CKX Lands, Inc. (CKX): Price and Financial Metrics

CKX Price/Volume Stats

| Current price | $13.10 | 52-week high | $14.44 |

| Prev. close | $13.02 | 52-week low | $9.82 |

| Day low | $12.99 | Volume | 2,100 |

| Day high | $13.13 | Avg. volume | 2,261 |

| 50-day MA | $13.57 | Dividend yield | N/A |

| 200-day MA | $12.90 | Market Cap | 26.55M |

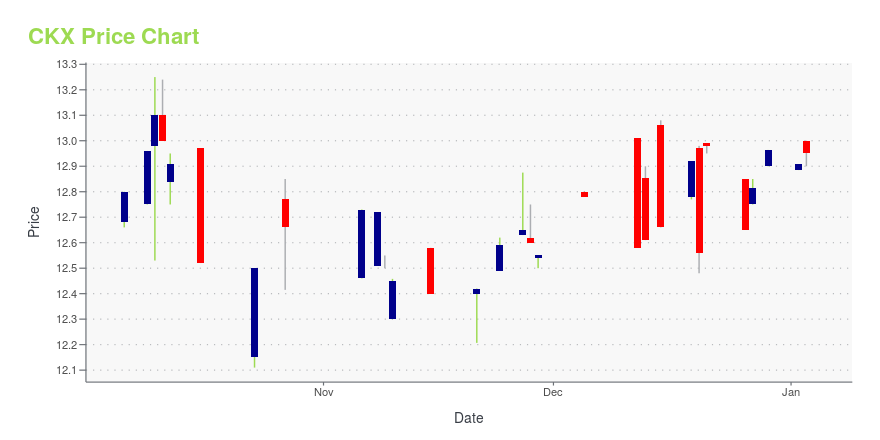

CKX Stock Price Chart Interactive Chart >

CKX Lands, Inc. (CKX) Company Bio

CKX Lands, Inc. engages in the ownership and management of land in the United States. It operates through three segments: Oil and Gas, Surface, and Timber. The company leases its properties for minerals, such as oil and gas; raising and harvesting timber; and surface uses comprising agriculture, right of ways, and hunting. It owns approximately 13,972 net acres of land consisting of 10,522 net acres of timber lands; 2,361 net acres of agriculture lands; and 895 net acres of marsh lands, as well as 194 net acres of land that is located in metropolitan areas. The company was formerly known as Calcasieu Real Estate & Oil Co., Inc. and changed its name to CKX Lands, Inc. in May 2005. CKX Lands, Inc. was founded in 1930 and is based in Lake Charles, Louisiana.

Latest CKX News From Around the Web

Below are the latest news stories about CKX LANDS INC that investors may wish to consider to help them evaluate CKX as an investment opportunity.

CKX Lands (NYSEAMERICAN:CKX) Raised to B- at TheStreetCKX Lands (NYSEAMERICAN:CKX) was upgraded by equities researchers at TheStreet from a c+ rating to a b- rating in a research note issued on Tuesday, TheStreetRatingsTable reports. Shares of CKX Lands stock opened at $11.93 on Tuesday. The stock has a market cap of $23.14 million, a PE ratio of 28.41 and a beta of [] |

CKX Price Returns

| 1-mo | -0.76% |

| 3-mo | -9.28% |

| 6-mo | 1.16% |

| 1-year | N/A |

| 3-year | 14.31% |

| 5-year | 31.69% |

| YTD | 1.05% |

| 2023 | 30.29% |

| 2022 | N/A |

| 2021 | 0.00% |

| 2020 | 2.11% |

| 2019 | -9.62% |

Continue Researching CKX

Want to see what other sources are saying about Ckx Lands Inc's financials and stock price? Try the links below:Ckx Lands Inc (CKX) Stock Price | Nasdaq

Ckx Lands Inc (CKX) Stock Quote, History and News - Yahoo Finance

Ckx Lands Inc (CKX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...