China Jo-Jo Drugstores, Inc. (CJJD): Price and Financial Metrics

CJJD Price/Volume Stats

| Current price | $2.37 | 52-week high | $4.20 |

| Prev. close | $2.35 | 52-week low | $1.56 |

| Day low | $2.34 | Volume | 3,612 |

| Day high | $2.44 | Avg. volume | 45,074 |

| 50-day MA | $2.50 | Dividend yield | N/A |

| 200-day MA | $2.39 | Market Cap | 15.77M |

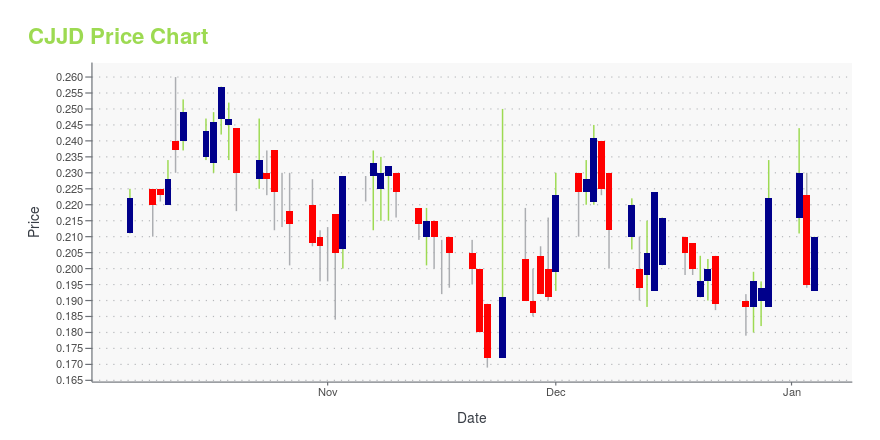

CJJD Stock Price Chart Interactive Chart >

Latest CJJD News From Around the Web

Below are the latest news stories about CHINA JO-JO DRUGSTORES INC that investors may wish to consider to help them evaluate CJJD as an investment opportunity.

China Jo-Jo Drugstores Announces Celebration of its 20th AnniversaryChina Jo-Jo Drugstores, Inc. (Nasdaq: CJJD) ("Jo-Jo Drugstores" or the "Company"), a leading online and offline retailer, wholesale distributor of pharmaceutical and other healthcare products and healthcare provider in China, today announced that its 20th Anniversary Ceremony (the "Ceremony") was held in Hangzhou. The Ceremony not only marks a milestone in the Company's history, but also heralds a new chapter for its future growth. |

China Jo-Jo Drugstores Announces $2.59 Million Registered Direct OfferingChina Jo-Jo Drugstores, Inc. (Nasdaq: CJJD) ("Jo-Jo Drugstores" or the "Company"), a leading online and offline retailer, wholesale distributor of pharmaceutical and other healthcare products and healthcare provider in China, today announced that it has entered into definitive agreements with a number of investors providing for the issuance of 9.96 million ordinary shares, at a purchase price of $0.26 per share (the "Purchase Price"), in a registered direct offering for aggregate gross proceeds |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on TuesdayWe're starting off Tuesday with a breakdown of the biggest pre-market stock movers investors will want to keep an eye on! |

China Jo-Jo Drugstores Announced Receipt of Nasdaq Notification Regarding Minimum Bid Price DeficiencyChina Jo-Jo Drugstores, Inc. (Nasdaq: CJJD) ("Jo-Jo Drugstores" or the "Company"), a leading online and offline retailer, wholesale distributor of pharmaceutical and other healthcare products and healthcare provider in China, today announced that on June 15, 2023, the Company has received a notification letter from Nasdaq Listing Qualifications Department ("Nasdaq") notifying the Company that it is not in compliance with the minimum bid price requirement from May 3, 2023 through June 14, 2023. A |

China Jo-Jo Drugstores Full Year 2023 Earnings: US$2.07 loss per share (vs US$0.92 loss in FY 2022)China Jo-Jo Drugstores ( NASDAQ:CJJD ) Full Year 2023 Results Key Financial Results Revenue: US$148.8m (down 9.5% from... |

CJJD Price Returns

| 1-mo | 5.33% |

| 3-mo | -16.37% |

| 6-mo | 29.72% |

| 1-year | -37.96% |

| 3-year | -97.63% |

| 5-year | -98.19% |

| YTD | 6.76% |

| 2023 | -93.79% |

| 2022 | -20.64% |

| 2021 | -62.83% |

| 2020 | -44.51% |

| 2019 | -9.00% |

Continue Researching CJJD

Want to do more research on China Jo-Jo Drugstores Inc's stock and its price? Try the links below:China Jo-Jo Drugstores Inc (CJJD) Stock Price | Nasdaq

China Jo-Jo Drugstores Inc (CJJD) Stock Quote, History and News - Yahoo Finance

China Jo-Jo Drugstores Inc (CJJD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...