China Pharma Holdings, Inc. (CPHI): Price and Financial Metrics

CPHI Price/Volume Stats

| Current price | $0.25 | 52-week high | $1.77 |

| Prev. close | $0.25 | 52-week low | $0.24 |

| Day low | $0.24 | Volume | 61,957 |

| Day high | $0.25 | Avg. volume | 379,983 |

| 50-day MA | $0.27 | Dividend yield | N/A |

| 200-day MA | $0.41 | Market Cap | 3.97M |

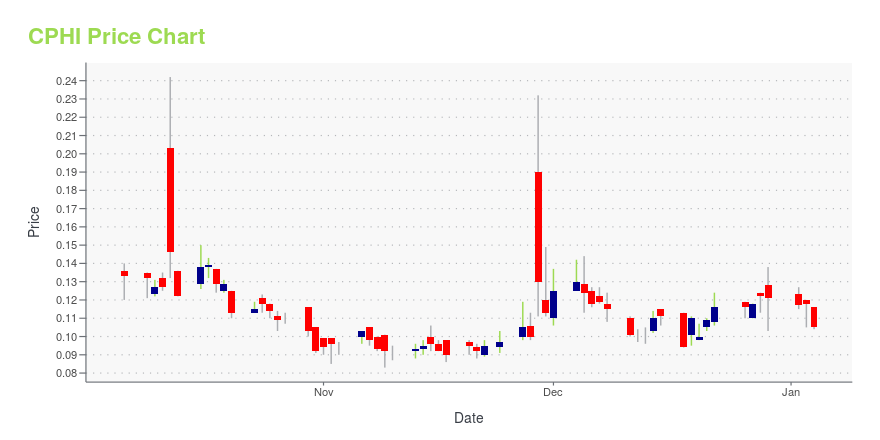

CPHI Stock Price Chart Interactive Chart >

Latest CPHI News From Around the Web

Below are the latest news stories about CHINA PHARMA HOLDINGS INC that investors may wish to consider to help them evaluate CPHI as an investment opportunity.

China Pharma Holdings, Inc. Announced the Completion of Third Party Testing of Dry Eye Disease Therapeutic DeviceChina Pharma Holdings, Inc. (NYSE American: CPHI) ("China Pharma", or the "Company"), an NYSE American-listed corporation with a fully-integrated specialty pharmaceuticals subsidiary based in China, today announced that its Dry Eye Disease (DED) therapeutic device has passed third-party testing and is preparing to apply for market launch to the National Medical Products Administration (NMPA) of China. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayPre-market stock movers are a hot topic this morning and we're checking on the biggest ones investors will want to watch on Friday! |

Is China Pharma Holding (CPHI) A Hidden Gem or A Value Trap?Unraveling the Financial Health of China Pharma Holding |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayIt's time to start the week off right with a look at the biggest pre-market stock movers worth watching on Monday morning! |

China Pharma's Candesartan Hypertension Product Passes the Quality and Efficacy Consistency Evaluation of Generic DrugsChina Pharma Holdings, Inc. (NYSE American: CPHI) ("China Pharma," the "Company" or "We"), a specialty pharmaceutical company, today announced that its wholly-owned subsidiary Hainan Helpson Medical & Biotechnology Co., Ltd. (hereinafter referred to as "Helpson") has received the "Drug Supplementary Application Approval Notice" for its candesartan tablets by National Medical Products Administration of China (hereinafter referred to as NMPA"), indicating that the Company's candesartan tablets hav |

CPHI Price Returns

| 1-mo | -2.31% |

| 3-mo | -17.30% |

| 6-mo | -46.58% |

| 1-year | -84.66% |

| 3-year | -99.29% |

| 5-year | -98.33% |

| YTD | -58.68% |

| 2023 | -87.38% |

| 2022 | -80.13% |

| 2021 | 8.25% |

| 2020 | 88.26% |

| 2019 | -7.86% |

Continue Researching CPHI

Want to do more research on China Pharma Holdings Inc's stock and its price? Try the links below:China Pharma Holdings Inc (CPHI) Stock Price | Nasdaq

China Pharma Holdings Inc (CPHI) Stock Quote, History and News - Yahoo Finance

China Pharma Holdings Inc (CPHI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...