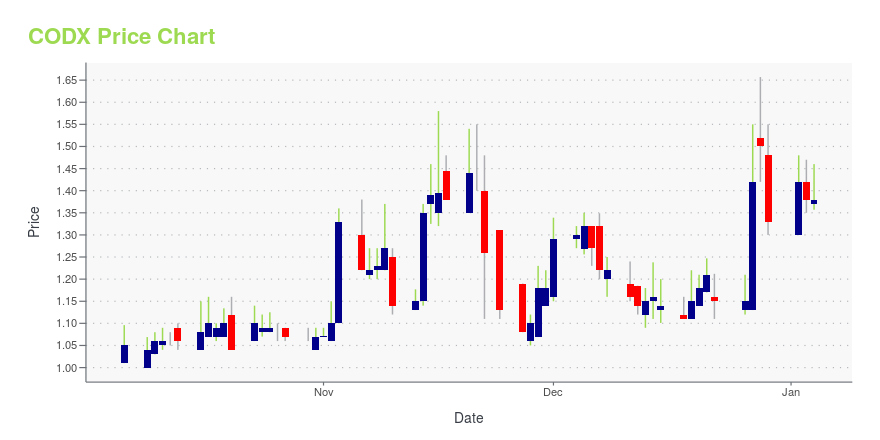

Co-Diagnostics, Inc. (CODX): Price and Financial Metrics

CODX Price/Volume Stats

| Current price | $1.12 | 52-week high | $1.73 |

| Prev. close | $1.10 | 52-week low | $0.98 |

| Day low | $1.09 | Volume | 119,466 |

| Day high | $1.16 | Avg. volume | 93,261 |

| 50-day MA | $1.26 | Dividend yield | N/A |

| 200-day MA | $1.21 | Market Cap | 35.03M |

CODX Stock Price Chart Interactive Chart >

Co-Diagnostics, Inc. (CODX) Company Bio

Co-Diagnostics, Inc., a molecular diagnostics company, intends to manufacture and sell reagents used for diagnostic tests that function via the detection and/or analysis of nucleic acid molecules. It also intends to sell diagnostic equipment from other manufacturers as self-contained lab systems. The company was founded in 2013 and is headquartered in Salt Lake City, Utah.

Latest CODX News From Around the Web

Below are the latest news stories about CO-DIAGNOSTICS INC that investors may wish to consider to help them evaluate CODX as an investment opportunity.

Co-Diagnostics, Inc. Completes Submission to FDA for Co-Dx PCR ProCo-Diagnostics, Inc. (Nasdaq-CM: CODX) (the "Company" or "Co-Dx"), a molecular diagnostics company with a unique, patented platform for the development of molecular diagnostic tests, today announced that it has submitted its Co-Dx™ PCR COVID-19 test with Co-Dx PCR Pro™ instrument for review by the U.S. Food and Drug Administration (FDA) for Emergency Use Authorization (EUA). The submission includes the PCR Pro instrument, COVID-19 detection test, and mobile app, all designed for use in point-of- |

Co-Diagnostics, Inc. to Participate in the Piper Sandler 35th Annual Healthcare Conference in New York City on November 30, 2023Co-Diagnostics, Inc. (Nasdaq-CM: CODX) (the "Company" or "Co-Dx"), a molecular diagnostics company with a unique, patented platform for the development of molecular diagnostic tests, announced today that Co-Diagnostics will be presenting at the Piper Sandler 35th Annual Healthcare Conference in New York City, New York on November 30, 2023. |

Co-Diagnostics, Inc. (NASDAQ:CODX) Q3 2023 Earnings Call TranscriptCo-Diagnostics, Inc. (NASDAQ:CODX) Q3 2023 Earnings Call Transcript November 9, 2023 Co-Diagnostics, Inc. beats earnings expectations. Reported EPS is $-0.2, expectations were $-0.29. Operator: Hello. Welcome to the Co-Diagnostics Third Quarter 2023 Earnings Conference Call. All participants will be in listen-only mode. [Operator Instructions] Please note today’s event is being recorded. I would now like […] |

Q3 2023 Co-Diagnostics Inc Earnings CallQ3 2023 Co-Diagnostics Inc Earnings Call |

Co-Diagnostics, Inc. Reports Third Quarter 2023 Financial ResultsCo-Diagnostics, Inc. (NASDAQ: CODX), a molecular diagnostics company with a unique, patented platform for the development of molecular diagnostic tests, today announced financial results for the quarter ended September 30, 2023. |

CODX Price Returns

| 1-mo | -15.79% |

| 3-mo | 0.90% |

| 6-mo | -11.11% |

| 1-year | -17.04% |

| 3-year | -88.31% |

| 5-year | -15.79% |

| YTD | -15.79% |

| 2023 | -47.22% |

| 2022 | -71.78% |

| 2021 | -3.98% |

| 2020 | 938.87% |

| 2019 | -39.92% |

Continue Researching CODX

Want to see what other sources are saying about Co-Diagnostics Inc's financials and stock price? Try the links below:Co-Diagnostics Inc (CODX) Stock Price | Nasdaq

Co-Diagnostics Inc (CODX) Stock Quote, History and News - Yahoo Finance

Co-Diagnostics Inc (CODX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...