Clene Inc. (CLNN): Price and Financial Metrics

CLNN Price/Volume Stats

| Current price | $4.49 | 52-week high | $15.80 |

| Prev. close | $4.46 | 52-week low | $4.23 |

| Day low | $4.40 | Volume | 22,400 |

| Day high | $4.67 | Avg. volume | 43,973 |

| 50-day MA | $6.60 | Dividend yield | N/A |

| 200-day MA | $7.95 | Market Cap | 28.83M |

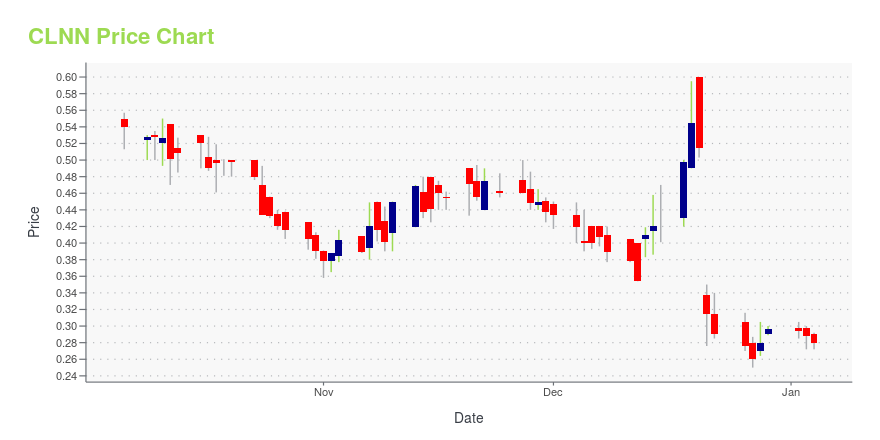

CLNN Stock Price Chart Interactive Chart >

Clene Inc. (CLNN) Company Bio

Clene Inc. is a clinical-stage biopharmaceutical company. The Company focuses on the development of unique therapeutics for neurodegenerative diseases. Clene provides nanotechnology drug platform for the development of a new class of orally administered neurotherapeutic drugs.

Latest CLNN News From Around the Web

Below are the latest news stories about CLENE INC that investors may wish to consider to help them evaluate CLNN as an investment opportunity.

Clene Announces New Data from HEALEY ALS Platform TrialLOS ANGELES, CA - (NewMediaWire) - December 22, 2023 - (InvestorBrandNetwork via NewMediaWire) - This original article is powered by IBN, a financial news, content creation and publishing company.Clene (NASDAQ: CLNN) (along with its subsidiaries, "Cl... |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayIt's time to start off Thursday with a breakdown of the biggest pre-market stock movers worth keeping an eye on this morning! |

Clene Reports Reduction in Biomarker Plasma Neurofilament Light (NfL) Levels and Improved Survival With CNM-Au8® Treatment From HEALEY ALS Platform Trial Long-Term Open Label ExtensionCNM-Au8 30mg treatment demonstrated significantly reduced plasma neurofilament light chain (NfL) levels at 76 weeks relative to placebo (18 months from randomization, p=0.023)60% decreased risk of long-term all-cause mortality (>18 months, p=0.0167) in participants originally randomized to CNM-Au8 30mg compared to those originally randomized to placebo using the rank-preserving structural failure time model (RPSFTM) CNM-Au8 30mg had greater overall treatment effect in delaying the time to morbid |

Clene Provides Update on ALS Clinical Development Meeting With FDASALT LAKE CITY, Dec. 21, 2023 (GLOBE NEWSWIRE) -- Clene Inc. (Nasdaq: CLNN) (along with its subsidiaries, “Clene”) and its wholly owned subsidiary Clene Nanomedicine Inc., a clinical-stage biopharmaceutical company focused on improving mitochondrial health and protecting neuronal function to treat neurodegenerative diseases, including amyotrophic lateral sclerosis (ALS) and multiple sclerosis (MS), today provided an ALS regulatory update from its recent meeting with the U.S. Food and Drug Admini |

How Clene CNM-Au8(R) Takes Advantage of Gold Nanocrystals to Target Neurodegenerative DisordersLOS ANGELES, CA - (NewMediaWire) - December 19, 2023 - (InvestorBrandNetwork via NewMediaWire) - This original article is powered by IBN, a financial news, content creation and publishing company.Clene, a late clinical-stage biopharmaceutical company... |

CLNN Price Returns

| 1-mo | -36.06% |

| 3-mo | -33.95% |

| 6-mo | -57.47% |

| 1-year | -69.33% |

| 3-year | -97.12% |

| 5-year | N/A |

| YTD | -24.31% |

| 2023 | -70.34% |

| 2022 | -75.61% |

| 2021 | -54.50% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...