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CHK

Want to see what other sources are saying about Chesapeake Energy Corp's financials and stock price? Try the links below:Chesapeake Energy Corp (CHK) Stock Price | Nasdaq

Chesapeake Energy Corp (CHK) Stock Quote, History and News - Yahoo Finance

Chesapeake Energy Corp (CHK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...