CleanSpark, Inc. (CLSK): Price and Financial Metrics

CLSK Price/Volume Stats

| Current price | $17.12 | 52-week high | $24.72 |

| Prev. close | $16.18 | 52-week low | $3.38 |

| Day low | $16.66 | Volume | 26,181,759 |

| Day high | $17.67 | Avg. volume | 32,949,926 |

| 50-day MA | $16.98 | Dividend yield | N/A |

| 200-day MA | $12.99 | Market Cap | 3.90B |

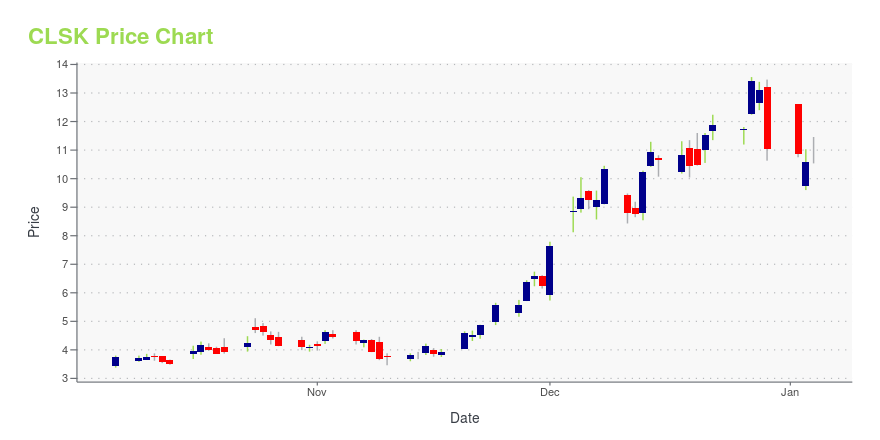

CLSK Stock Price Chart Interactive Chart >

CleanSpark, Inc. (CLSK) Company Bio

CleanSpark, Inc. provides energy software and control technology solutions worldwide. It offers distributed energy systems that allow customers to design, engineer, communicate, and manage renewable energy generation, storage, and consumption; and microgrids, which comprise generation, energy storage, and smart distribution assets that serve a single or multiple loads connected to the utility grid and separate from the utility grid for commercial, industrial, defense, campus, and residential users. The company's products include mPulse software suite, a modular platform that provides intelligent control of a microgrid; and microgrid value stream optimizer that offers a robust distributed energy and microgrid system modeling solution. It also provides critical power switchgear and hardware solutions, including parallel switchgear, automatic transfer switches, and related control and circuit protective equipment solutions; technology-based consulting services comprising design, marketing/digital content, engineering and SalesForce development, and strategy services; and distributed energy microgrid system design and engineering, and project consulting services. In addition, the company offers open automated demand response (OpenADR) and other middleware communication protocol software solutions, such as Canvas, an OpenADR virtual top node built for testing and managing virtual end nodes; and Plaid, a software solution that allows internet connected products to add load shifting capabilities into APIs. Further, it owns a gasification technology and process for converting waste and organic materials into synthesis gas, which is used as fuel for power plants, motor vehicles, jets, duel-fuel diesel engines, gas turbines, steam boilers, and as feedstock for the generation of di-methyl ether. The company was formerly known as Stratean Inc. and changed its name to CleanSpark, Inc. in November 2016. CleanSpark, Inc. was incorporated in 1987 and is based in Woods Cross, Utah.

Latest CLSK News From Around the Web

Below are the latest news stories about CLEANSPARK INC that investors may wish to consider to help them evaluate CLSK as an investment opportunity.

Blockchain Builders: 3 Stocks Innovating With Blockchain TechnologyBlockchain stocks should be on your radar as the market gears up for a crypto rally. |

CleanSpark, Inc. (NASDAQ:CLSK) Q4 2023 Earnings Call TranscriptCleanSpark, Inc. (NASDAQ:CLSK) Q4 2023 Earnings Call Transcript December 1, 2023 Operator: Good afternoon. My name is Krista, and I will be your conference operator today. At this time, I would like to welcome everyone to CleanSpark’s Fiscal Full Year 2023 Financial Results Conference Call. [Operator Instructions] And at this time, I would like to […] |

CleanSpark Releases November 2023 Bitcoin Mining UpdateCleanSpark Inc. (Nasdaq: CLSK), America's Bitcoin Miner™, today released its unaudited Bitcoin (or "BTC") mining and operations update for the month ending November 30, 2023. |

Is CleanSpark, Inc. (NASDAQ:CLSK) Trading At A 42% Discount?Key Insights The projected fair value for CleanSpark is US$10.80 based on 2 Stage Free Cash Flow to Equity CleanSpark... |

Cleanspark Inc (CLSK) Reports 28% Revenue Growth Amidst Market Volatility in FY2023Annual Bitcoin Production Nearly Doubles as Company Strengthens Balance Sheet |

CLSK Price Returns

| 1-mo | 6.47% |

| 3-mo | -10.97% |

| 6-mo | 113.73% |

| 1-year | 192.65% |

| 3-year | 27.38% |

| 5-year | 14.90% |

| YTD | 55.21% |

| 2023 | 440.69% |

| 2022 | -78.57% |

| 2021 | -67.23% |

| 2020 | 442.99% |

| 2019 | -73.90% |

Loading social stream, please wait...