Cumberland Pharmaceuticals Inc. (CPIX): Price and Financial Metrics

CPIX Price/Volume Stats

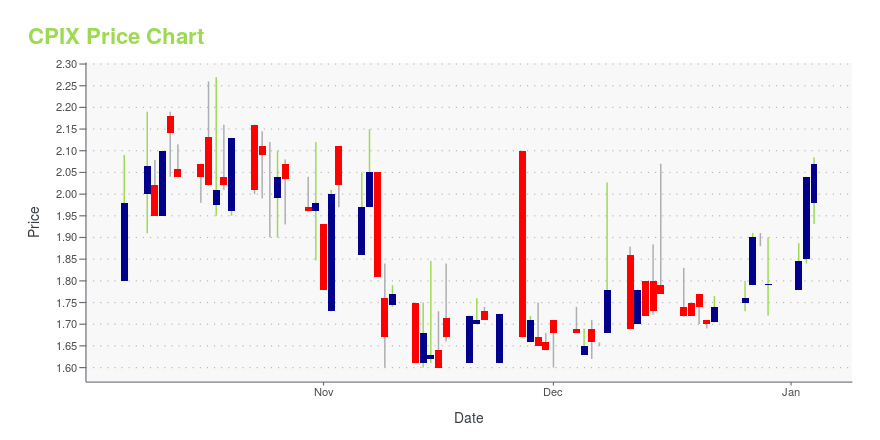

| Current price | $1.47 | 52-week high | $2.36 |

| Prev. close | $1.49 | 52-week low | $1.38 |

| Day low | $1.46 | Volume | 3,831 |

| Day high | $1.50 | Avg. volume | 9,833 |

| 50-day MA | $1.49 | Dividend yield | N/A |

| 200-day MA | $1.77 | Market Cap | 20.86M |

CPIX Stock Price Chart Interactive Chart >

Cumberland Pharmaceuticals Inc. (CPIX) Company Bio

Cumberland Pharmaceuticals Inc., a specialty pharmaceutical company, focuses on acquiring, developing, and commercializing branded prescription products for the hospital acute care and gastroenterology markets in the United States and internationally. The company was founded in 1999 and is based in Nashville, Tennessee.

Latest CPIX News From Around the Web

Below are the latest news stories about CUMBERLAND PHARMACEUTICALS INC that investors may wish to consider to help them evaluate CPIX as an investment opportunity.

Cumberland Pharmaceuticals Inc. (NASDAQ:CPIX) Q3 2023 Earnings Call TranscriptCumberland Pharmaceuticals Inc. (NASDAQ:CPIX) Q3 2023 Earnings Call Transcript November 11, 2023 Operator: Good afternoon, and welcome to Cumberland Pharmaceuticals Third Quarter 2023 Company Update and Financial Report. This call is being recorded at Cumberland’s request and will be archived on the company’s website for one year from today’s date. I would now like to […] |

Cumberland Pharmaceuticals Reports Third Quarter 2023 Financial ResultsCumberland Pharmaceuticals Inc. (NASDAQ: CPIX), a specialty pharmaceutical company, announced today that its product portfolio of FDA-approved brands delivered combined revenues of $10.1 million during the third quarter of 2023 and $30.2 million year to date. |

CUMBERLAND PHARMACEUTICALS TO ANNOUNCE THIRD QUARTER 2023 FINANCIAL RESULTSCumberland Pharmaceuticals Inc. (NASDAQ: CPIX), a specialty pharmaceuticals company, announced today that it will release the third quarter 2023 financial results and provide a company update after the market closes on Tuesday, Nov. 7, 2023. |

NEW VIBATV® PEDIATRIC PUBLICATION HIGHLIGHTS ITS SAFETY IN PATIENTS 2 TO 17 YEARS OF AGECumberland Pharmaceuticals Inc. (NASDAQ: CPIX) announced today a new publication in Antimicrobial Agents and Chemotherapy1 detailing the results of the first clinical study investigating the safety and pharmacokinetics of Vibativ® (telavancin) injection in children 2 to 17 years of age. Vibativ is an intravenous antibiotic approved by the FDA for the treatment of hospital-acquired and ventilator-associated bacterial pneumonia (HABP/VABP) as well as complicated skin and skin structure infections |

Cumberland Pharmaceuticals Reports Revenue and Earnings Growth Second Quarter 2023Cumberland Pharmaceuticals Inc. (NASDAQ: CPIX), a specialty pharmaceutical company, today announced significantly improved financial results and a favorable overall company performance for the second quarter of 2023. |

CPIX Price Returns

| 1-mo | -3.29% |

| 3-mo | -16.48% |

| 6-mo | -30.66% |

| 1-year | -3.92% |

| 3-year | -56.64% |

| 5-year | -74.43% |

| YTD | -17.96% |

| 2023 | -20.37% |

| 2022 | -51.82% |

| 2021 | 58.31% |

| 2020 | -42.72% |

| 2019 | -14.59% |

Continue Researching CPIX

Here are a few links from around the web to help you further your research on Cumberland Pharmaceuticals Inc's stock as an investment opportunity:Cumberland Pharmaceuticals Inc (CPIX) Stock Price | Nasdaq

Cumberland Pharmaceuticals Inc (CPIX) Stock Quote, History and News - Yahoo Finance

Cumberland Pharmaceuticals Inc (CPIX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...