CPS Technologies Corp. (CPSH): Price and Financial Metrics

CPSH Price/Volume Stats

| Current price | $1.69 | 52-week high | $3.08 |

| Prev. close | $1.67 | 52-week low | $1.60 |

| Day low | $1.65 | Volume | 3,657 |

| Day high | $1.69 | Avg. volume | 26,659 |

| 50-day MA | $1.72 | Dividend yield | N/A |

| 200-day MA | $2.09 | Market Cap | 24.54M |

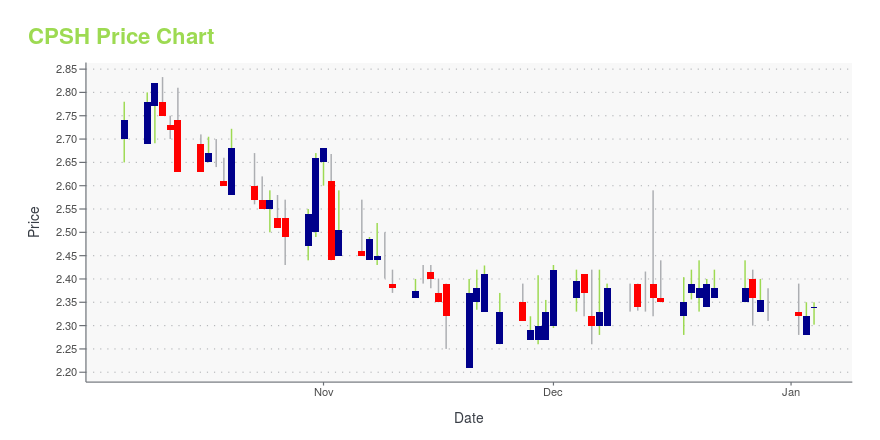

CPSH Stock Price Chart Interactive Chart >

Latest CPSH News From Around the Web

Below are the latest news stories about CPS TECHNOLOGIES CORP that investors may wish to consider to help them evaluate CPSH as an investment opportunity.

We Like These Underlying Return On Capital Trends At CPS Technologies (NASDAQ:CPSH)What trends should we look for it we want to identify stocks that can multiply in value over the long term? Ideally, a... |

CPS Technologies Corporation to Participate in Virtual Investor Summit on December 7, 2023NORTON, Mass., Nov. 28, 2023 (GLOBE NEWSWIRE) -- CPS Technologies Corporation (NASDAQ:CPSH) (“CPS” or the “Company”) today announced that it will participate in the Virtual Investor Summit conference, open to institutional investors, on December 7. A general presentation, to be webcast live, will be held at 10:00 am Eastern. Event:Investor Summit Presentation:December 7th, 2023 @ 10:00 AM ET Location:https://us06web.zoom.us/webinar/register/WN_TYPCYNyXTJKHkcMtrzLfkw For one-on-one investor calls |

CPS Technologies Corporation (NASDAQ:CPSH) Q3 2023 Earnings Call TranscriptCPS Technologies Corporation (NASDAQ:CPSH) Q3 2023 Earnings Call Transcript November 4, 2023 Operator: Good day, everyone, and welcome to the CPS Technologies Third Quarter 2023 Earnings Call. [Operator Instructions] It is now my pleasure to turn the floor over to your host, Chuck Griffith, Chief Financial Officer of CPS Technologies. Chuck Griffith: Thank you, operator, […] |

CPS Technologies Corp (CPSH) Reports Q3 2023 Earnings: Revenue Down 6.9% YoY, Net Income at $0.2MDespite a slight dip in revenue, CPS Technologies Corp (CPSH) remains on track for a record year |

CPS Technologies Corporation Announces Third Quarter 2023 Financial ResultsRevenue of $6.3 Million; Company Remains on Track for Record YearNORTON, Mass., Nov. 01, 2023 (GLOBE NEWSWIRE) -- CPS Technologies Corporation (NASDAQ:CPSH) (“CPS” or the “Company”) today announced financial results for the fiscal third quarter ended September 30, 2023. Third Quarter Highlights Revenue of $6.3 million for the third quarter of 2023 versus $6.7 million in the prior-year period, reflecting a shift in certain orders into the fourth quarter, as previously discussedGross margin of 19. |

CPSH Price Returns

| 1-mo | -2.87% |

| 3-mo | -4.52% |

| 6-mo | -31.02% |

| 1-year | -40.07% |

| 3-year | -74.59% |

| 5-year | 69.00% |

| YTD | -28.09% |

| 2023 | -12.64% |

| 2022 | -29.02% |

| 2021 | 36.33% |

| 2020 | 175.25% |

| 2019 | -17.89% |

Continue Researching CPSH

Want to see what other sources are saying about Cps Technologies Corp's financials and stock price? Try the links below:Cps Technologies Corp (CPSH) Stock Price | Nasdaq

Cps Technologies Corp (CPSH) Stock Quote, History and News - Yahoo Finance

Cps Technologies Corp (CPSH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...