ConocoPhillips (COP): Price and Financial Metrics

COP Price/Volume Stats

| Current price | $110.86 | 52-week high | $135.18 |

| Prev. close | $111.03 | 52-week low | $105.77 |

| Day low | $109.93 | Volume | 5,199,044 |

| Day high | $111.54 | Avg. volume | 5,588,120 |

| 50-day MA | $114.17 | Dividend yield | 2.09% |

| 200-day MA | $117.16 | Market Cap | 129.65B |

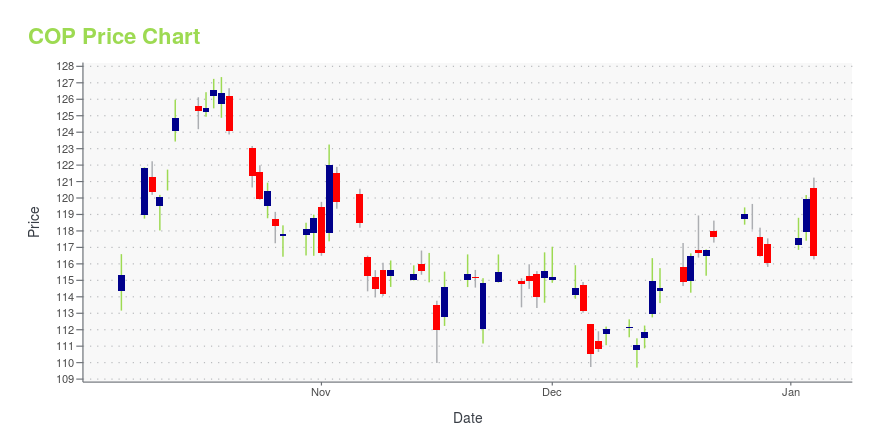

COP Stock Price Chart Interactive Chart >

ConocoPhillips (COP) Company Bio

ConocoPhillips is an American multinational corporation engaged in hydrocarbon exploration. It is based in the Energy Corridor district of Houston, Texas. (Source:Wikipedia)

Latest COP News From Around the Web

Below are the latest news stories about CONOCOPHILLIPS that investors may wish to consider to help them evaluate COP as an investment opportunity.

Top Performers: 7 High-Efficiency Stocks With Stellar Profit Per Employee RatiosInundated with myriad ways of assessing publicly traded companies, one unique metric could intrigue investors seeking opportunities in 2024 and that would be high-efficiency stocks. |

Here's Why Hold Strategy is Apt for ConocoPhillips (COP) NowFavorable oil price is aiding ConocoPhillips' (COP) bottom line. However, increasing production and operating expenses are hurting it. |

ConocoPhillips (COP) to Proceed With Alaska's Willow Oil ProjectThe latest announcement marks the official approval for ConocoPhillips (COP) to proceed with the development until it reaches the stage of producing the first oil. |

ConocoPhillips' Willow Project: Green Light for Alaskan Energy Boost Amid ControversyOn Friday, ConocoPhillips (NYSE: COP) disclosed that it is moving forward with developing the Willow project in Alaska. The Final Investment Decision approved the project and funds for construction needed to reach the first oil. The decision follows the Department of the Interior March 2023 Record of Decision and recent positive court orders, including this week's Ninth Circuit Court of Appeals denial of plaintiffs' request for an injunction. In November, COP reportedly received judicial endorse |

Investors in ConocoPhillips (NYSE:COP) have seen impressive returns of 235% over the past three yearsThe worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put... |

COP Price Returns

| 1-mo | -2.42% |

| 3-mo | -14.34% |

| 6-mo | 0.12% |

| 1-year | -1.55% |

| 3-year | 118.98% |

| 5-year | 125.50% |

| YTD | -3.20% |

| 2023 | 1.98% |

| 2022 | 71.59% |

| 2021 | 86.60% |

| 2020 | -36.04% |

| 2019 | 6.63% |

COP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching COP

Want to do more research on Conocophillips's stock and its price? Try the links below:Conocophillips (COP) Stock Price | Nasdaq

Conocophillips (COP) Stock Quote, History and News - Yahoo Finance

Conocophillips (COP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...