Calumet Specialty Products Partners, L.P. - Common units representing limited partner interests (CLMT): Price and Financial Metrics

CLMT Price/Volume Stats

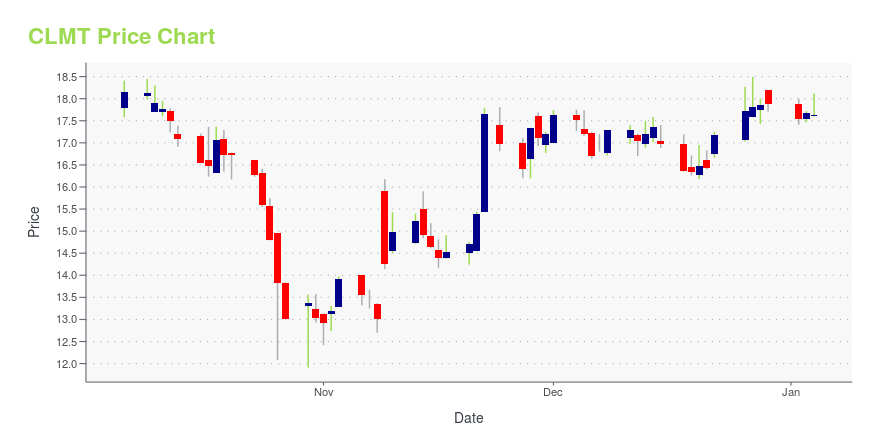

| Current price | $13.15 | 52-week high | $19.91 |

| Prev. close | $12.24 | 52-week low | $11.91 |

| Day low | $12.22 | Volume | 644,346 |

| Day high | $13.21 | Avg. volume | 155,488 |

| 50-day MA | $15.69 | Dividend yield | N/A |

| 200-day MA | $15.83 | Market Cap | 1.06B |

CLMT Stock Price Chart Interactive Chart >

Calumet Specialty Products Partners, L.P. - Common units representing limited partner interests (CLMT) Company Bio

Calumet Specialty Products Partners LP produces and sells specialty hydrocarbon products in North America. It operates in three segments: Specialty Products, Fuel Products, and Oilfield Services. The company was founded in 1916 and is based in Indianapolis, Indiana.

Latest CLMT News From Around the Web

Below are the latest news stories about CALUMET SPECIALTY PRODUCTS PARTNERS LP that investors may wish to consider to help them evaluate CLMT as an investment opportunity.

Operational Update: Calumet Announces Montana Renewables Returns to Full OperationsCalumet Specialty Products Partners, L.P. (NASDAQ: CLMT) ("Calumet," "we," "our" or "us"), announced today that Montana Renewables, LLC ("MRL") renewable diesel facility has returned to normal operations. The previously announced steam drum replacement and turnaround activity has been successfully completed, and the facility is now processing over 12,000 barrels per day of renewable feedstock. |

Calumet Specialty Products Partners, L.P. (NASDAQ:CLMT) Q3 2023 Earnings Call TranscriptCalumet Specialty Products Partners, L.P. (NASDAQ:CLMT) Q3 2023 Earnings Call Transcript November 9, 2023 Calumet Specialty Products Partners, L.P. beats earnings expectations. Reported EPS is $1.26, expectations were $-0.03. Operator: Good day, and welcome to the Calumet Specialty Products Third Quarter 2023 Results Conference Call. [Operator Instructions] Please note, this event is being recorded. I […] |

Q3 2023 Calumet Specialty Products Partners LP Earnings CallQ3 2023 Calumet Specialty Products Partners LP Earnings Call |

Calumet Specialty Products Partners LP (CLMT) Reports Mixed Q3 Results Amid Operational ChallengesNet Income Soars While Adjusted EBITDA Faces Headwinds |

Calumet Specialty Products Partners, L.P. Reports Third Quarter 2023 ResultsCalumet Specialty Products Partners, L.P. (NASDAQ: CLMT) (the "Partnership," "Calumet," "we," "our" or "us"), today reported results for the third quarter ended September 30, 2023, as follows: |

CLMT Price Returns

| 1-mo | -17.92% |

| 3-mo | -15.27% |

| 6-mo | -17.66% |

| 1-year | -17.45% |

| 3-year | 96.86% |

| 5-year | 184.02% |

| YTD | -26.41% |

| 2023 | 5.86% |

| 2022 | 27.88% |

| 2021 | 321.73% |

| 2020 | -14.25% |

| 2019 | 65.16% |

Continue Researching CLMT

Want to see what other sources are saying about Calumet Specialty Products Partners LP's financials and stock price? Try the links below:Calumet Specialty Products Partners LP (CLMT) Stock Price | Nasdaq

Calumet Specialty Products Partners LP (CLMT) Stock Quote, History and News - Yahoo Finance

Calumet Specialty Products Partners LP (CLMT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...