Americold Realty Trust Common Shares (COLD): Price and Financial Metrics

COLD Price/Volume Stats

| Current price | $29.47 | 52-week high | $33.90 |

| Prev. close | $28.85 | 52-week low | $21.87 |

| Day low | $28.82 | Volume | 2,697,861 |

| Day high | $29.59 | Avg. volume | 2,402,163 |

| 50-day MA | $26.49 | Dividend yield | 2.99% |

| 200-day MA | $26.60 | Market Cap | 8.37B |

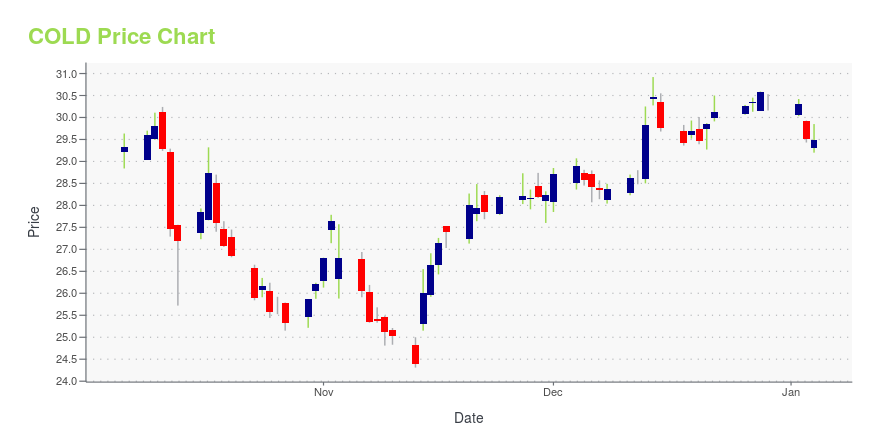

COLD Stock Price Chart Interactive Chart >

Americold Realty Trust Common Shares (COLD) Company Bio

AmeriCold Realty Trust provides cold storage warehousing services and is based in Atlanta, Georgia. AmeriCold Realty Trust operates as a subsidiary of The Yucaipa Companies, LLC. The company is based in Atlanta, Georgia.

Latest COLD News From Around the Web

Below are the latest news stories about AMERICOLD REALTY TRUST that investors may wish to consider to help them evaluate COLD as an investment opportunity.

November’s Surprising Sector WinnerReal estate investment trusts (REITs), which have been beaten down by surging interest rates and economic uncertainty, are now showing signs of strength. |

Americold Realty Trust, Inc. Declares Fourth Quarter 2023 DividendATLANTA, GA, Dec. 12, 2023 (GLOBE NEWSWIRE) -- Americold Realty Trust, Inc. (NYSE: COLD) (the “Company”), a global leader in temperature-controlled logistics, real estate, and value-added services focused on the ownership, operation, acquisition and development of temperature-controlled warehouses, today announced that its Board of Directors has declared a dividend of $0.22 per share for the fourth quarter of 2023, payable to holders of the Company’s common stock. The dividend will be payable in |

Americold Partners with RSA Cold Chain and DP World to Bring a New State-of-the-Art Cold Chain Logistics Platform to DubaiATLANTA, GA, Dec. 12, 2023 (GLOBE NEWSWIRE) -- Americold Realty Trust, Inc. (NYSE: COLD), through its joint venture RSA Cold Chain in Dubai, today announced plans to build and operate a new $35 million, state-of-the-art cold storage facility with 40,000 pallet positions, in the Jebel Ali Free Zone (Jafza) in the Port of Jebel Ali in Dubai. This investment builds on the strategic collaboration between Americold and DP World, the leading provider of worldwide smart end-to-end supply chain logistic |

Insider Sell: EVP Robert Chambers Sells 9,100 Shares of Americold Realty Trust Inc (COLD)Recent filings with the SEC have revealed that Robert Chambers, the Executive Vice President and Chief Commercial Officer of Americold Realty Trust Inc (NYSE:COLD), has sold 9,100 shares of the company's stock. |

Americold Realty Trust, Inc. (NYSE:COLD) Q3 2023 Earnings Call TranscriptAmericold Realty Trust, Inc. (NYSE:COLD) Q3 2023 Earnings Call Transcript November 2, 2023 Americold Realty Trust, Inc. misses on earnings expectations. Reported EPS is $-0.01 EPS, expectations were $0.32. Operator: Greetings and welcome to the Americold Realty Trust Third Quarter 2023 Earnings Call. At this time, all participants are in a listen-only mode. A brief […] |

COLD Price Returns

| 1-mo | 16.32% |

| 3-mo | 33.68% |

| 6-mo | 6.08% |

| 1-year | -4.68% |

| 3-year | -16.00% |

| 5-year | 0.80% |

| YTD | -0.90% |

| 2023 | 10.11% |

| 2022 | -10.89% |

| 2021 | -9.89% |

| 2020 | 9.03% |

| 2019 | 40.61% |

COLD Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching COLD

Want to see what other sources are saying about Americold Realty Trust's financials and stock price? Try the links below:Americold Realty Trust (COLD) Stock Price | Nasdaq

Americold Realty Trust (COLD) Stock Quote, History and News - Yahoo Finance

Americold Realty Trust (COLD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...