CareMax Medical Group, LLC (CMAX): Price and Financial Metrics

CMAX Price/Volume Stats

| Current price | $6.39 | 52-week high | $85.80 |

| Prev. close | $5.64 | 52-week low | $1.55 |

| Day low | $5.78 | Volume | 22,982,898 |

| Day high | $8.49 | Avg. volume | 1,313,786 |

| 50-day MA | $2.85 | Dividend yield | N/A |

| 200-day MA | $14.83 | Market Cap | 24.30M |

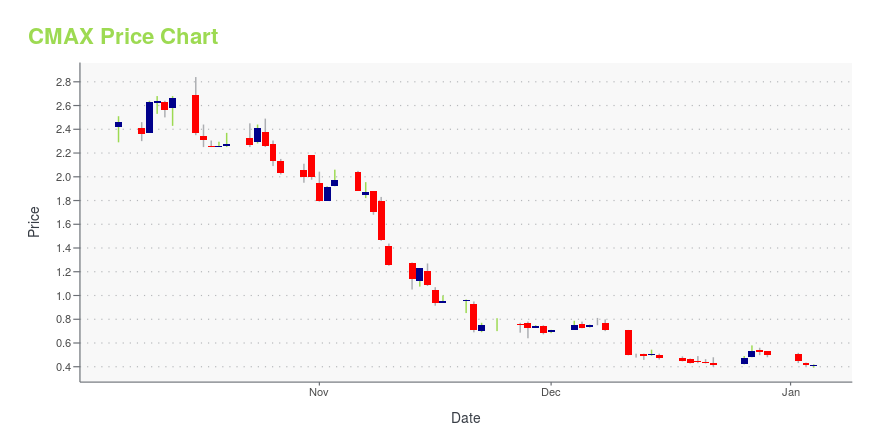

CMAX Stock Price Chart Interactive Chart >

CareMax Medical Group, LLC (CMAX) Company Bio

CareMax Medical Group, LLC operates as a health care organization that offers medical services through physicians and health care professionals. The company offers primary care, specialty care, telemedicine, health and wellness, optometry, dental, and transportation services. CareMax Medical Group, LLC was founded in 2011 and is based in Miami, Florida.

Latest CMAX News From Around the Web

Below are the latest news stories about CAREMAX INC that investors may wish to consider to help them evaluate CMAX as an investment opportunity.

CareMax, Inc. (NASDAQ:CMAX) Q3 2023 Earnings Call TranscriptCareMax, Inc. (NASDAQ:CMAX) Q3 2023 Earnings Call Transcript November 11, 2023 Operator: Good morning, and welcome to the CareMax, Inc. Third Quarter 2023 Financial Results and Conference Call. [Operator Instructions] I would now like to turn today’s call over to Roger Ou, Senior Vice President of Investor Relations. Please go ahead sir. Roger Ou: Good […] |

CareMax Inc (CMAX) Reports Growth Amidst Challenges in Q3 2023Medicare Advantage Membership Soars as Company Faces Net Loss Due to Goodwill Impairment |

CareMax Reports Third Quarter 2023 ResultsMIAMI, November 09, 2023--CareMax, Inc. (NASDAQ: CMAX; CMAXW) ("CareMax" or the "Company"), a leading technology-enabled value-based care delivery system, today announced financial results for the third quarter ended September 30, 2023. |

CareMax Schedules Third Quarter 2023 Earnings Conference CallMIAMI, October 25, 2023--CareMax, Inc. ("CareMax") (NASDAQ: CMAX; CMAXW), a leading value-based care delivery system, announced today that it will release its financial results for the third quarter 2023 before the opening of the financial markets on Thursday, November 9, 2023, and host a conference call at 8:30 am Eastern Time the same day to discuss the results. |

CareMax to Present at the Morgan Stanley 21st Annual Global Healthcare ConferenceMIAMI, September 06, 2023--CareMax, Inc. ("CareMax") (NASDAQ: CMAX; CMAXW), a leading technology-enabled provider of value-based care to seniors, announced today that Chief Executive Officer, Carlos de Solo, and Chief Financial Officer, Kevin Wirges, will participate in a fireside chat at the Morgan Stanley 21st Annual Global Healthcare Conference on Wednesday, September 13, 2023, at 7:30 am Eastern Time. |

CMAX Price Returns

| 1-mo | 87.39% |

| 3-mo | 104.81% |

| 6-mo | -48.05% |

| 1-year | -90.27% |

| 3-year | -97.87% |

| 5-year | N/A |

| YTD | -57.25% |

| 2023 | -86.35% |

| 2022 | -52.47% |

| 2021 | -50.77% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...