Traeger, Inc. (COOK): Price and Financial Metrics

COOK Price/Volume Stats

| Current price | $2.48 | 52-week high | $6.70 |

| Prev. close | $2.39 | 52-week low | $1.97 |

| Day low | $2.38 | Volume | 116,876 |

| Day high | $2.49 | Avg. volume | 277,245 |

| 50-day MA | $2.37 | Dividend yield | N/A |

| 200-day MA | $2.37 | Market Cap | 319.60M |

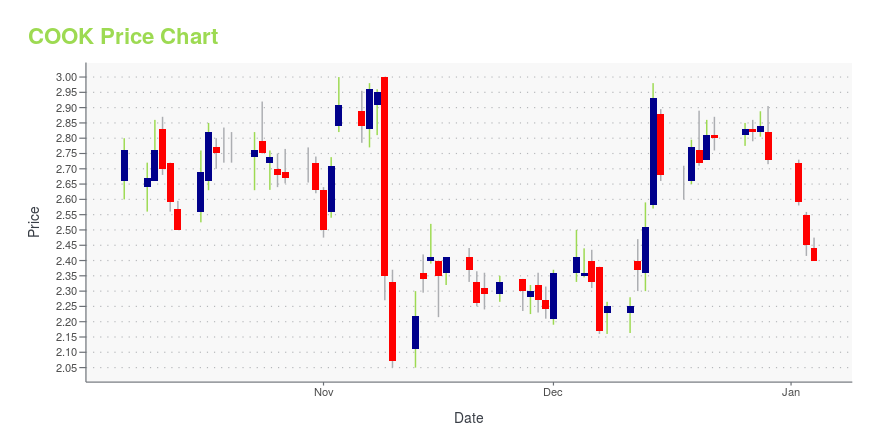

COOK Stock Price Chart Interactive Chart >

Traeger, Inc. (COOK) Company Bio

TGPX Holdings I LLC, together with its subsidiaries, designs, sources, sells, and supports wood pellet fueled barbeque grills for retailers, distributors, and direct to consumers in the United States. Its wood pellet grills are internet of things devices that allow owners to program, monitor, and control their grill through its Traeger app. The company also produces a library of digital content, including instructional recipes and videos that demonstrate tips, tricks, and cooking techniques that empower Traeger owners to progress their cooking skills; and short- and long-form branded content highlighting stories, community members, and lifestyle content from the Traegerhood. In addition, it provides wood pellets that are used to fire the grills; rubs and sauces, seasonings, and marinades; covers, drip trays, bucket liners, and shelves; tools to aid in meal prep, cooking, and cleanup, including pellet storage systems, cleaning solutions, and barbecue tools; replacement parts; and apparel and merchandise. The company was incorporated in 2017 and is headquartered in Salt Lake City, Utah.

Latest COOK News From Around the Web

Below are the latest news stories about TRAEGER INC that investors may wish to consider to help them evaluate COOK as an investment opportunity.

Is There An Opportunity With Traeger, Inc.'s (NYSE:COOK) 45% Undervaluation?Key Insights Using the 2 Stage Free Cash Flow to Equity, Traeger fair value estimate is US$5.32 Traeger's US$2.93 share... |

Traeger Announces Participation in the Morgan Stanley Global Consumer & Retail ConferenceSALT LAKE CITY, November 28, 2023--Traeger, Inc. ("Traeger") (NYSE: COOK), creator and category leader of the wood pellet grill, today announced that the company will be participating in the Morgan Stanley Global Consumer & Retail Conference in New York City. Jeremy Andrus, Chief Executive Officer, Dominic Blosil, Chief Financial Officer, and Nick Bacchus, Vice President of Investor Relations, will participate in a fireside chat that is scheduled to begin at 10:15 a.m. EST on Tuesday, December 5 |

Fewer Investors Than Expected Jumping On Traeger, Inc. (NYSE:COOK)With a median price-to-sales (or "P/S") ratio of close to 0.6x in the Consumer Durables industry in the United States... |

Traeger, Inc. (NYSE:COOK) Q3 2023 Earnings Call TranscriptTraeger, Inc. (NYSE:COOK) Q3 2023 Earnings Call Transcript November 8, 2023 Traeger, Inc. misses on earnings expectations. Reported EPS is $-0.15526 EPS, expectations were $-0.11. Operator: Hello, everyone, and thank you for joining us today. Welcome to the Traeger Third Quarter Fiscal 2023 Earnings Conference Call. My name is Emily, and I’ll be coordinating your […] |

Traeger remains 'disciplined' on growing post-pandemic salesGrill maker Traeger (COOK) squeaked past third-quarter revenue estimates while coming in line with earnings projections of a loss of $0.12 per share. Traeger CEO Jeremy Andrus joins Yahoo Finance's Jared Blikre to discuss the company's growth outlook while considering consumer behavior in the post-pandemic period. "We're grinding through a tough environment, being disciplined so that we can drive EBITDA, but also ensuring that we can prioritize the right investments that allow us to drive growth in the future," Andrus explains. For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live. |

COOK Price Returns

| 1-mo | 12.22% |

| 3-mo | 16.98% |

| 6-mo | 7.36% |

| 1-year | -39.95% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -9.16% |

| 2023 | -3.19% |

| 2022 | -76.81% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...