CI Financial Corp (CIXX): Price and Financial Metrics

CIXX Price/Volume Stats

| Current price | $11.42 | 52-week high | $20.63 |

| Prev. close | $11.50 | 52-week low | $8.50 |

| Day low | $11.24 | Volume | 52,500 |

| Day high | $11.50 | Avg. volume | 126,800 |

| 50-day MA | $10.47 | Dividend yield | 4.7% |

| 200-day MA | $11.23 | Market Cap | 2.13B |

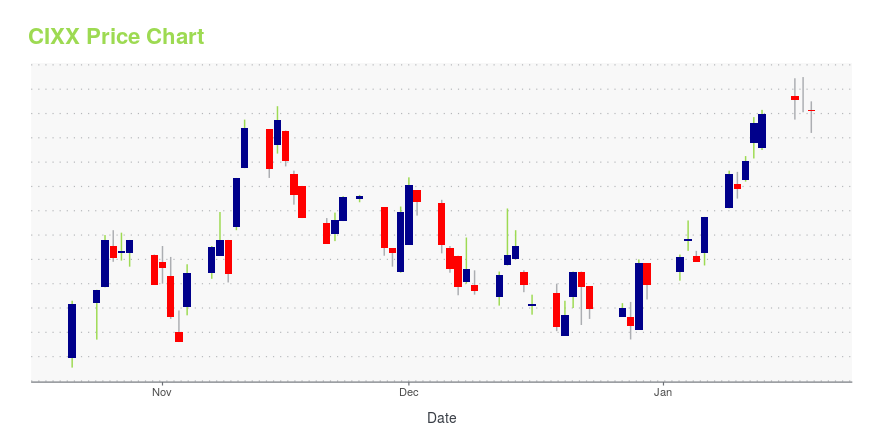

CIXX Stock Price Chart Interactive Chart >

CI Financial Corp (CIXX) Company Bio

CI Financial Corp. is a publicly owned asset management holding company. Through its subsidiaries, the firm manages separate client focused equity, fixed income, and alternative investments portfolios. It also manages mutual funds, hedge funds, and fund of funds for its clients through its subsidiaries. The firm was founded in 1965 and is based in Toronto, Canada with additional offices in Vancouver, Canada; Calgary, Canada; and Montreal, Canada.

Latest CIXX News From Around the Web

Below are the latest news stories about CI FINANCIAL CORP that investors may wish to consider to help them evaluate CIXX as an investment opportunity.

CI Global Asset Management Launches Minimum Downside Volatility ETFsTORONTO, January 24, 2023--CI Global Asset Management's suite of Minimum Downside Volatility ETFs begins trading today on the TSX. |

CI Financial (TSE:CIX) Is Due To Pay A Dividend Of CA$0.18The board of CI Financial Corp. ( TSE:CIX ) has announced that it will pay a dividend on the 14th of April, with... |

Why Canada’s CI Financial Signed a Big New York Office LeaseThe office will house six New York-based RIAs the company has acquired and leave room for further expansion. |

CI Financial Announces Fourth Quarter Earnings Conference Call and WebcastTORONTO, January 23, 2023--CI Financial will release its Q4-2022 financial results on February 24, 2023 and hold its call with analysts that day at 10 a.m. ET. |

CI Financial Corp. (TSE:CIX) insiders placed bullish bets worth CA$13m in the last 12 monthsIn the last year, multiple insiders have substantially increased their holdings of CI Financial Corp. ( TSE:CIX... |

CIXX Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -32.15% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -49.78% |

| 2021 | 70.75% |

| 2020 | N/A |

| 2019 | N/A |

CIXX Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...