Clean Energy Fuels Corp. (CLNE): Price and Financial Metrics

CLNE Price/Volume Stats

| Current price | $2.06 | 52-week high | $3.67 |

| Prev. close | $2.04 | 52-week low | $1.30 |

| Day low | $2.05 | Volume | 453,098 |

| Day high | $2.10 | Avg. volume | 2,807,398 |

| 50-day MA | $1.93 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 455.22M |

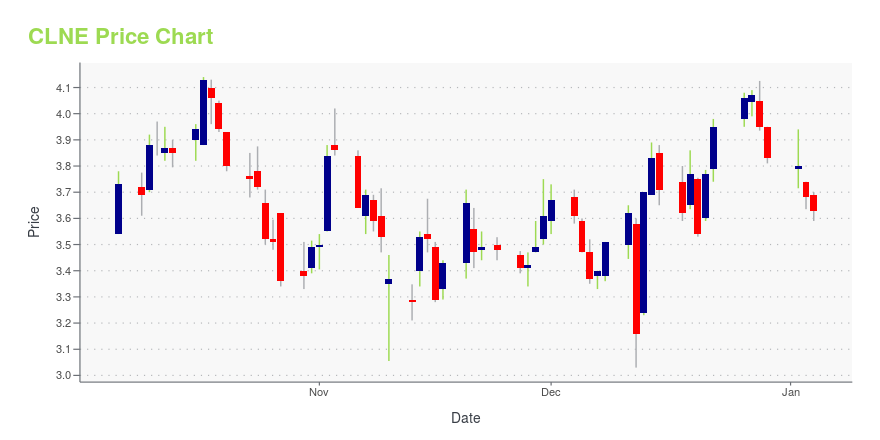

CLNE Stock Price Chart Interactive Chart >

Clean Energy Fuels Corp. (CLNE) Company Bio

Clean Energy Fuels Corp. provides natural gas as an alternative fuel for vehicle fleets in the United States and Canada. It designs, builds, operates, and maintains fueling stations; and supplies compressed natural gas (CNG) fuel for light, medium, and heavy-duty vehicles, as well as liquefied natural gas (LNG) fuel for medium and heavy-duty vehicles. The company was founded in 2001 and is based in Newport Beach, California.

CLNE Price Returns

| 1-mo | 4.57% |

| 3-mo | N/A |

| 6-mo | -28.47% |

| 1-year | -22.85% |

| 3-year | -62.34% |

| 5-year | -16.94% |

| YTD | -17.93% |

| 2024 | -34.46% |

| 2023 | -26.35% |

| 2022 | -15.17% |

| 2021 | -22.01% |

| 2020 | 235.90% |

Continue Researching CLNE

Here are a few links from around the web to help you further your research on Clean Energy Fuels Corp's stock as an investment opportunity:Clean Energy Fuels Corp (CLNE) Stock Price | Nasdaq

Clean Energy Fuels Corp (CLNE) Stock Quote, History and News - Yahoo Finance

Clean Energy Fuels Corp (CLNE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...