Coupang Inc. (CPNG): Price and Financial Metrics

CPNG Price/Volume Stats

| Current price | $20.18 | 52-week high | $23.77 |

| Prev. close | $19.79 | 52-week low | $13.51 |

| Day low | $19.94 | Volume | 9,691,993 |

| Day high | $20.42 | Avg. volume | 11,034,115 |

| 50-day MA | $21.58 | Dividend yield | N/A |

| 200-day MA | $18.49 | Market Cap | 36.08B |

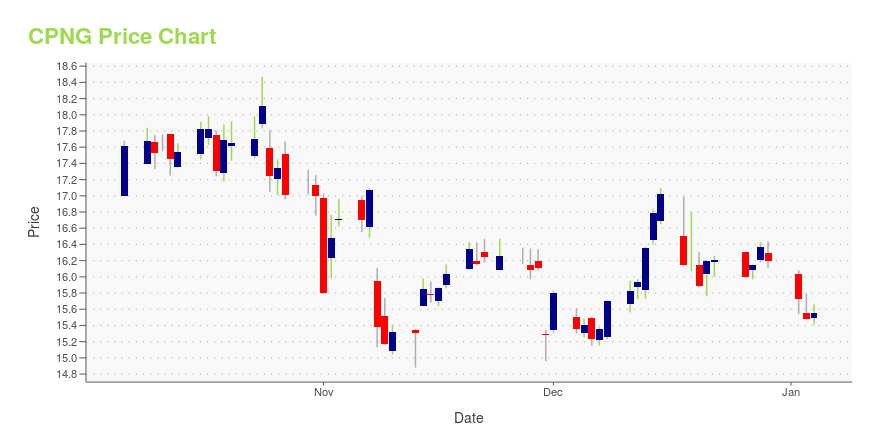

CPNG Stock Price Chart Interactive Chart >

Coupang Inc. (CPNG) Company Bio

Coupang (Korean: 쿠팡) is a South Korean e-commerce company based in Seoul, South Korea, and incorporated in Delaware, United States. Founded in 2010 by Bom Kim, the company expanded to become the largest online marketplace in South Korea. Its expansion led the company to the video streaming distribution after the launch of the service Coupang Play. Coupang is often referred to as the "Amazon of South Korea", due its position and corporate size in South Korean online market. (Source:Wikipedia)

Latest CPNG News From Around the Web

Below are the latest news stories about COUPANG INC that investors may wish to consider to help them evaluate CPNG as an investment opportunity.

Growth Galore: 7 Long-Term Stock Picks for Prolonged ProsperityIn the late 1950s, the average holding period for stocks was eight years. |

7 Top Growth Stocks to Buy BEFORE They Take Off in 2024These top growth stocks across high-potential sectors have been executing very well recently and seem poised to take off in 2024. |

40 Luxury Gifts for Men Who Have EverythingIn this article, we’ll take a look at the 40 Luxury Gifts for Men Who Have Everything, with insights into the recent developments in the luxury goods market. For a quick overview of the top 10 luxury gifts, read 10 Luxury Gifts for Men Who Have Everything. The luxury goods market is a multi-billion-dollar industry […] |

Down 66%, Is This Growth Stock a Buy Going Into 2024?With the majority of growth stocks being overbought, this hidden gem should be on your watch list. |

17 High Growth Large-Cap Stocks To Invest InIn this article, we will take a detailed look at the 17 High Growth Large-Cap Stocks To Invest In. For a quick overview of such stocks, read our article 5 High Growth Large-Cap Stocks To Invest In. Market skeptics are on the back foot after the Federal Reserve’s indication that its battle against inflation is bearing fruit and its […] |

CPNG Price Returns

| 1-mo | -5.17% |

| 3-mo | -11.92% |

| 6-mo | 38.89% |

| 1-year | 18.85% |

| 3-year | -46.24% |

| 5-year | N/A |

| YTD | 24.64% |

| 2023 | 10.06% |

| 2022 | -49.93% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...