CLPS Incorporation (CLPS): Price and Financial Metrics

CLPS Price/Volume Stats

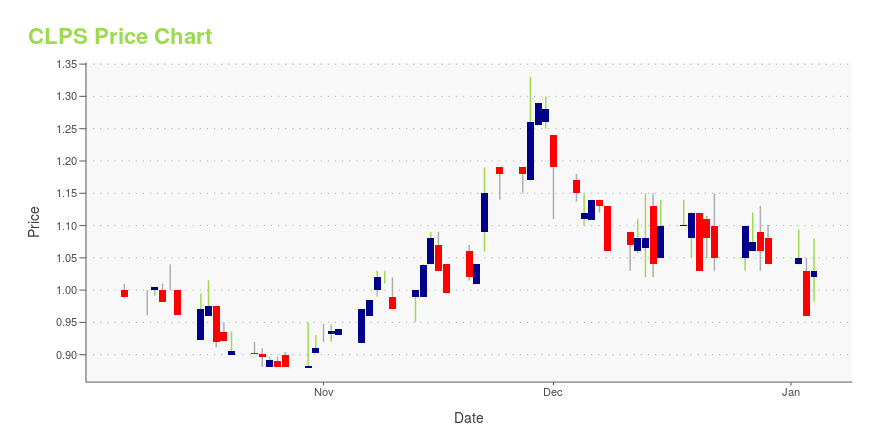

| Current price | $0.86 | 52-week high | $1.33 |

| Prev. close | $0.89 | 52-week low | $0.68 |

| Day low | $0.80 | Volume | 21,825 |

| Day high | $0.87 | Avg. volume | 13,049 |

| 50-day MA | $0.91 | Dividend yield | N/A |

| 200-day MA | $0.99 | Market Cap | 22.04M |

CLPS Stock Price Chart Interactive Chart >

CLPS Incorporation (CLPS) Company Bio

CLPS Incorporation provides information technology and consulting services to banking, insurance, and financial sectors in the People's Republic of China and internationally. It offers IT consulting services in credit card business areas, such as credit card application, account setup, authorization and activation, settlement, collection, promotion, point system, anti-fraud, statement, reporting, and risk management. The company also provides core banking services, including business analysis, system design, development, testing, system maintenance, and operation support; and services in loans, deposit, general ledger, wealth management, debit card, anti-money-laundering, statement and reporting, and risk management, as well as architecture consulting services for core banking systems, and online and mobile banking. In addition, it offers software project development, maintenance, and testing solution services, including COBOL, Java, .NET, Mobile, and other technology applications; and CLPS Virtual Banking Platform, a training platform for IT talents owned by CLPS. The company was founded in 2005 and is based in Shanghai, the People's Republic of China.

Latest CLPS News From Around the Web

Below are the latest news stories about CLPS INC that investors may wish to consider to help them evaluate CLPS as an investment opportunity.

CLPS Incorporation Expands Overseas Credit Card Business with the Acquisition of Purple Potato FinanceCLPS Incorporation (the "Company" or "CLPS") (Nasdaq: CLPS), today announced that its wholly-owned subsidiary, Qinson Credit Card Services Limited ("QCC"), has successfully acquired 100% equity of Purple Potato Finance Limited ("Purple Potato"). This strategic move enables CLPS to broaden its credit card business within the Hong Kong market. |

CLPS Incorporation (NASDAQ:CLPS) Will Want To Turn Around Its Return TrendsIf we want to find a stock that could multiply over the long term, what are the underlying trends we should look for... |

CLPS Incorporation Declares Second Special Cash Dividend of $0.10 Per ShareCLPS Incorporation (the "Company" or "CLPS") (Nasdaq: CLPS), today announced that its Board of Directors has declared a special cash dividend of $0.10 per share of common stock. It is payable on December 13, 2023 to shareholders of record as of December 4, 2023. The aggregate amount of the payment to be made in connection with this special cash dividend will be approximately $2.56 million. |

CLPS Incorporation Reports Financial Results for the Second Half and Full Year of Fiscal 2023CLPS Incorporation (the "Company" or "CLPS") (Nasdaq: CLPS), today announced its financial results for the six months ended June 30, 2023 and full year of fiscal 2023. |

CLPS Incorporation to Announce Second Half and Full Year of Fiscal 2023 Financial ResultsCLPS Incorporation (Nasdaq: CLPS) ("CLPS" or "the Company"), today announced that it will release its second half and full year of fiscal 2023 financial results before the market opens on Wednesday, October 18, 2023. |

CLPS Price Returns

| 1-mo | -5.75% |

| 3-mo | -7.97% |

| 6-mo | -16.49% |

| 1-year | -18.87% |

| 3-year | -76.44% |

| 5-year | -84.22% |

| YTD | -17.31% |

| 2023 | -7.14% |

| 2022 | -42.86% |

| 2021 | -35.53% |

| 2020 | -39.20% |

| 2019 | 106.61% |

Continue Researching CLPS

Here are a few links from around the web to help you further your research on CLPS Inc's stock as an investment opportunity:CLPS Inc (CLPS) Stock Price | Nasdaq

CLPS Inc (CLPS) Stock Quote, History and News - Yahoo Finance

CLPS Inc (CLPS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...