Canadian National Railway Co. (CNI): Price and Financial Metrics

CNI Price/Volume Stats

| Current price | $103.18 | 52-week high | $123.96 |

| Prev. close | $103.93 | 52-week low | $91.65 |

| Day low | $103.03 | Volume | 350,899 |

| Day high | $104.69 | Avg. volume | 1,417,620 |

| 50-day MA | $104.25 | Dividend yield | 2.46% |

| 200-day MA | $104.46 | Market Cap | 64.64B |

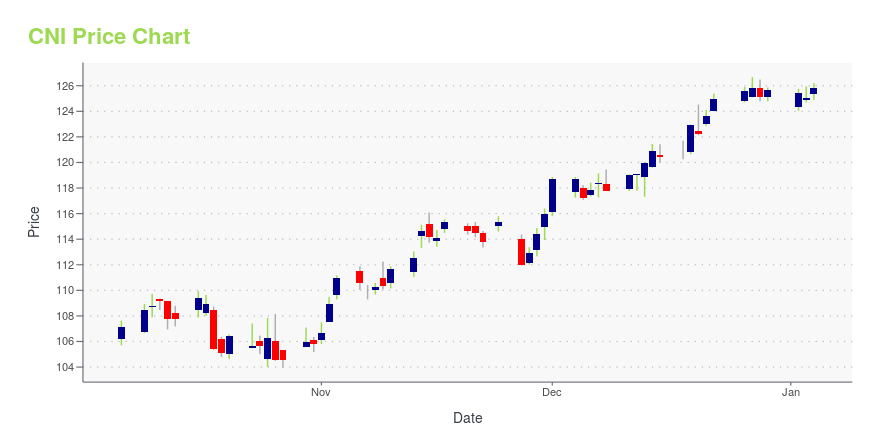

CNI Stock Price Chart Interactive Chart >

Canadian National Railway Co. (CNI) Company Bio

The Canadian National Railway Company (French: Compagnie des chemins de fer nationaux du Canada) (reporting mark CN) is a Canadian Class I freight railway headquartered in Montreal, Quebec, which serves Canada and the Midwestern and Southern United States. (Source:Wikipedia)

CNI Price Returns

| 1-mo | -0.57% |

| 3-mo | 5.36% |

| 6-mo | 2.41% |

| 1-year | -13.15% |

| 3-year | -1.67% |

| 5-year | 19.67% |

| YTD | 2.90% |

| 2024 | -17.52% |

| 2023 | 7.84% |

| 2022 | -1.41% |

| 2021 | 12.69% |

| 2020 | 23.62% |

CNI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CNI

Want to see what other sources are saying about Canadian National Railway Co's financials and stock price? Try the links below:Canadian National Railway Co (CNI) Stock Price | Nasdaq

Canadian National Railway Co (CNI) Stock Quote, History and News - Yahoo Finance

Canadian National Railway Co (CNI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...