Chunghwa Telecom Co. Ltd. ADR (CHT): Price and Financial Metrics

CHT Price/Volume Stats

| Current price | $37.12 | 52-week high | $39.78 |

| Prev. close | $36.74 | 52-week low | $35.44 |

| Day low | $36.88 | Volume | 145,355 |

| Day high | $37.21 | Avg. volume | 77,251 |

| 50-day MA | $38.24 | Dividend yield | 3.12% |

| 200-day MA | $37.98 | Market Cap | 28.80B |

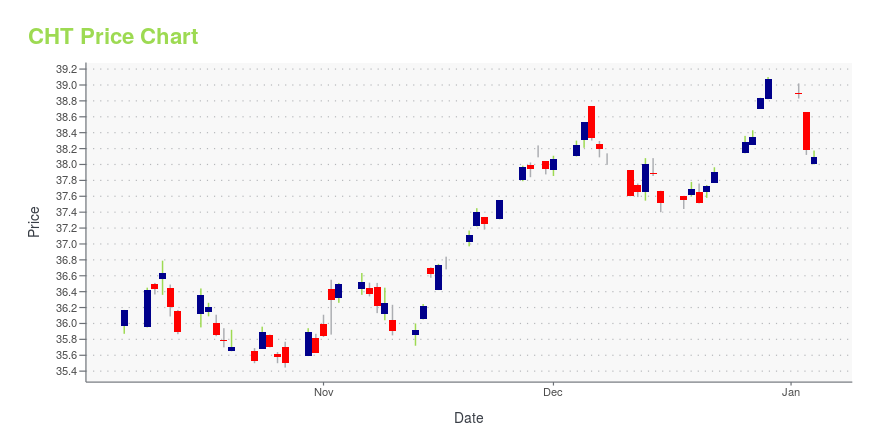

CHT Stock Price Chart Interactive Chart >

Chunghwa Telecom Co. Ltd. ADR (CHT) Company Bio

Chunghwa Telecom Company, Ltd. (Chinese: 中華電信股份有限公司; pinyin: Zhōnghuá Diànxìn; Wade–Giles: Chung1-hua2 Tien4-hsin4) (TWSE: 2412, NYSE: CHT) is the largest telecommunications company in Taiwan and the incumbent local exchange carrier of PSTN, Mobile, and broadband services in the country.(Source:Wikipedia)

Latest CHT News From Around the Web

Below are the latest news stories about CHUNGHWA TELECOM CO LTD that investors may wish to consider to help them evaluate CHT as an investment opportunity.

Chunghwa Applauded by Frost & Sullivan for Offering Customer Value in 5G and for Its Market-leading Position in Telecom and Data Center ServicesFrost & Sullivan recently assessed the 5G services, telecommunications, and data center services (DCS) industries and, based on its findings, recognizes Chunghwa Telecom (CHT) with the 2023 Taiwanese 5G Customer Value Leadership Award and two Company of the Year Awards, respectively. The company is the largest Internet data center (IDC) provider and telecoms service provider in Taiwan. Operating a vast network infrastructure encompassing fixed broadband, submarine cables, and mobile networks (4G |

Chunghwa Telecom Co., Ltd. (NYSE:CHT) Q3 2023 Earnings Call TranscriptChunghwa Telecom Co., Ltd. (NYSE:CHT) Q3 2023 Earnings Call Transcript November 3, 2023 Operator: Good afternoon, ladies and gentlemen. Welcome to Chunghwa Telecom Conference Call for the company’s Third Quarter 2023 Operating Results. During the presentation all lines will be on listen-only mode. [Operator Instructions] For your information, this conference call is now being broadcasted […] |

Chunghwa Telecom Reports Un-Audited Consolidated Operating Results for the Third Quarter of 2023Chunghwa Telecom Co., Ltd. (TAIEX: 2412, NYSE: CHT) ("Chunghwa" or "the Company") today reported its un-audited operating results for the third quarter of 2023. All figures were prepared in accordance with Taiwan-International Financial Reporting Standards ("T-IFRSs") on a consolidated basis. |

Chunghwa Telecom Reports Un-Audited Consolidated Operating Results for the Second Quarter of 2023Chunghwa Telecom Co., Ltd. (TAIEX: 2412, NYSE: CHT) ("Chunghwa" or "the Company") today reported its un-audited operating results for the second quarter of 2023. All figures were prepared in accordance with Taiwan-International Financial Reporting Standards ("T-IFRSs") on a consolidated basis. |

Chunghwa Telecom Appoints Mr. Chau-Young Lin as New PresidentChunghwa Telecom Co., Ltd., today announced the appointment of Mr. Chau-Young Lin as the new President of Chunghwa Telecom's Information Technology Group, succeeding Mr. Shui-Yi Kuo, effective July 7, 2023. The appointment was approved by the Board of Directors in an extraordinary board meeting held today. |

CHT Price Returns

| 1-mo | 0.28% |

| 3-mo | 0.99% |

| 6-mo | -0.84% |

| 1-year | 3.25% |

| 3-year | 1.76% |

| 5-year | 23.50% |

| YTD | -2.08% |

| 2023 | 9.95% |

| 2022 | -10.86% |

| 2021 | 12.51% |

| 2020 | 7.71% |

| 2019 | 6.32% |

CHT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CHT

Want to do more research on Chunghwa Telecom Co Ltd's stock and its price? Try the links below:Chunghwa Telecom Co Ltd (CHT) Stock Price | Nasdaq

Chunghwa Telecom Co Ltd (CHT) Stock Quote, History and News - Yahoo Finance

Chunghwa Telecom Co Ltd (CHT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...