Claros Mortgage Trust, Inc. (CMTG): Price and Financial Metrics

CMTG Price/Volume Stats

| Current price | $9.61 | 52-week high | $15.25 |

| Prev. close | $9.48 | 52-week low | $6.80 |

| Day low | $9.43 | Volume | 205,200 |

| Day high | $9.72 | Avg. volume | 324,425 |

| 50-day MA | $8.33 | Dividend yield | 10.37% |

| 200-day MA | $10.22 | Market Cap | 1.33B |

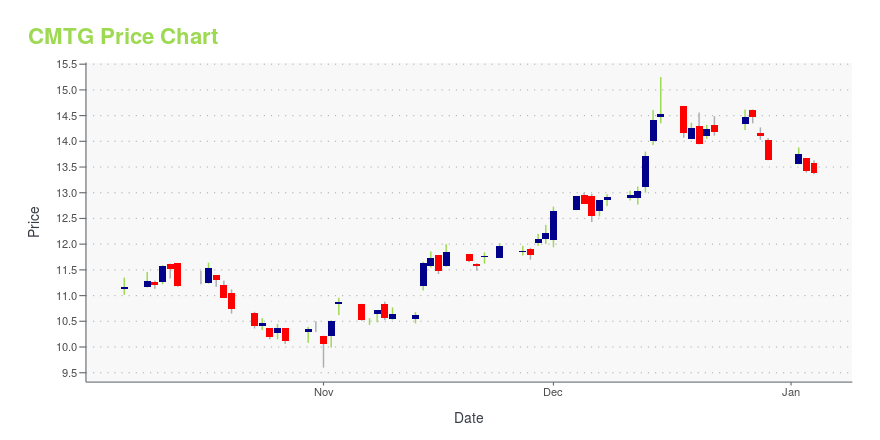

CMTG Stock Price Chart Interactive Chart >

Claros Mortgage Trust, Inc. (CMTG) Company Bio

Claros Mortgage Trust, Inc. focuses primarily on originating senior and subordinate loans on transitional commercial real estate assets located in the United States markets. The company qualifies as a real estate investment trust for federal income tax purposes. It generally would not be subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its stockholders. Claros Mortgage Trust, Inc. was incorporated in 2015 and is based in New York, New York.

Latest CMTG News From Around the Web

Below are the latest news stories about CLAROS MORTGAGE TRUST INC that investors may wish to consider to help them evaluate CMTG as an investment opportunity.

Claros Mortgage Trust (NYSE:CMTG) shareholders are up 3.9% this past week, but still in the red over the last yearClaros Mortgage Trust, Inc. ( NYSE:CMTG ) shareholders should be happy to see the share price up 28% in the last... |

Claros Mortgage Trust, Inc. Declares Common Stock DividendNEW YORK, December 14, 2023--Claros Mortgage Trust, Inc. (NYSE: CMTG) ("the Company" or "CMTG") declared a dividend of $0.25 per share of common stock for the fourth quarter of 2023. The dividend is payable on January 12, 2024 to stockholders of record as of the close of business on December 29, 2023. |

New Strong Sell Stocks for November 9thCMTG, BB and CASS have been added to the Zacks Rank #5 (Strong Sell) List on November 9, 2023. |

Claros Mortgage Trust, Inc. (NYSE:CMTG) Q3 2023 Earnings Call TranscriptClaros Mortgage Trust, Inc. (NYSE:CMTG) Q3 2023 Earnings Call Transcript November 1, 2023 Operator: Hello, everyone and welcome to Claros Mortgage Trust Third Quarter 2023 Earnings Conference Call. My name is Nadia and I will be your conference facilitator today. [Operator Instructions] I would now like to hand over the call to Anh Huynh, Vice […] |

Q3 2023 Claros Mortgage Trust Inc Earnings CallQ3 2023 Claros Mortgage Trust Inc Earnings Call |

CMTG Price Returns

| 1-mo | 18.90% |

| 3-mo | 13.85% |

| 6-mo | -18.91% |

| 1-year | -13.23% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -25.27% |

| 2023 | 2.82% |

| 2022 | -1.38% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

CMTG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...