CNFinance Holdings Limited American Depositary Shares, each representing twenty (20) Ordinary Shares (CNF): Price and Financial Metrics

CNF Price/Volume Stats

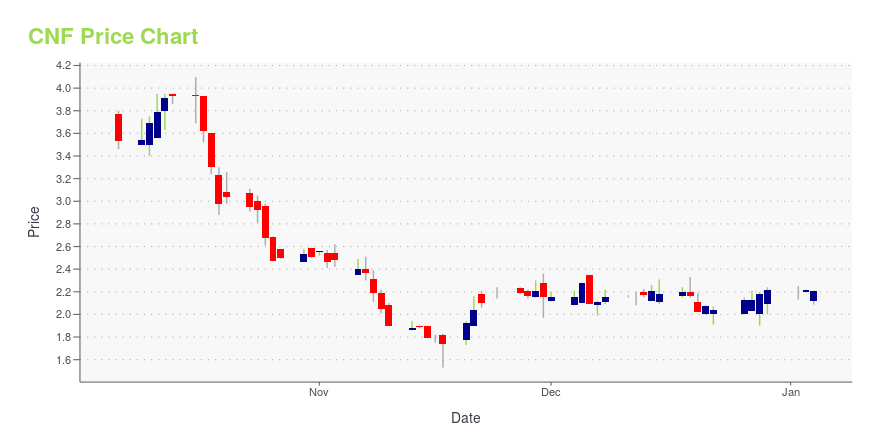

| Current price | $1.11 | 52-week high | $4.10 |

| Prev. close | $1.09 | 52-week low | $1.02 |

| Day low | $1.04 | Volume | 9,893 |

| Day high | $1.12 | Avg. volume | 25,266 |

| 50-day MA | $1.51 | Dividend yield | N/A |

| 200-day MA | $2.03 | Market Cap | 76.13M |

CNF Stock Price Chart Interactive Chart >

CNFinance Holdings Limited American Depositary Shares, each representing twenty (20) Ordinary Shares (CNF) Company Bio

CNFinance Holdings Ltd. engages in the provision of home equity loan services. It facilitate loans by connecting micro- and small-enterprise owners with its funding partners. The company was founded in January 2014 and is headquartered in Guangzhou, China.

Latest CNF News From Around the Web

Below are the latest news stories about CNFINANCE HOLDINGS LTD that investors may wish to consider to help them evaluate CNF as an investment opportunity.

Retail investors account for 42% of CNFinance Holdings Limited's (NYSE:CNF) ownership, while institutions account for 29%Key Insights The considerable ownership by retail investors in CNFinance Holdings indicates that they collectively have... |

CNFinance Holdings Limited (NYSE:CNF) Q3 2023 Earnings Call TranscriptCNFinance Holdings Limited (NYSE:CNF) Q3 2023 Earnings Call Transcript November 29, 2023 CNFinance Holdings Limited misses on earnings expectations. Reported EPS is $0.1 EPS, expectations were $0.11. Operator: Good day, and welcome to the CNFinance Holdings Limited Third Quarter of 2023 Financial Results Conference Call. All participants will be in listen-only mode. [Operator Instructions] After […] |

Q3 2023 CNFinance Holdings Ltd Earnings CallQ3 2023 CNFinance Holdings Ltd Earnings Call |

CNFinance Announces Third Quarter of 2023 Unaudited Financial ResultsCNFinance Holdings Limited (NYSE: CNF) ("CNFinance" or the "Company"), a leading home equity loan service provider in China, today announced its unaudited financial results for the third quarter ended September 30, 2023. |

CNFinance to Report Third Quarter of 2023 Financial Results on Wednesday, November 29, 2023CNFinance Holdings Limited (NYSE: CNF) ("CNFinance" or the "Company"), a leading home equity loan service provider in China, today announced that it will report its unaudited financial results for the third quarter ended September 30, 2023, before U.S. markets open on Wednesday, November 29, 2023. |

CNF Price Returns

| 1-mo | -33.13% |

| 3-mo | -40.64% |

| 6-mo | -53.56% |

| 1-year | -65.20% |

| 3-year | -68.76% |

| 5-year | -79.89% |

| YTD | -50.00% |

| 2023 | 29.82% |

| 2022 | -58.09% |

| 2021 | -3.09% |

| 2020 | 5.25% |

| 2019 | -27.40% |

Continue Researching CNF

Want to do more research on CNFinance Holdings Ltd's stock and its price? Try the links below:CNFinance Holdings Ltd (CNF) Stock Price | Nasdaq

CNFinance Holdings Ltd (CNF) Stock Quote, History and News - Yahoo Finance

CNFinance Holdings Ltd (CNF) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...