China Online Education Group ADR (COE): Price and Financial Metrics

COE Price/Volume Stats

| Current price | $17.05 | 52-week high | $19.75 |

| Prev. close | $18.53 | 52-week low | $6.00 |

| Day low | $16.60 | Volume | 21,100 |

| Day high | $18.55 | Avg. volume | 8,614 |

| 50-day MA | $10.25 | Dividend yield | N/A |

| 200-day MA | $8.14 | Market Cap | 97.56M |

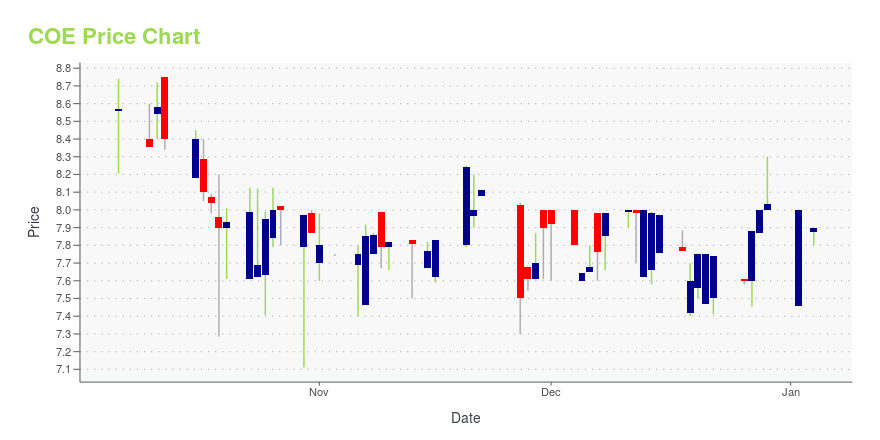

COE Stock Price Chart Interactive Chart >

China Online Education Group ADR (COE) Company Bio

China Online Education Group, through its subsidiaries, provides online English language education services to students in the People's Republic of China and the Philippines. It operates online and mobile education platforms enable students to take one-on-one live interactive English lessons with international foreign teachers. The company was founded in 2011 and is headquartered in Beijing, the People's Republic of China.

Latest COE News From Around the Web

Below are the latest news stories about 51TALK ONLINE EDUCATION GROUP that investors may wish to consider to help them evaluate COE as an investment opportunity.

COE Stock Earnings: 51 Talk Online Education Reported Results for Q3 202351 Talk Online Education just reported results for the third quarter of 2023. |

51Talk Online Education Group Announces Third Quarter 2023 Results51Talk Online Education Group ("51Talk" or the "Company") (NYSE American: COE), a global online education platform with core expertise in English education, announced its unaudited results for the third quarter ended September 30, 2023. |

51Talk Online Education Group to Report Third Quarter 2023 Financial Results on Monday, December 18, 202351Talk Online Education Group ("51Talk", or the "Company") (NYSEAMERICAN: COE), a global online education platform with core expertise in English education, today announced that it will report its unaudited financial results for the third quarter ended September 30, 2023 on Monday, December 18, 2023, before the open of U.S. markets. |

51Talk Online Education Group Announces Second Quarter 2023 Results51Talk Online Education Group ("51Talk" or the "Company") (NYSE American: COE), a global online education platform with core expertise in English education, announced its interim unaudited results for the second quarter ended June 30, 2023. |

51Talk Online Education Group to Report Second Quarter 2023 Financial Results on Friday, August 25, 202351Talk Online Education Group ("51Talk", or the "Company") (NYSEAMERICAN: COE), a global online education platform with core expertise in English education, today announced that it will report its unaudited financial results for the second quarter ended June 30, 2023 on Friday, August 25, 2023, before the open of U.S. markets. |

COE Price Returns

| 1-mo | 57.14% |

| 3-mo | 157.94% |

| 6-mo | 124.64% |

| 1-year | 98.95% |

| 3-year | 46.98% |

| 5-year | -29.82% |

| YTD | 112.30% |

| 2023 | 27.48% |

| 2022 | 30.17% |

| 2021 | -95.54% |

| 2020 | 176.07% |

| 2019 | 36.01% |

Continue Researching COE

Want to do more research on China Online Education Group's stock and its price? Try the links below:China Online Education Group (COE) Stock Price | Nasdaq

China Online Education Group (COE) Stock Quote, History and News - Yahoo Finance

China Online Education Group (COE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...