Canadian Imperial Bank of Commerce (CM): Price and Financial Metrics

CM Price/Volume Stats

| Current price | $51.21 | 52-week high | $51.35 |

| Prev. close | $50.53 | 52-week low | $34.35 |

| Day low | $50.65 | Volume | 1,134,458 |

| Day high | $51.35 | Avg. volume | 1,529,085 |

| 50-day MA | $48.89 | Dividend yield | 5.21% |

| 200-day MA | $45.85 | Market Cap | 48.29B |

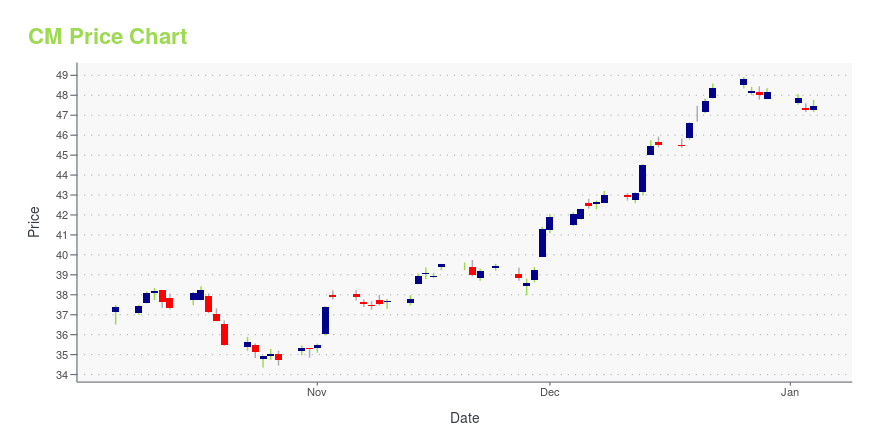

CM Stock Price Chart Interactive Chart >

Canadian Imperial Bank of Commerce (CM) Company Bio

The Canadian Imperial Bank of Commerce (CIBCC; French: Banque Canadienne Impériale de Commerce) is a Canadian multinational banking and financial services corporation headquartered at CIBC Square in the Financial District of Toronto, Ontario. CIBC's Institution Number (or bank number) is 010, and its SWIFT code is CIBCCATT. It is one of two Big Five banks founded in Toronto, the other being the Toronto-Dominion Bank. The Canadian Imperial Bank of Commerce was formed through the June 1, 1961, merger of the Canadian Bank of Commerce (founded in 1867) and the Imperial Bank of Canada (founded in 1873), the largest merger between chartered banks in Canadian history. (Source:Wikipedia)

Latest CM News From Around the Web

Below are the latest news stories about CANADIAN IMPERIAL BANK OF COMMERCE that investors may wish to consider to help them evaluate CM as an investment opportunity.

CIBC Asset Management announces revised CIBC ETF cash distributions for December 2023CIBC (TSX: CM) (NYSE: CM) – CIBC Asset Management Inc. today announced the revised December 2023 cash distributions for CIBC ETFs and ETF Series of the CIBC Fixed Income Pools and CIBC Sustainable Investment Solutions, which distribute monthly. |

Paying down debt is the top financial priority for Canadians for 2024: CIBC PollAt a time when higher inflation is putting a strain on household budgets, this year's priority for Canadians is paying down debt (13 per cent). The goal of debt repayment was tied with the goal of saving as much as possible (13 per cent), according to CIBC's annual Financial Priorities poll. Keeping up with bills (12 per cent) is also high on the list for 2024. |

Canadian Imperial Bank of Commerce's Dividend AnalysisCanadian Imperial Bank of Commerce (NYSE:CM) recently announced a dividend of $0.90 per share, payable on 2024-01-29, with the ex-dividend date set for 2023-12-27. Using the data from GuruFocus, let's look into Canadian Imperial Bank of Commerce's dividend performance and assess its sustainability. What Does Canadian Imperial Bank of Commerce Do? |

Oil Posts Biggest Weekly Gain in Two Months on Red Sea Chaos(Bloomberg) -- Oil posted the biggest weekly gain since October as attacks in the Red Sea forced hundreds of ships to take safer but longer routes, delaying the delivery of oil cargoes.Most Read from BloombergChina Is Softening Stance on Gaming After $80 Billion RoutEthiopia Fails to Pay Coupon, Becoming Latest African DefaulterBank of Russia Governor Says She Is Bracing for More SanctionsStock Futures Rise, Dollar Weakens in Thin Trading: Markets WrapGoldman’s Painful 2023 Lesson on China Force |

39th CIBC Miracle Day: $6 million donated to children's charities worldwideCIBC announced today that following the 39th annual CIBC Miracle Day held on December 6, $6 million will be going to children's charities globally, thanks to the generosity of the bank's team members and clients. |

CM Price Returns

| 1-mo | 7.87% |

| 3-mo | 8.57% |

| 6-mo | 14.94% |

| 1-year | 23.02% |

| 3-year | 2.98% |

| 5-year | 65.79% |

| YTD | 9.28% |

| 2023 | 24.69% |

| 2022 | -27.15% |

| 2021 | 40.69% |

| 2020 | 9.37% |

| 2019 | 17.63% |

CM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CM

Want to do more research on Canadian Imperial Bank Of Commerce's stock and its price? Try the links below:Canadian Imperial Bank Of Commerce (CM) Stock Price | Nasdaq

Canadian Imperial Bank Of Commerce (CM) Stock Quote, History and News - Yahoo Finance

Canadian Imperial Bank Of Commerce (CM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...