Clearside Biomedical, Inc. (CLSD): Price and Financial Metrics

CLSD Price/Volume Stats

| Current price | $0.64 | 52-week high | $1.65 |

| Prev. close | $0.84 | 52-week low | $0.32 |

| Day low | $0.32 | Volume | 3,059,466 |

| Day high | $0.84 | Avg. volume | 235,906 |

| 50-day MA | $0.82 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 49.72M |

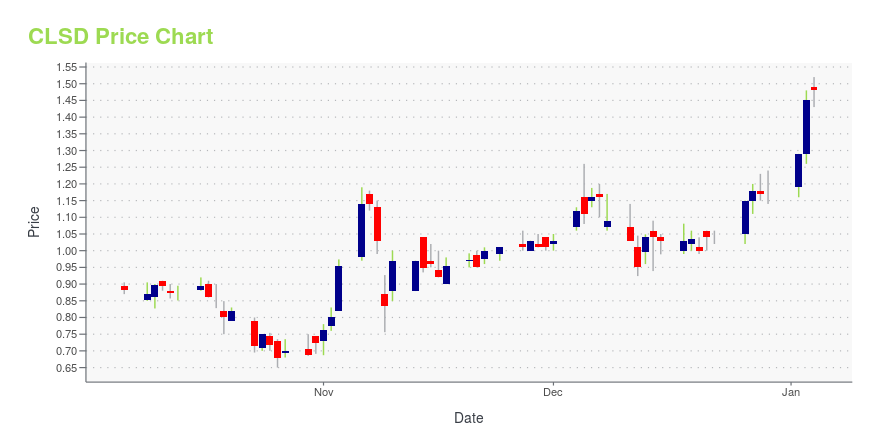

CLSD Stock Price Chart Interactive Chart >

Clearside Biomedical, Inc. (CLSD) Company Bio

Clearside Biomedical, a biopharmaceutical company, develops drug therapies to treat chronic blinding diseases of the eye. The company was founded in 2011 and is based in Alpharetta, Georgia

CLSD Price Returns

| 1-mo | -18.99% |

| 3-mo | N/A |

| 6-mo | -31.18% |

| 1-year | -47.11% |

| 3-year | -63.84% |

| 5-year | -66.14% |

| YTD | -32.63% |

| 2024 | -18.80% |

| 2023 | 4.46% |

| 2022 | -59.27% |

| 2021 | 0.36% |

| 2020 | -5.52% |

Continue Researching CLSD

Want to do more research on Clearside Biomedical Inc's stock and its price? Try the links below:Clearside Biomedical Inc (CLSD) Stock Price | Nasdaq

Clearside Biomedical Inc (CLSD) Stock Quote, History and News - Yahoo Finance

Clearside Biomedical Inc (CLSD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...