Catalyst Bancorp, Inc. (CLST): Price and Financial Metrics

CLST Price/Volume Stats

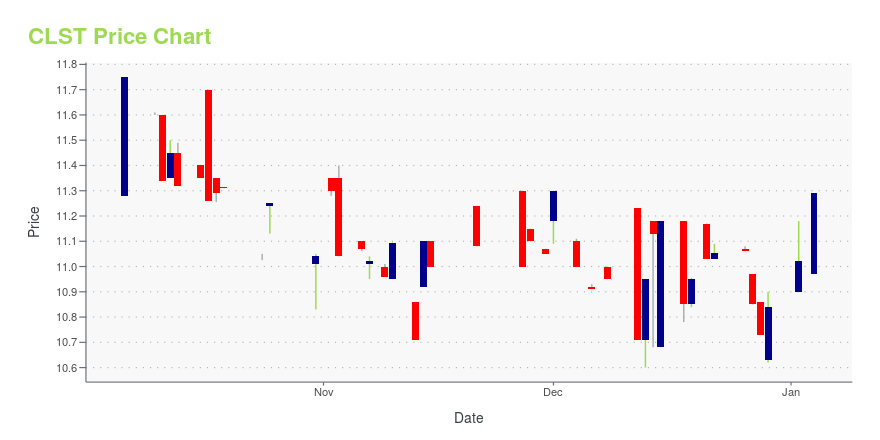

| Current price | $11.98 | 52-week high | $12.71 |

| Prev. close | $11.98 | 52-week low | $10.60 |

| Day low | $11.95 | Volume | 11,008 |

| Day high | $12.00 | Avg. volume | 9,544 |

| 50-day MA | $11.67 | Dividend yield | N/A |

| 200-day MA | $11.61 | Market Cap | 54.31M |

CLST Stock Price Chart Interactive Chart >

Catalyst Bancorp, Inc. (CLST) Company Bio

Catalyst Bancorp, Inc. focuses on operating as a holding company for the St Landry Homestead Federal Savings Bank that provides various banking services to individuals and corporate customers in Louisiana. Its principal deposit products include savings accounts, demand and NOW accounts, money market accounts, and certificates of deposit. The company's lending products comprise one- to four-family residential real estate loans, commercial real estate and multi-family residential mortgage loans, commercial and industrial loans, construction and land loans, as well as consumer loans consisting primarily of loans secured by deposits at the Bank, automobile, recreational vehicle and boat loans, and other loans. It conducts its business through its main office, as well as four additional full-service branch offices. The company was founded in 1922 and is headquartered in Opelousas, Louisiana.

Latest CLST News From Around the Web

Below are the latest news stories about CATALYST BANCORP INC that investors may wish to consider to help them evaluate CLST as an investment opportunity.

Catalyst Bancorp, Inc. Announces 2023 Third Quarter ResultsCatalyst Bancorp, Inc. (Nasdaq: "CLST") (the "Company"), the parent company for Catalyst Bank (the "Bank") (www.catalystbank.com), reported financial results for the third quarter of 2023. For the quarter, the Company reported net income of $170,000, up $131,000, compared to net income of $39,000 for the second quarter of 2023. |

Catalyst Bancorp, Inc. Announces 2023 Second Quarter ResultsCatalyst Bancorp, Inc. (Nasdaq: "CLST") (the "Company"), the parent company for Catalyst Bank (the "Bank") (www.catalystbank.com), reported financial results for the second quarter of 2023. For the quarter, the Company reported net income of $39,000, compared to $73,000 for the first quarter of 2023. |

Catalyst Bancorp, Inc. Announces 2023 First Quarter Results and Approval of New Share Repurchase PlanCatalyst Bancorp, Inc. (Nasdaq: "CLST") (the "Company"), the parent company for Catalyst Bank (the "Bank") (www.catalystbank.com), reported financial results for the first quarter of 2023. For the quarter, the Company reported net income of $73,000 compared to $171,000 for the fourth quarter of 2022. |

Catalyst Bancorp, Inc. Announces 2022 Fourth Quarter Results and Approval of Share Repurchase PlanCatalyst Bancorp, Inc. (Nasdaq: "CLST") (the "Company"), the parent company for Catalyst Bank (the "Bank") (www.catalystbank.com), reported financial results for the fourth quarter of 2022. For the quarter, the Company reported net income of $171,000, up $36,000, or 27%, from the third quarter of 2022. |

CLST Price Returns

| 1-mo | 3.46% |

| 3-mo | 2.08% |

| 6-mo | 0.00% |

| 1-year | -5.74% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | 10.52% |

| 2023 | -14.65% |

| 2022 | -7.10% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...