Vita Coco Company, Inc. (COCO): Price and Financial Metrics

COCO Price/Volume Stats

| Current price | $24.30 | 52-week high | $33.29 |

| Prev. close | $23.98 | 52-week low | $19.41 |

| Day low | $23.93 | Volume | 548,800 |

| Day high | $24.72 | Avg. volume | 673,231 |

| 50-day MA | $27.62 | Dividend yield | N/A |

| 200-day MA | $25.76 | Market Cap | 1.38B |

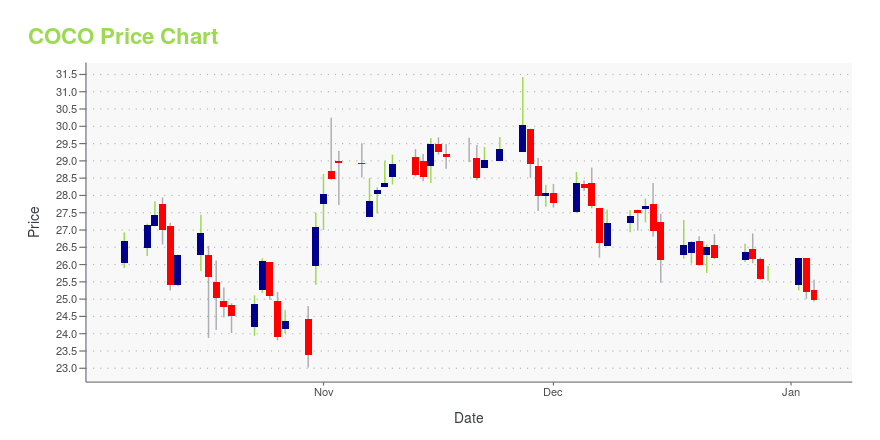

COCO Stock Price Chart Interactive Chart >

Vita Coco Company, Inc. (COCO) Company Bio

The Vita Coco Company, Inc. develops, markets, and distributes coconut water products under the brand name Vita Coco in the United States, Canada, Europe, the Middle East, and the Asia Pacific. The company offers coconut oil and coconut milk; sparkling water; Runa, a natural energy drink; a packaged water under the brand Ever & Ever name; and PWR LIFT, a flavorful and protein-infused water. It distributes its products through club, food, drug, mass, convenience, e-commerce, and foodservice channels. The company was formerly known as All Market Inc. and changed its name to The Vita Coco Company, Inc. in September 2021. The Vita Coco Company, Inc. was founded in 2004 and is based in New York, New York.

Latest COCO News From Around the Web

Below are the latest news stories about VITA COCO COMPANY INC that investors may wish to consider to help them evaluate COCO as an investment opportunity.

Digital Initiatives to Keep FEMSA (FMX) Stock in Good StrideFEMSA (FMX) is well-placed for growth through investments in digital and technology-driven initiatives, and continued strength in OXXO Mexico and OXXO Gas. |

Revitalization Plan Keeps Molson Coors (TAP) on Growth TrackMolson Coors (TAP) has been gaining from progress in its revitalization plan, focused on reshaping its product portfolio and growing in emerging markets. |

The Vita Coco Company, Inc.'s (NASDAQ:COCO) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong?With its stock down 7.5% over the past week, it is easy to disregard Vita Coco Company (NASDAQ:COCO). However, stock... |

Insider Sell Alert: Chief Sales Officer Es Van Sells 5,537 Shares of The Vita Coco Co Inc (COCO)In the world of stock market movements, insider transactions hold a special place for investors seeking clues about a company's health and future prospects. |

Can Monster Beverage (MNST) Keep Its Momentum Amid Cost Hike?Monster Beverage's (MNST) strategic pricing, innovative product launches and efficient operations at its Ireland facility are driving profitability despite challenges posed by rising costs. |

COCO Price Returns

| 1-mo | -12.84% |

| 3-mo | -1.82% |

| 6-mo | 20.96% |

| 1-year | -6.07% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -5.26% |

| 2023 | 85.60% |

| 2022 | 23.72% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...