CorEnergy Infrastructure Trust, Inc. (CORR): Price and Financial Metrics

CORR Price/Volume Stats

| Current price | $0.02 | 52-week high | $1.75 |

| Prev. close | $0.24 | 52-week low | $0.02 |

| Day low | $0.02 | Volume | 3,600,600 |

| Day high | $0.19 | Avg. volume | 126,126 |

| 50-day MA | $0.27 | Dividend yield | N/A |

| 200-day MA | $0.72 | Market Cap | 304.01K |

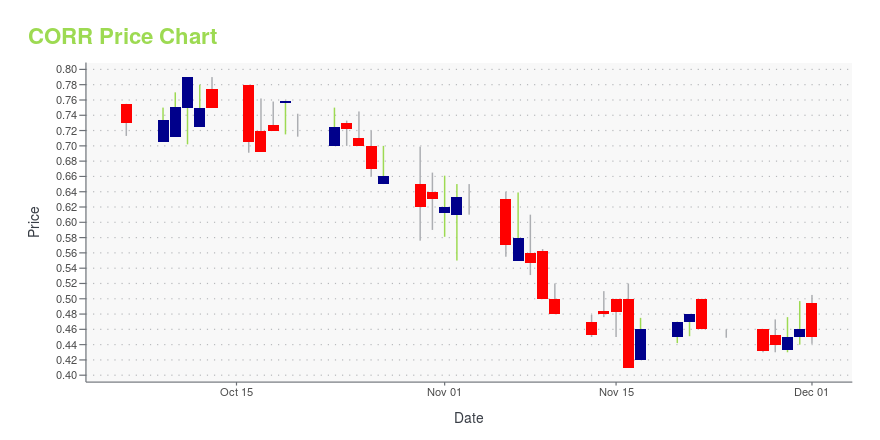

CORR Stock Price Chart Interactive Chart >

CorEnergy Infrastructure Trust, Inc. (CORR) Company Bio

CorEnergy is managed by Corridor InfraTrust Management LLC, a real property asset manager with a focus on U.S. energy infrastructure assets - primarily owns midstream and downstream assets that perform utility-like functions, such as pipelines, storage terminals, and transmission and distribution assets. The company was formed in 2014 and is based in Kansas City, Missouri.

Latest CORR News From Around the Web

Below are the latest news stories about CORENERGY INFRASTRUCTURE TRUST INC that investors may wish to consider to help them evaluate CORR as an investment opportunity.

CorEnergy Announces Suspension of NYSE StatusKANSAS CITY, Mo., December 04, 2023--CorEnergy Infrastructure Trust, Inc. (OTC: CORR, CORRL) ("CorEnergy" or the "Company") today announced that on December 1, 2023 it received notice that the New York Stock Exchange ("NYSE") has determined to suspend trading of and commenced proceedings to delist shares of CorEnergy’s common and preferred stock. The notice was issued because the Company fell below the NYSE’s continued listing standard requiring an average global common stock market capitalizati |

CorEnergy Infrastructure Trust, Inc. (NYSE:CORR) Q3 2023 Earnings Call TranscriptCorEnergy Infrastructure Trust, Inc. (NYSE:CORR) Q3 2023 Earnings Call Transcript November 7, 2023 Operator: Greetings. Welcome to the CorEnergy Third Quarter 2023 Results Call. [Operator Instructions] Please note, this conference is being recorded. I will now turn the conference over to your host, Matt Kreps, Investor Relations at CorEnergy. You may begin. Matt Kreps: Thank […] |

Q3 2023 CorEnergy Infrastructure Trust Inc Earnings CallQ3 2023 CorEnergy Infrastructure Trust Inc Earnings Call |

CorEnergy Announces Third Quarter 2023 ResultsKANSAS CITY, Mo., November 07, 2023--CorEnergy Infrastructure Trust, Inc. (NYSE: CORR, CORRPrA) ("CorEnergy" or the "Company") today announced financial results for the third quarter ended September 30, 2023. |

CorEnergy Schedules Results Release for Third Quarter 2023KANSAS CITY, Mo., October 26, 2023--CorEnergy Infrastructure Trust, Inc. (NYSE: CORR, CORRPrA) ("CorEnergy" or the "Company") announced today that it will report results for its third quarter ended September 30, 2023, on November 7, 2023. |

CORR Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -93.60% |

| 1-year | -98.26% |

| 3-year | -99.61% |

| 5-year | -99.94% |

| YTD | -94.29% |

| 2023 | -83.25% |

| 2022 | -27.87% |

| 2021 | -52.60% |

| 2020 | -84.09% |

| 2019 | 45.16% |

Continue Researching CORR

Want to see what other sources are saying about CorEnergy Infrastructure Trust Inc's financials and stock price? Try the links below:CorEnergy Infrastructure Trust Inc (CORR) Stock Price | Nasdaq

CorEnergy Infrastructure Trust Inc (CORR) Stock Quote, History and News - Yahoo Finance

CorEnergy Infrastructure Trust Inc (CORR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...