Chemung Financial Corp (CHMG): Price and Financial Metrics

CHMG Price/Volume Stats

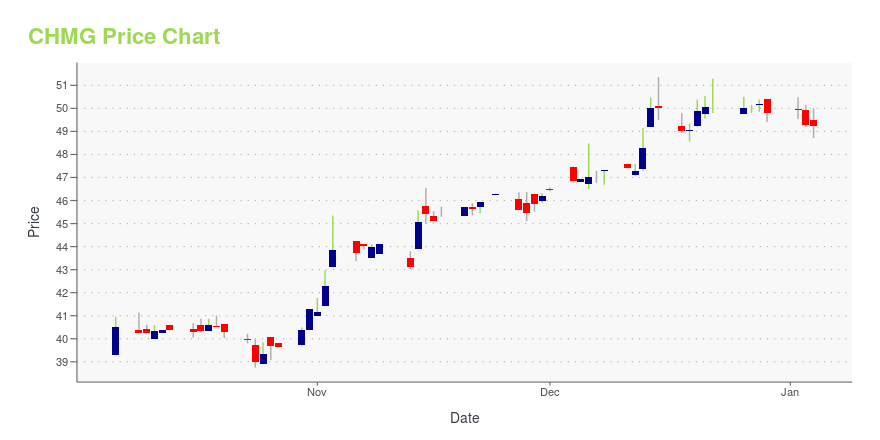

| Current price | $48.79 | 52-week high | $51.36 |

| Prev. close | $48.58 | 52-week low | $38.64 |

| Day low | $48.67 | Volume | 11,900 |

| Day high | $49.00 | Avg. volume | 8,769 |

| 50-day MA | $44.88 | Dividend yield | 2.53% |

| 200-day MA | $44.40 | Market Cap | 231.85M |

CHMG Stock Price Chart Interactive Chart >

Chemung Financial Corp (CHMG) Company Bio

Chemung Financial Corporation provides a range of banking, financing, fiduciary, and other financial services primarily in New York. The company was founded in 1833 and is based in Elmira, New York.

Latest CHMG News From Around the Web

Below are the latest news stories about CHEMUNG FINANCIAL CORP that investors may wish to consider to help them evaluate CHMG as an investment opportunity.

Should Value Investors Buy Chemung Financial Corp (CHMG) Stock?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

What Makes Chemung Financial (CHMG) a New Buy StockChemung Financial (CHMG) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term. |

HomeTrust Bancshares (HTBI) Soars 5.4%: Is Further Upside Left in the Stock?HomeTrust Bancshares (HTBI) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions may not translate into further price increase in the near term. |

Chemung Financial (NASDAQ:CHMG) Could Be A Buy For Its Upcoming DividendReaders hoping to buy Chemung Financial Corporation ( NASDAQ:CHMG ) for its dividend will need to make their move... |

Chemung Financial (NASDAQ:CHMG) Will Pay A Dividend Of $0.31Chemung Financial Corporation ( NASDAQ:CHMG ) has announced that it will pay a dividend of $0.31 per share on the 2nd... |

CHMG Price Returns

| 1-mo | 8.49% |

| 3-mo | 14.13% |

| 6-mo | 3.41% |

| 1-year | 17.68% |

| 3-year | 16.44% |

| 5-year | 27.56% |

| YTD | -0.58% |

| 2023 | 11.72% |

| 2022 | 1.57% |

| 2021 | 40.56% |

| 2020 | -17.11% |

| 2019 | 5.27% |

CHMG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CHMG

Here are a few links from around the web to help you further your research on Chemung Financial Corp's stock as an investment opportunity:Chemung Financial Corp (CHMG) Stock Price | Nasdaq

Chemung Financial Corp (CHMG) Stock Quote, History and News - Yahoo Finance

Chemung Financial Corp (CHMG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...